Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Attendance Management is divided into 2 parts:

Attendance Service

Muster-Roll Service

To verify the IDs of the individuals, the attendance service depends on the Individual Registry. It is an optional dependency. If the no individual registry is linked with the attendance service, then the IDs would not be checked for validity and assumed to be correct.

Attendance Service manages the following:

Attendance-Register: It maintains a list of individuals enrolled for a given register.

Staff: Staff members manage the register. Staff can be created or deleted from a register.

Attendee: Attendees are the individuals participating in the register. Attendees can be created or deleted from the register.

Attendance-Log: The log entries of the attendance. It will have events of entry and exit.

Muster-Roll is a report built upon the attendance logs. It has computed attendance values. It will pass through an approval workflow.

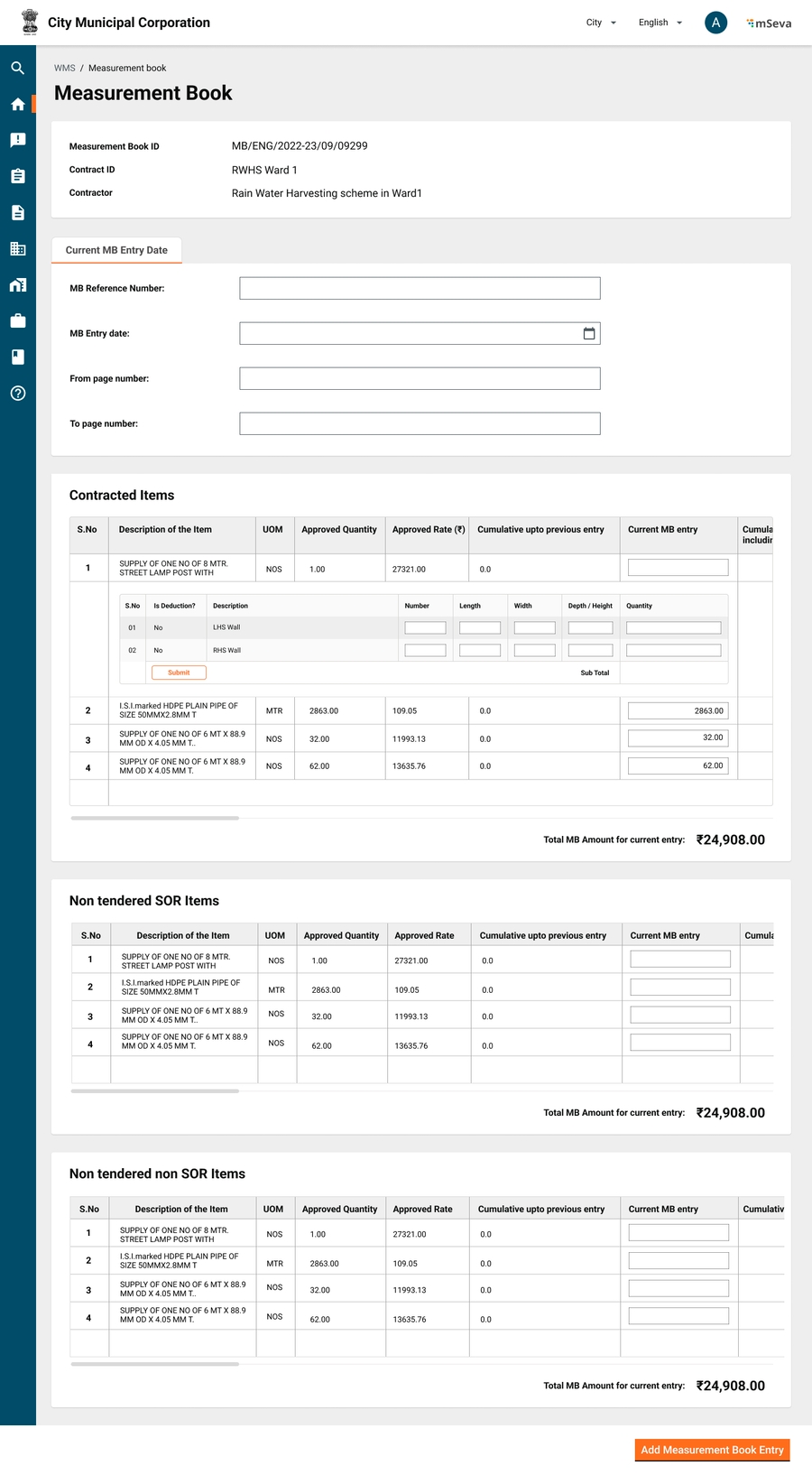

Measurement books or M-Books help track the work progress once the execution of the contract is initiated. The page provides detailed steps on how to use a measurement book.

Measurement Books are legal copies signed and issued by contract_creator to the contractor noting down the Book ID, Number of Pages, and Title (as per project title).

In offline methods, measurements can be filled daily, weekly, monthly or as per demand (usually before the time of bill creation) to raise a bill and attach a copy of the book as a reference document validating the bill information.

Measurement Books are initially empty. The M-Books will be filled with the estimated line items only. Once all the estimated line items are filled/counted in the MBook, they can be submitted along with the final Bill.

The Book is also sent as an attachment to the accountant for bill approval.

Digitising offline measurement books offers several advantages, including:

Faster Measurement Capture: Digital tools allow for quicker and more efficient recording of measurements, reducing the time required for data entry.

Timely Data Capture: Real-time or near-real-time data capture ensures that measurements are recorded promptly, eliminating delays in processing.

Error-Free Calculation: Automated calculations reduce the risk of human errors in measurement calculations, leading to more accurate results.

Automation of Billing: Digital systems can automate the billing process, generating invoices and reports based on the captured measurements, further streamlining operations.

Overall, digitisation enhances efficiency, accuracy, and the overall effectiveness of measurement and billing processes.

The system creates the M-Book automatically while the contract is accepted.

Contractor/MBook-tracker will track M-Book readings

MBook-Checker will check the measurements

MBook-Approver will approve the measurements

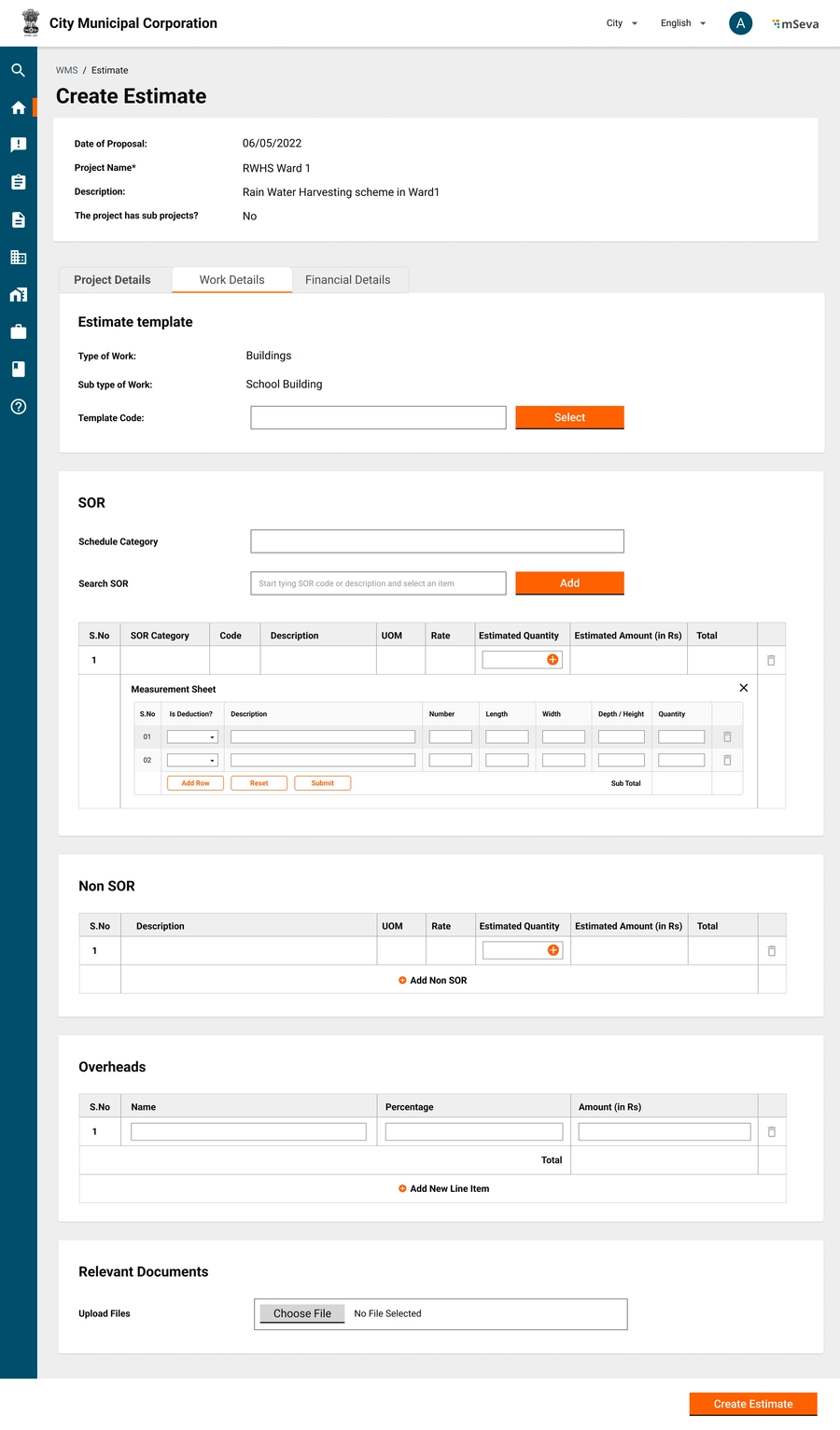

While creating an estimate, the estimate creator can add measurement rows for each SOR /Non-SOR line item. It is not mandatory to fill in these measurements unless the user clicks the "+" icon in the Quantity section of the SOR line item row.

Upon selecting the measurement box, an expansion slide-down will appear. Here he/she can enter the measurement details

The user can delete or add multiple measurement items.

The measurement box will contain fields for quantity, length, width, and height/depth and the product of these three values will be automatically calculated and populated in the Quantity box.

In cases where an object's area is not measured using length, width, and height, the user can directly enter the area in the Quantity field. The fields for length, width, and size should be greyed out and not editable in such cases.

The summation of all the measurement quantities will be automatically populated in the SOR/Non-SOR Quantity row. This quantity will then be multiplied by the rate to calculate the final amount.

Measurement Book will be created only when the contract is accepted.

Mbook line items will be SOR line items if while creating an estimate, a sub-line item under SOR is not created.

If SOR sub-line items are created, the M-Book will have to be tracked at the SOR sub-line items level.

There should be an option to capture images of physical mbook and site photos along with m-book readings for each date.

Each M-book entry will go for approval workflow

ID

NA

NA

UUID

MBook ID

Alphanumeric

Y

Mbook ID

MB<Year>/<Mo>/<Running Sequence>

Contract ID

Autofill

Y

Every Mbook is linked to a contract

MBook Created Date

Date it is created in the system.

Typically date of acceptance of Contract

MBook start Date

Date

Y

Start date of Measurement Book - From this date onwards readings can be taken

MBook end date

Date

Y

End date of Measurement Book - On this date onwards readings capture should stop

[Array for each dated entry]

Mbook reference number

Text

Y

Offline reference number of Mbook, Since this may change after few weeks due to limit in number of pages in each mbook, readings this could be captured with each date

MB Entry Date

Alphanumeric

Y

Default to today's date. Can take dates between mbook start date and today's date. Cannot be future date

MB from page

Alphanumeric

Y

Offline reference of Page numbers in mbook hard copy.

Mb To Page

Date

Y

Offline reference of Page numbers in mbook hard copy.

Attachments

Attachments

N

Photos of site, photos of physical mbook

[Array for each SOR/NON SOR Line Item]

SOR ID

View Only

N

Only for Line items that have SOR ID

Description

View Only

Y

From Estimate

UOM

View Only

Y

From Estimate

Approved Quantity

View Only

Y

From Estimate

Approved Rate

View Only

Y

From Estimate

Current MB Entry

Numeric

Y

Entry from last reading till current reading

Remarks

Alphanumeric

N

Comments if any against that particular reading.

[Array for each Sub Line Item if defined during estimation]

Is Deduction?

Binary

Y

Yes/No.

This is used to measure if any Sub line item has to be measured fully and removed a certain piece. Since payment is done on overall quantity and not based on individual sub line item level measurements this will not affect billing

Description

Alphanumeric

Y

Number

Numeric

Y

Quantity of construction mentioned in the description

Length

Numeric

Y

Length of construction mentioned in the description

Width

Numeric

Y

Width of construction mentioned in the description

Depth/height

Numeric

Y

Depth of construction mentioned in the description

Create an M-Book when the contract is accepted with the start and end dates as per the contract

Measurements can be taken both on the web and mobile (Mobile First).

Measurement books initially will have line items from estimates with zero quantities. These will get filled as the project progresses and cannot go beyond what is estimated.

Measurement Book readings can be sent for approval for any duration/marked period, from the last marked period.

Once approved, that corresponding amount will be allowed for payment to the contractor.

Tracking of MBook will be required to know the project progress and subsequently pay to contractor based on work done

User: Mbook-Tracker

Detail:

Mbook tracking can be done only against the line items that are captured in the estimate.

This can be done at the estimate SOR line item level or sub-line item level.

At least one measurement needs to be filled in to submit an MBook for approval.

Each submission of the measurement book can use the same ID of the MBook with a running sequence number appended at the end.

To add another measurement reading for the same project, users can click on Actions > Add New Measurements, which opens another tab.

The overall measurements cannot exceed the estimated quantities.

A project can have any number of measurement entries.

M Book tracking can only be done until the last date of Mbook.

Each mBook recording will have an approval workflow.

MBook is created by contractor/mbooktracker,

Checked by m-book checker,

Approved by m-book approver.

An Mbook should be able to tell using analysis of rates, how much labour, material and other heads as bifurcated in the estimate under SOR item detail 1.

Upon each mBook entry creation, a labour consumption log and material consumption log should also be generated as to how much material from the last entry till this entry is consumed.

Only based on material consumed, the material supplier is eligible to get paid.

Need:

Cancelling of Mbook is only possible with the cancellation of the contract

Roles: Contract_Canceller

Detail

If a contract gets cancelled Mbook will also get cancel status.

MBook reading entry if is in the approval workflow, will be moved to cancel status as well.

Whatever approvals done so far on Mbook workflows are eligible for payments.

Since we do automatic payments, a bill would have already been created for such mbook entries.

Track Measurement

Detailed measurement input screen

Measurements successfullly submitted

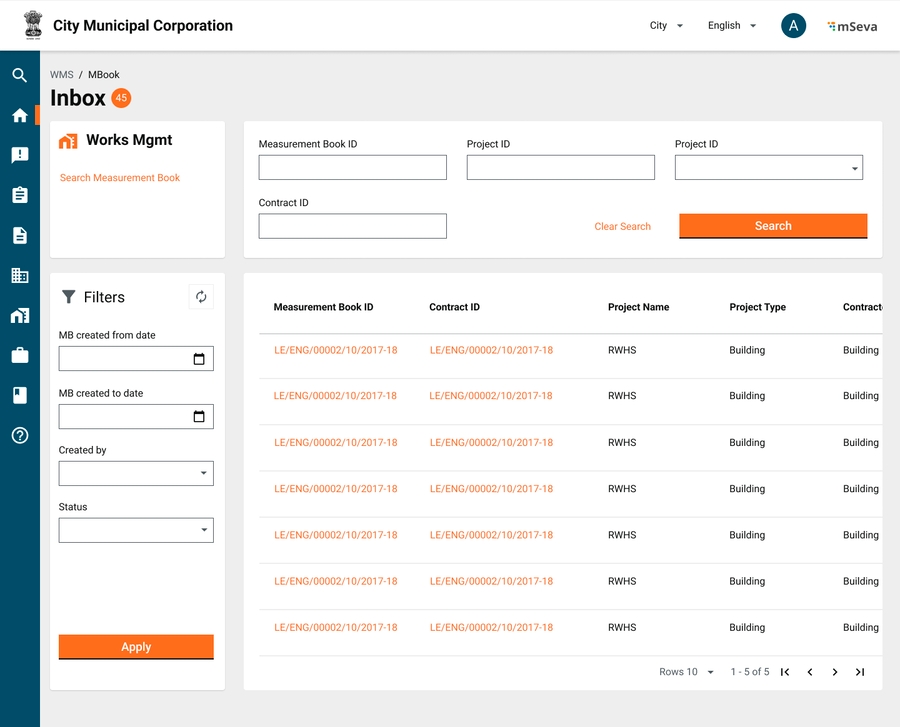

Measurement Inbox

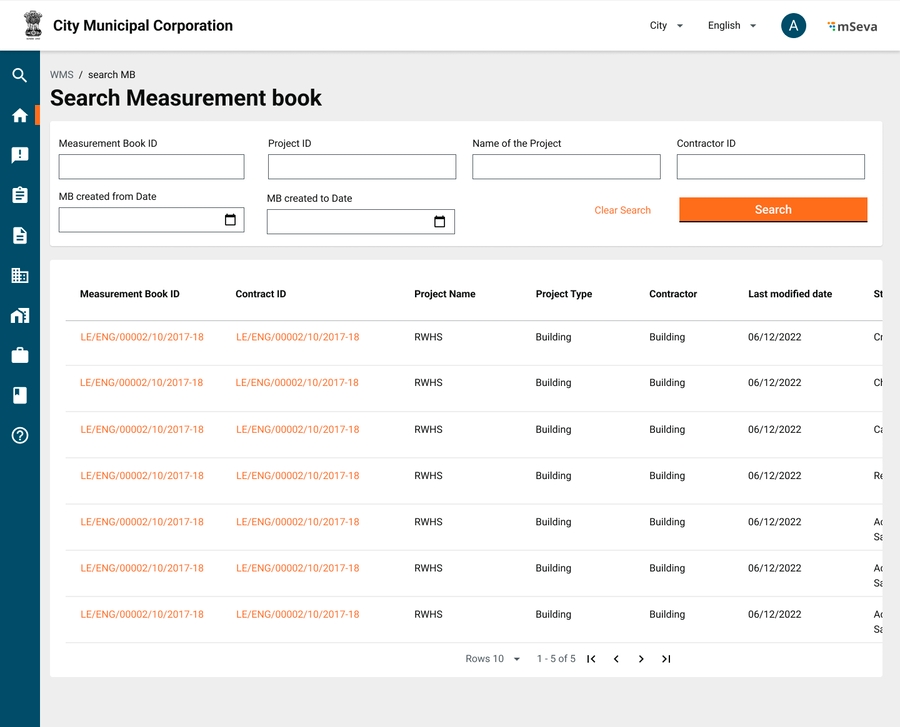

Measurement Book Search

DIGIT - Projects functional details

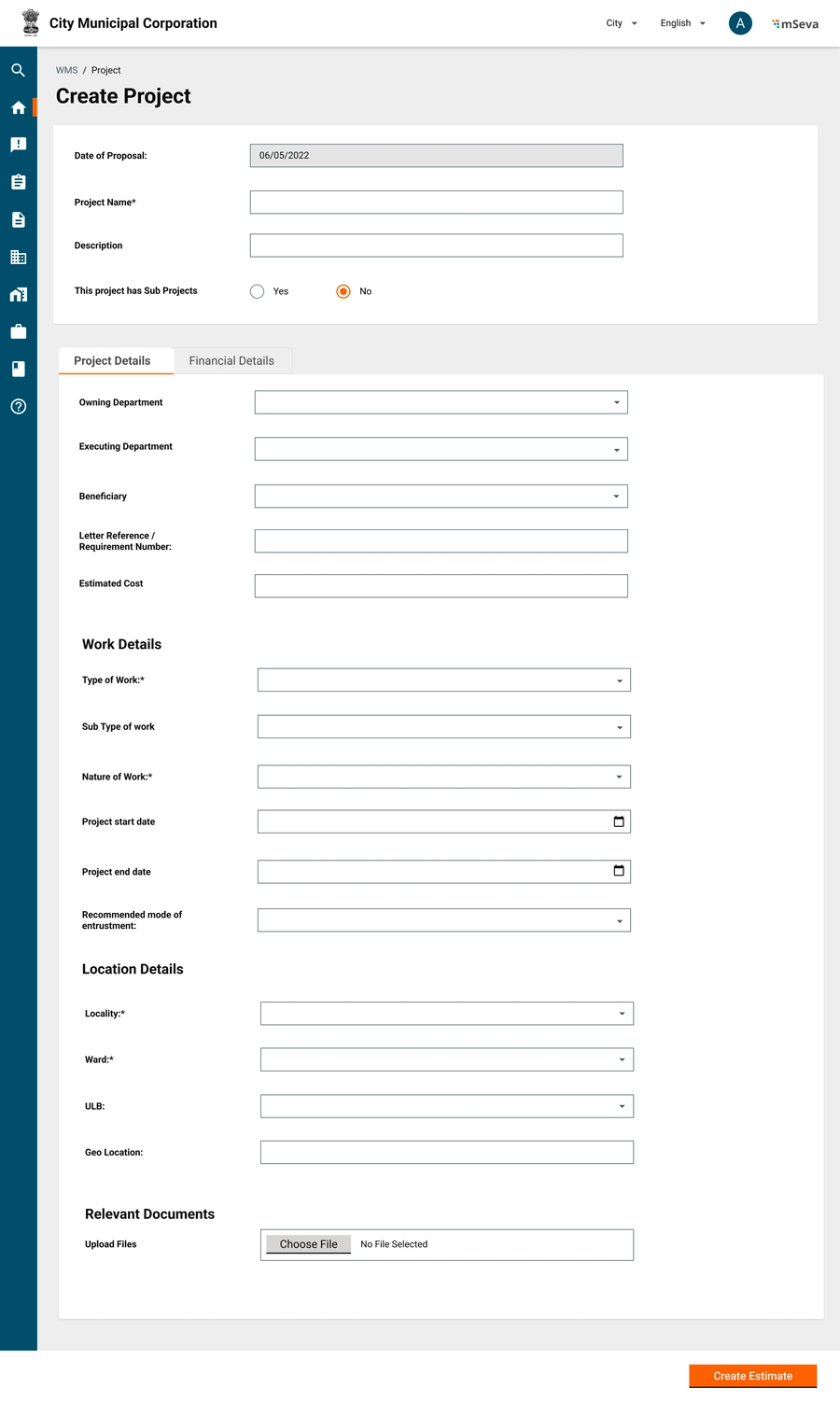

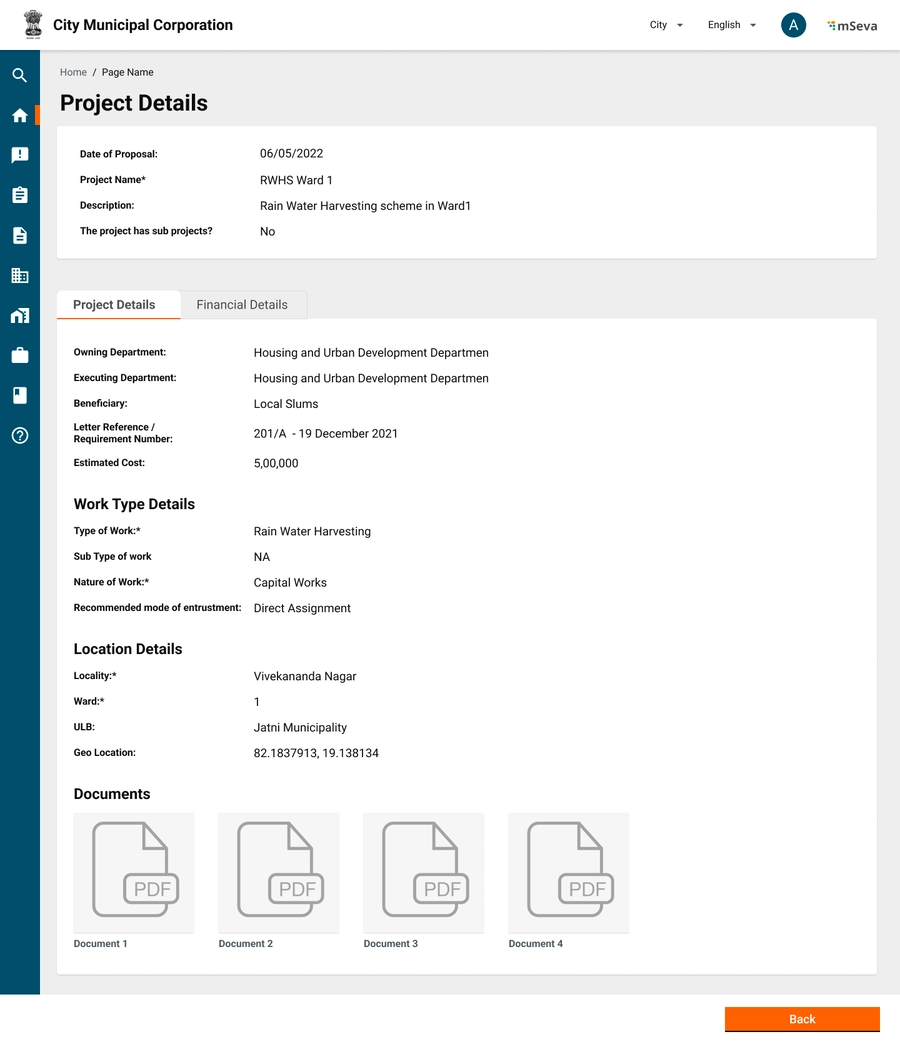

Projects are the first work entity defined by the State/Department/ULB or any executing authority. This consists of basic details like IDs, descriptions, addresses, sub-project details, project types, start and end dates etc.

Projects may not focus on just construction or civil works. Examples of projects - a health campaign, office decoration, a pre-contractual phase with an IT vendor for new software, new service delivery initiatives etc.

Users: Junior Engineer or Assistant Engineer who creates Works Projects for the ULB/Department

JE creates projects with the below-mentioned attributes.

A project can have sub-projects as well depending on the way of executing the project.

When a project is divided into sub-projects, each will have the same attributes to be captured as the main project.

A project can be sent for approval depending on the need.

Usually, the administrative sanction is done on projects by EO. Post approval, detailed and abstract estimates are done.

Once the admin sanctions the project, the fund is also blocked for the respective heads of accounts.

Project status -

Created

In progress

Approved

Rejected

Cancelled

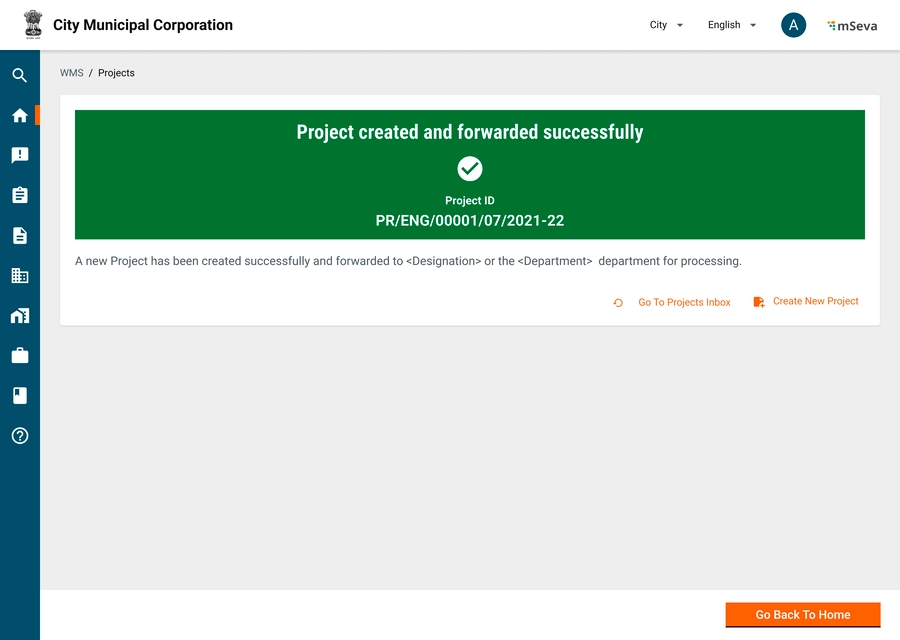

Once a project is created on the UI, the system generates a unique ID for each project/sub-project.

ID: PROJ/<ULB/Department Code>/<Year>/<month>/<Date>/<running sequence number>

The project details capture the financial information such as the funding source for the project. These details, however, are not part of the Project Service but are captured as part of the Program Service.

The table below provides the list of project attributes.

The following primary masters are defined by this module and used for validations. Other common masters such as department, tenant etc..are also used by this module.

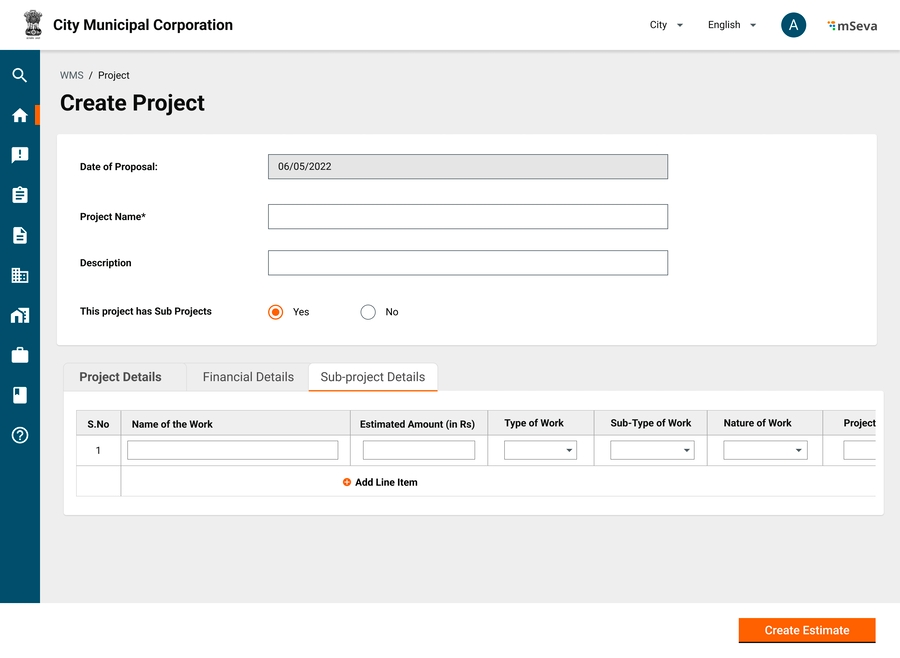

A project can be divided into multiple sub-projects, each with its own workflows/business requirements defined.

In a government setting, payments can be categorized into two main types: payments made to the government and made by the government.

Payments made to the government are payments received by the government, categorized as receipts or revenue. Payments to the government can be divided into two types: demand-based collection and non-demand-based collection.

Payments made by the government are expenses incurred by the government. Examples include - Salaries, Wages, Beneficiary payments, Contractor Payments, or Ad Hoc Payments.

Demand-Based Collection

Demand Generation: The government generates a demand for payments.

Examples: Property Tax, Trade License, Water Tax.

Invoice Issuance: An invoice is issued by the government detailing the demands. This invoice specifies what is owed to the government, including taxes, charges, or levies.

Payment by Citizen: The citizen acknowledges the demand and pays the specified amount.

Receipt Issuance: A receipt is issued to the citizen upon payment, acknowledging the receipt of the amount.

Non-Demand-Based Collection

Collections are made without a prior demand being generated by the government.

The DIGIT demand and billing service is used to manage payments made to governments.

For any transaction to happen, there is a payer, payee, amount and entity details

Payer and payee can be individuals or organizations.

Entity details contain other information which are important for a bill to be generated but not mandatory for payment advice

Examples - Invoice ID, Invoice date, Verification details etc

Every transaction ideally starts with an invoice equivalent that is generated by the supplier/contractor/muster/contract/payroll etc against which a payee generates a bill in the name of the payer.

A bill can have single or multiple beneficiaries depending on verifiable information sources.

Example - If a muster roll has 20 beneficiaries, Bill also can have 20 beneficiaries. It is not needed to create 20 individual bills.

A single invoice should not be split into multiple bills.

Example - Even though the material is supplied in tranches, a single PO can lead to multiple invoices and only after the consumption of the entire material as per individual invoice and associated measurement book a bill for that invoiced amount can be created and paid.

Payment advice is generated to enable beneficiary payments and the module is integrated with a payment gateway.

Hence payment advice contains minimal information required for the bank/gateway to make the payment. Limits on the number of beneficiaries and amounts etc are configurable as needed by the integration.

Expenses are created by the JE and approved by ME, EE/ EO depending on the amount and associated approval authority.

This module should have the following components

Header Details

Bill ID

Bill Date

Party Bill ID

Party Bill Date

Bill Type

Salary/Pension Bill - Based on Payroll, leaves, PF, GPF, other allowances

Advance Bill

Unlike other bills which are post-work/service completion and measurement, the advance bill is raised prior and adjusted later.

Advance bill is horizontal and be applicable on top of all other bill types

Works/Contractor Bill

A contractor bill is created and measured against the measurement books and contract(work order) objects for verification.

When a user selects to pay a contractor bill, the user can select against which measurement books of the contract this bill is being raised, and accordingly bill amount will be calculated.

Muster/Labour Bill -

A labour bill is created from a muster roll and usually has multiple beneficiaries within the same bill.

When a user selects to pay a wages bill, the user can select which muster rolls to process as part of this bill, and accordingly bill amount and array of beneficiaries will be processed.

Supplier/Vendor Bill

A vendor bill is similar to a contractor bill where as here instead of a measurement book and work order, an invoice and material receipt register or purchase order are used for verification.

A vendor bill should ideally be against each invoice as submitted by the supplier.

Right now, there is no material receipt register or purchase order against which invoices are verified. Hence invoice in V1, cannot be as verifiable as we are verifying wage bills against muster rolls.

Contingency/Expense Bill

Ad Hoc expenses

Supervision Bill

This type of Bill is calculated as a percentage on top of other types of approved bills.

Others (need more use cases)

Debit Details

Account Code, Account head, Debit Amount

Treasury Payments - {Major, Sub Major, Minor, Sub Minor, Detail, Object head, Debit Amount}

ULB Payments - {Fund, Functionary, Budget head, Scheme, Sub Scheme, Debit Amount}

This should be configurable at the tenant level to choose what type of accounting system is followed.

Debit details should ideally be captured at the time of project creation. This helps in budget checks being done.

Each Project will be associated with a set of account codes and percentage amounts of the entire project, from where debit will happen.

Similarly, respective amounts (lumpsum/percentage) should be chosen from these account codes for each bill created.

Service should not allow debit more than the initial quoted amount under respective heads against the sum of all the bills created for the project.

Deductions

The amount that is deducted from the gross value of the bill as these are already included in the work line items

Deductions are classified into many types

Internal transfer

Example - SOR line items already include cess 1%. Hence it is deducted here and transferred to the labour welfare account head.

SOR line items also include royalty on the material. That needs to be deducted from here and transferred to Tahsildar.

Advance recoveries

Amounts paid earlier for mobilization advancement or material procurement etc are deducted while creating a new bill.

Retention Money

Money is withheld for payments and paid at a later date after the defect liability period.

Deductions are always done against a beneficiary.

If a bill contains multiple beneficiaries, it needs to be specified against which beneficiary the deductions are made.

Credit Details

A bill can have multiple beneficiaries. However, the nature of payments or beneficiary types should be the same for all beneficiaries in one bill.

Wage seekers bill should contain only beneficiaries for wages

Material bills should contain only vendors and be verified against their invoices

Once the bill of any type is created, this will go for approval and have wfstatus.

Every bill will also have a beneficiary payment status.

In the absence of intergrations with Banks/IFMS, this status can be updated manually to mark beneficiary payments.

In the presence of integration, systems should show the status of payment.

Once a bill is approved, payment advice needs to be created and sent to an integrated system. This system will send back the success/failure status along with the reasons.

In case of payment failure, Works should allow modifying the bill, marking the changes as mentioned in the error codes and resubmitting.

This will create a new payment advice, linking reference to an earlier bill.

Budget Checks

Input to expenditure service is when a project is created and an estimate is to be approved.

Expenditure will query the program service to get the status of fund availability.

Budget Blocking

In case funds are available, the expenditure service can also ask the program service to block respective funds (from estimation) for this project.

The budget hence is blocked and won’t be available for the next projects.

Release Blocked Budget

The expenditure module should also have a provision to release the pre-blocked budget. So this can be used for other projects. Or the existing project for which the budget has been blocked is deferred.

Expense Planning

The expenditure service will also have a planning module which will give timelines of expenses and respective amounts to funding agencies.

The blocking module also feeds into the planning module to block funds on time.

Billing management

Bills are created under contracts (projects)

A contract is issued by Payer to Payee.

The contract can be materials, labour, services, supervision etc

A payee in turn issues invoices against the contract on the supply of material/services.

After successful verification of supplies and invoices, the payer adds bills into the finance system

A voucher is created in the accounting system for auditing purposes.

Payment advice is sent to the bank for making financial transactions.

The voucher and bill statutes are updated once the payments are made.

Validations

A contract can have multiple invoices raised by the payee before the contract is deemed closed.

An invoice can be a material invoice, labour invoice (Muster roll), or invoice for supervision charges.

PS: Not every time an invoice is required to generate a bill.

Ex. Salary Bill, Advance bill, contingency bill etc don't need any invoices.

An invoice can have multiple line items.

In case of a restaurant bill - Restaurant captures additional GST amount on net amount. All line items are paid immediately by the service seeker. They pay the taxes collected from all invoices to respective government bodies at set intervals.

In the case of a salary bill - All line items are not immediately paid to the service provider (Employee). Instead, the employer deducts TDS and only pays part amount to the employee. Employer remits this amount to a government body. Even the employee remits his part of the tax at regular intervals.

An invoice can also have multiple beneficiaries and head-wise breakdowns for each beneficiary.

An invoice when entered into the system creates a Bill. A billing entity internally will have multiple line items each by payer, beneficiary, amount and head combination.

So a muster roll with 1 payer, 3 payees, each payee having 500 rs payable and 50 rs deduction on ESI can be on 1 bill with 6 line items.

This bill when processed will create a voucher in the accounting system

A payment voucher however can be a combination of multiple payers and payees by line items. From above example

There can be a minimum of 2 payment advises one for all payables of 450 rs to each individual

Other for all ESI deductions directed to the ESI department.

This will help payments go faster to respective departments.

Once the payments are made, respective bill line items will be updated with statuses. Once all bill line items are updated, the overall bill will be updated with status.

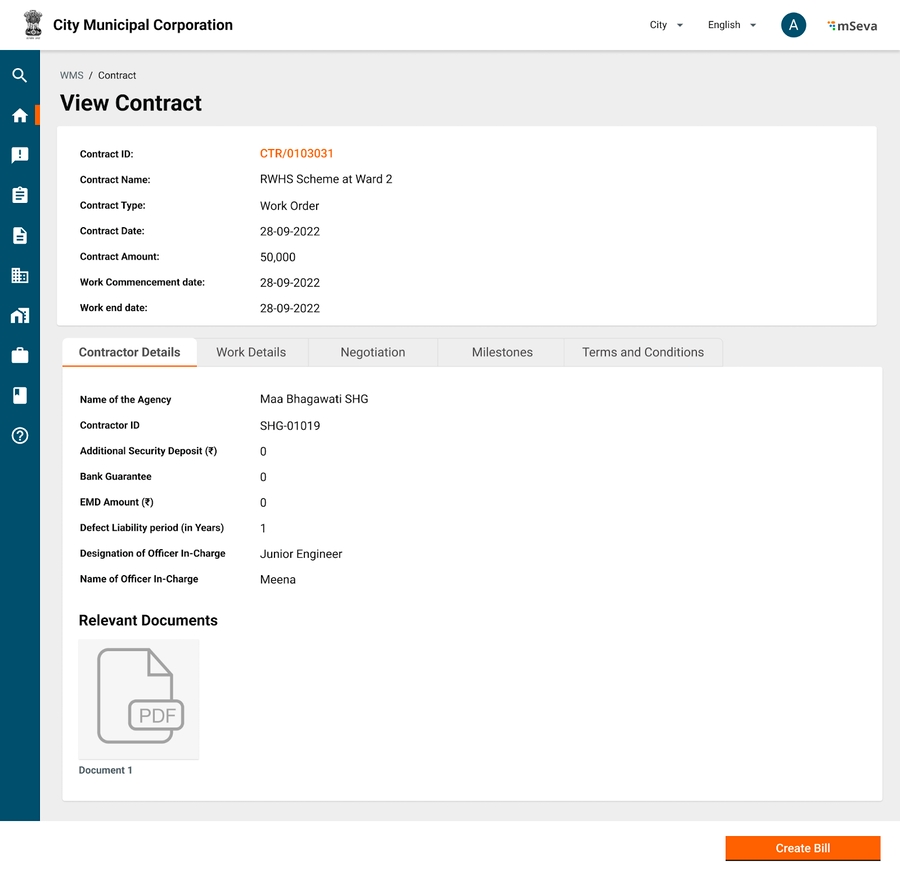

A contract document is a legal & financial obligation between any two parties entering into the contract.

After the estimates are created and approved, they are grouped or individually tendered/direct assigned to vendors to execute the work.

A works package is typically not seen in all Works Management Products. it is used only where high-complexity projects are executed where packaging is needed to form smaller or larger chunks so as to increase operational efficiency.

The current contract service includes Line items of estimates, Works packaging, Negotiation, Contract Terms, and Milestones.

The Junior Engineer/Assistant Engineer creates the contracts and the Municipal Engineer/Executing Officer approves the contract depending on its value. (Workflow configurations based on amount subject to platform capability in v1).

Story Detail

- for MuktaSoft

- for MuktaSoft

- for MuktaSoft

Actions to resolve:

Id

NA

Y

System generated UUID

Name

Alphanumeric

Y

MinChar 2 - Max Char - NA Ex - Construction of School Building

Project Type

MDMS Data

Y

Should be pre-defined master data Ex - Building

Project Sub Type

MDMS Data

N

Should be pre-defined master data. Estimate templates are linked to a project subtype Ex - School Building

Project Group

MDMS Data

Y

Should be pre-defined master data. Contract & Assetisation terms are defined based on this value. Ex - Capital Works

Address

Y

Address of the main project.

Proposed Start date

Date

N

Proposed End date

Date

N

Parent

ID

N

Parent Project ID

Status

MDMS Data

Y

Created, Rejected, Cancelled, In-progress, Completed

Owning Department

MDMS Data

Y

Reference No

Alphanumeric

N

MinChar 2 - Max Char - NA Reference No to Offline File if any

Description

Alphanumeric

N

MinChar 2 - Max Char - NA Description of the Project

Documents

Attachments

N

Upto 5 Documents each of 5 MB Document Attachments

works

ProjectType

Bill Details

1

Bill Date

Date

Y

Todays Date

2

Party Bill Date

Date

N

Date on which Invoice is given by third party

3

Party Bill Number

Alphanumeric

N

Reference number on Invoice given by third party

4

Bill Type

Dropdown

Y

Salary, Pension, Works, Advance, Others etc

Financial Details (For ULB Payments)

5

Fund

Dropdown

Y

Capital Fund, Municipal Fund, Grant Fund

6

Function

Dropdown

Y

202107 - Roads and Building Maintenance

202406 - Street Lighting Maintenance

202500 - Storm Water Drains

7

Department

Dropdown

Y

Road and highways

Streetlights

Storm water drains

8

Scheme

Dropdown

N

Scheme is tied to a fund

Muncipal Fund, funds schemes such as Housing, employment, Capital fund, funds scheme like buildings & highways

9

Sub Scheme

Dropdown

N

Sub Scheme is tied to scheme.

10

Fund Source

Dropdown

N

Loans, Own sources, Grants, etc

Financial Details (For State Department Payments)

11

Chart of Accounts

Dropdown

Y

Length varies from state to state. Punjab has 16 digits. Odisha has 27 Digit Codes.

Odisha has following format

Demand Number(2)-Major(4) –

SubMajor(2) – MinorHead(3)-

Sub(4)-Detail(5)-Object(3) –

PlanStatus(2) – ChargedVoted(1) – SectorCode(1)

Example - 11(Demand Number) –

2225 (Major Head) – 02 (Sub

Major Head) - 277 (Minor Head) –

2367 (Sub Head) – 40004 (Detail

Head) – 544 (Object Head) – 21

(Plan Status) – 1 (Charged Voted) – 1 (Sector Code)

Will be represented as

112225022772367400045442111.

Beneficiary Details (Array)

12

Beneficiary ID

Searchable dropdown

Y

Registration ID of the beneficiary in the system

13

Beneficiary Name

Y

Name of the beneficiary

14

Beneficiary Type

Contractor, Employee, Tahsildar, Wage seeker, Asha Worker, Student etc

15

Phone Number

Phone Number

16

Aadhar Number

Aadhar Number

17

Account Number

Y

Account Number

Bank Account Name

Y

Name on bank account

18

Account Type

Savings, Current, Loan etcRequired in IFMS while processing payments

19

IFSC

Y

IFSC

20

Amount

Numeric

Y

Debit Details

21

Account Code

Y

2723000 ,2101001

22

Account Head

Roads and Bridges-Roads & Bridges

Salaries, Wages and Bonus-Basic Pay

23

Debit Amount

Y

Deduction Details

24

Account Code

N

3502017,

25

Account Head

Recoveries payable-LCCS, Creditors-Contractors

26

Deduction Amount

N

Net Payables

27

Account Code

Y

3501002

28

Payable Amount

Y

Debit Amount should be equal to sum of deduction detail plus credit amount.

DDO Details

29

DDO Code

N

30

DDO Login ID

N

DDO Login id is mandatory if multiple DDO exists for the same DDO code.

Summary Details

Y

31

Gross Amount

Y

32

Net Amount

33

Number of beneficiaries

Y

34

PreviousBillReferenceNumber

N

Needed if re-submitting previously objected to the bill.

35

Payment Date

Y

36

Payment Mode

Y

1

EX0005

Could not find the XML in the Zip File

Technical

2

EX0006

Digital Signature File Missing in the Zip File

Technical

3

EX0007

Digital Certificate found to be Revoked

Technical

4

EX0008

Digital Certificate found to be Expired

Technical

5

EX0009

Certificate Serial Mismatch

Technical

6

EX0010

Signature Verification Failed

Technical

7

EX0030

Invalid Zip File

Technical

8

EX0033

Invalid File Naming Convention

Technical

9

EX0034

Public key not available for Signature verification

Technical

10

EX0903

XSD Validation Failure

Technical

11

FV0004

Duplicate File / Message

Technical

12

FV0005

Number of Transaction mentioned in the Header mismatch with the actual transaction

Technical

13

FV0006

Amount mentioned in the net amount mismatch with the actual transaction amount

How is this possible?

14

FV0007

ePayments Subscription not done for the Initiating Party

What is ePayments Subscription?

15

FV0008

Mismatch in Department Code or Service Code

Technical / Mapping

16

FV0058

Invalid File Name

Technical

17

FV0059

File Creation Date is greater than CBD

Technical

18

PV0007

Debtor Account Closed

Modify and Resubmit the Bill

19

PV0008

Debtor Account Freezed

Modify and Resubmit the Bill

20

PV0009

Debtor Account In-Operative

Modify and Resubmit the Bill

21

PV0010

Debtor Account Dormant

Modify and Resubmit the Bill

22

PV0014

Invalid Debtor IFSC

Modify and Resubmit the Bill

23

PV0070

Debtor IFSC and Creditor IFSC should not be same

Modify and Resubmit the Bill

24

PV0072

Invalid Payment Information ID Format

25

PV0073

Duplicate Payment Information Id

26

TV0002

Invalid Currency

27

TV0003

Invalid Creditor IFSC

Modify and Resubmit the Bill

28

TV0004

Duplicate End to End ID

29

TV0121

Creditor Account Closed

Modify and Resubmit the Bill

30

TV0122

Creditor Account Freezed

Modify and Resubmit the Bill

31

TV0123

Creditor Account In-operative

Modify and Resubmit the Bill

32

TV0124

Creditor Account Dormant

Modify and Resubmit the Bill

33

TV0130

Creditor Account Invalid

Modify and Resubmit the Bill

34

TV0133

Creditor Account Type Invalid

Modify and Resubmit the Bill

35

TV0161

Invalid IIN

What is IIN?

36

TV0162

Invalid Aadhaar format

Not required

37

TV0163

Invalid User Number

Not required

38

TR0001

Previous financial year bill not allowed

Modify and Resubmit the Bill

39

TR0002

Wrong bill head of account

Modify and Resubmit the Bill

40

TR0003

Duplicate bill number

Bill Number is generated Automatically by the system. It should ensure that this doesnt happen. if so, create another bill with new bill number

41

TR0004

Wrong object breakup head of account

Modify and Resubmit the Bill

42

TR0005

Wrong by transfer head of account

Modify and Resubmit the Bill

43

TR0006

Bill objected

Why?

44

TR0007

Payment failed

Why?

45

TR9999

Internal system error

Technical

46

0

Processed successfully

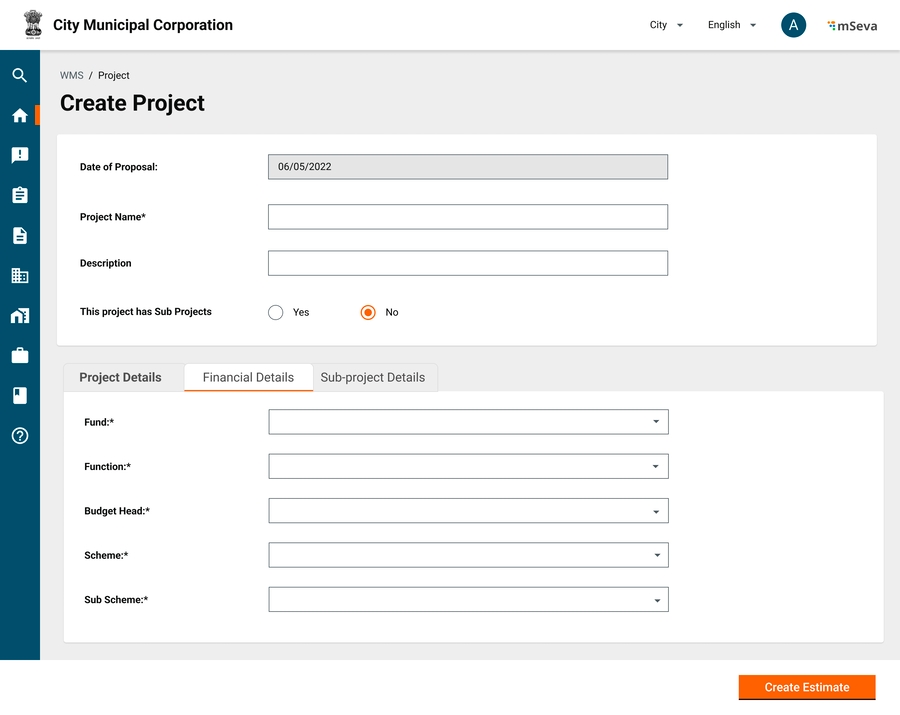

Create Project with no sub projects

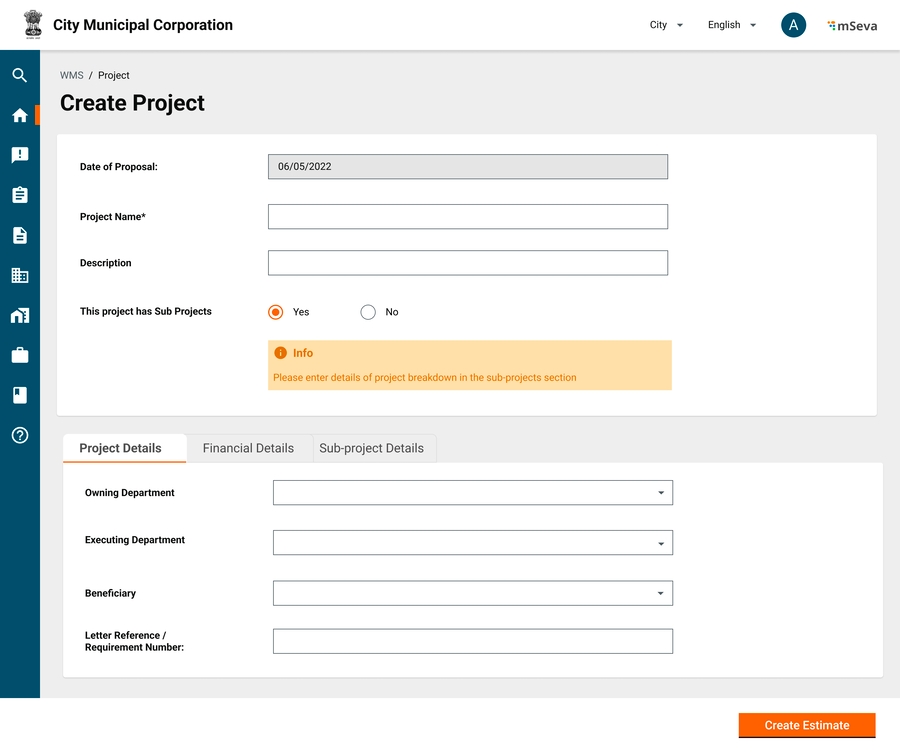

Create Project with Sub projects

Capturing Financial details of project (Part of Program service)

Capturing Sub Project Details

Project Created Successfully

View Project

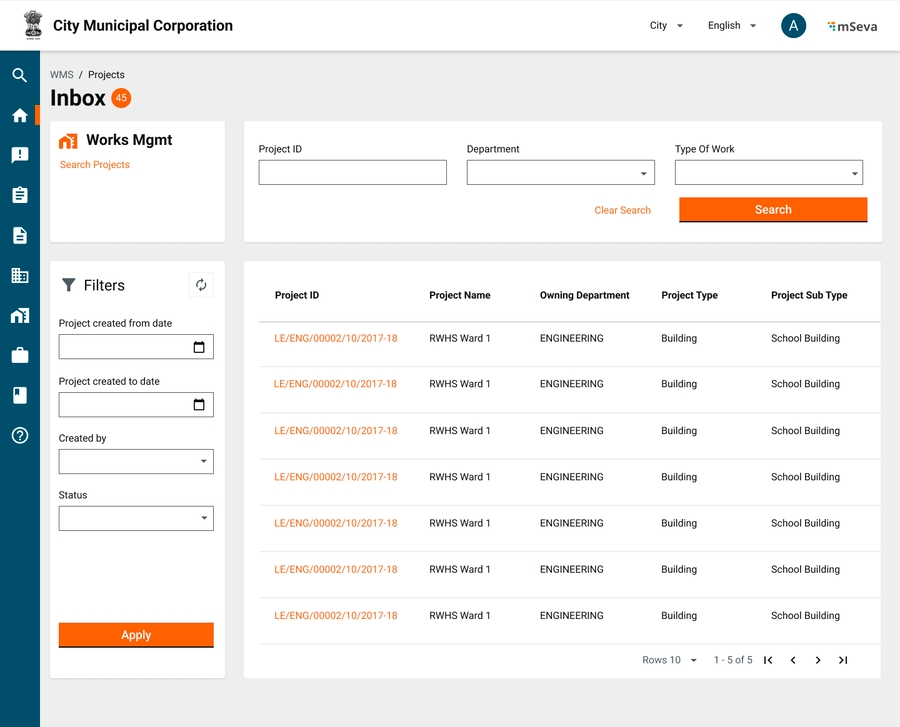

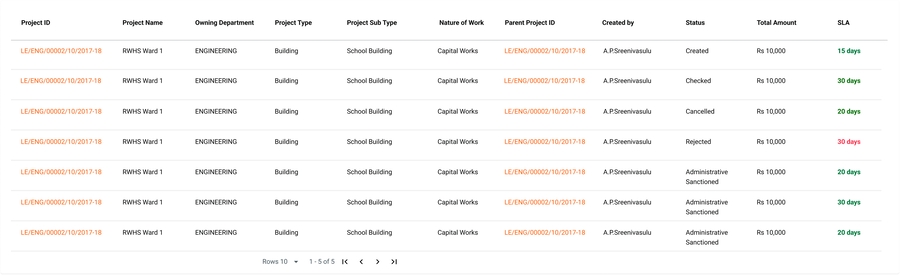

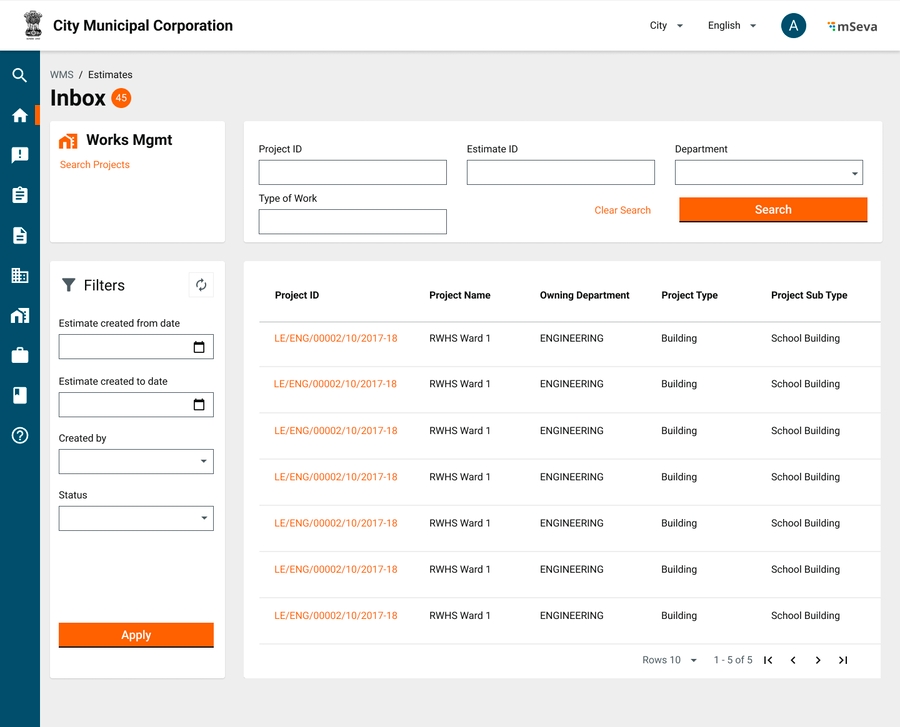

Projects Inbox

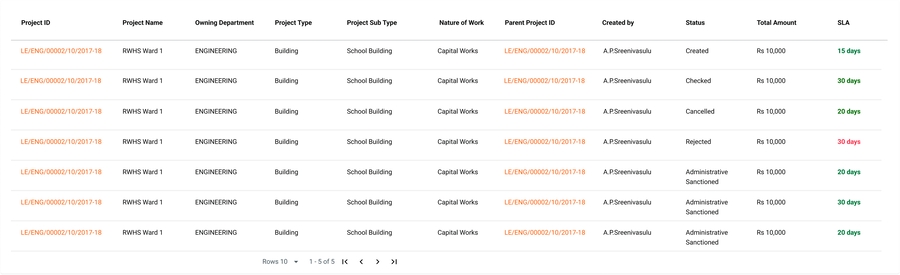

Inbox Table

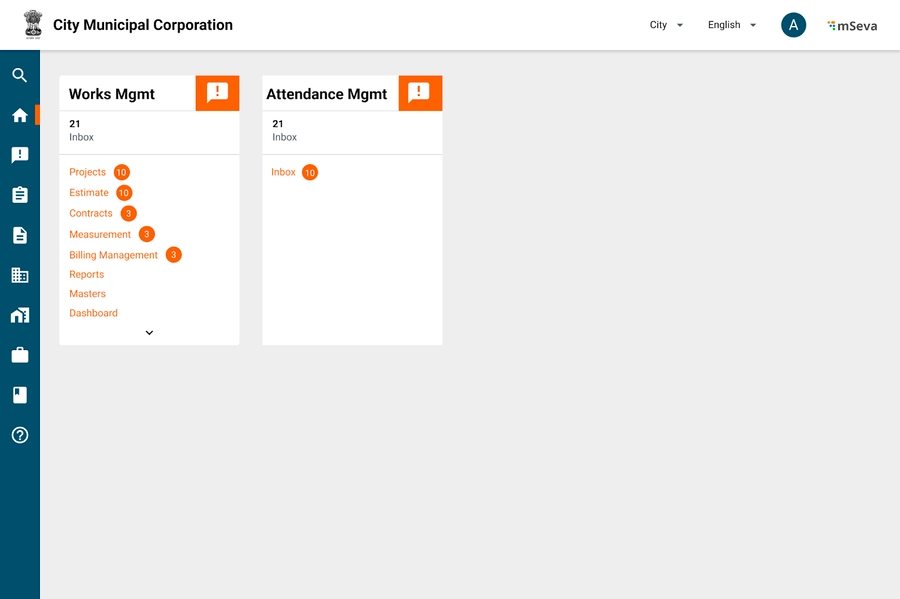

Works Home Screen

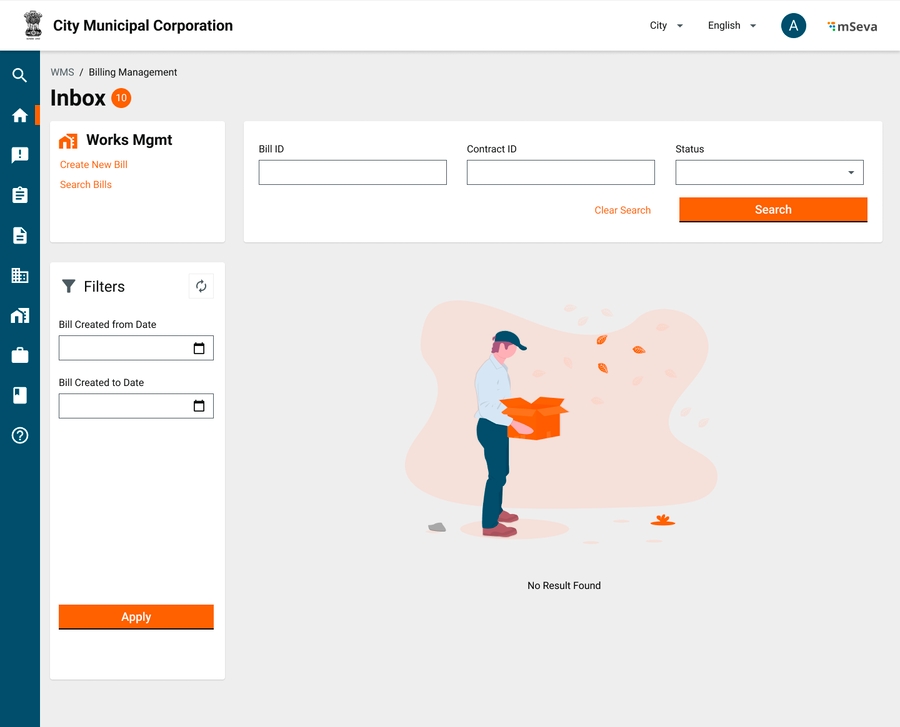

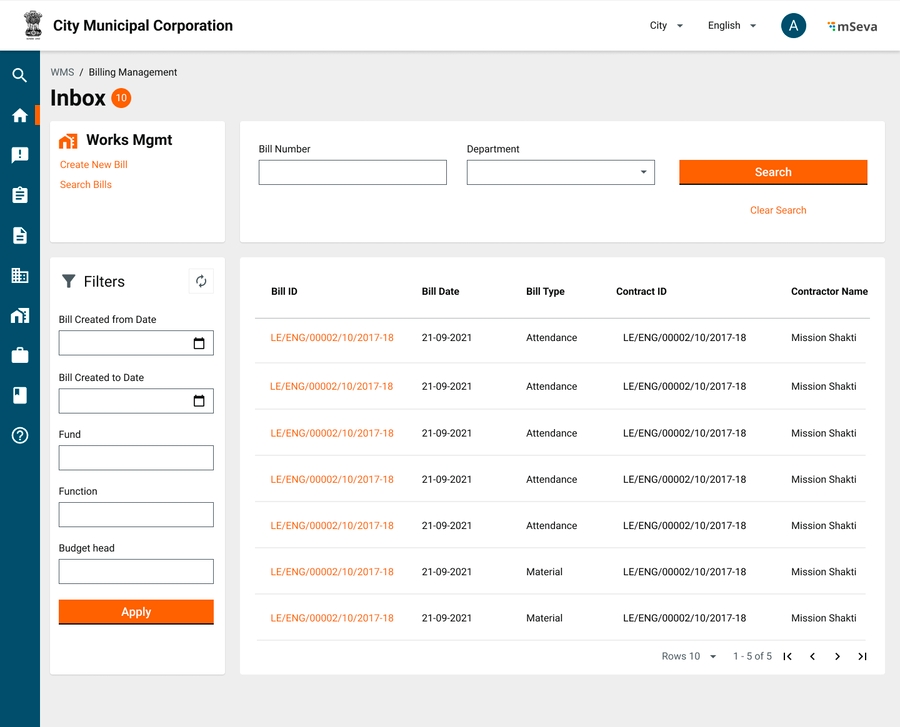

Users having access to billing management can come to the billing inbox by clicking on billing management on the home screen.

Billing Management Inbox

Billing management inbox will have links to create new bill, search for existing bill and filter bills using

Bill ID

Contract ID

Bill Status

Bill created from date

Bill created to date

Initially inbox will be empty as no bills are created.

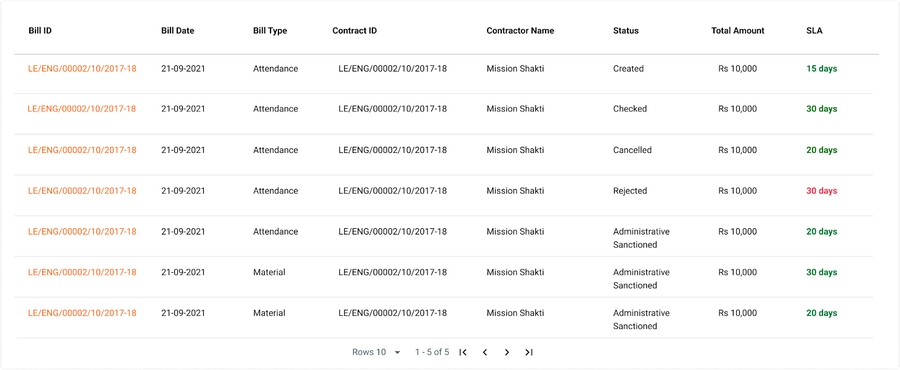

When bills are created and assigned to other users for approval, inbox table is filled as shown.

Table columns are

Bill ID

Bill date

Bill Type

Contract ID

Contractor Name

Status

Total Amount

SLA

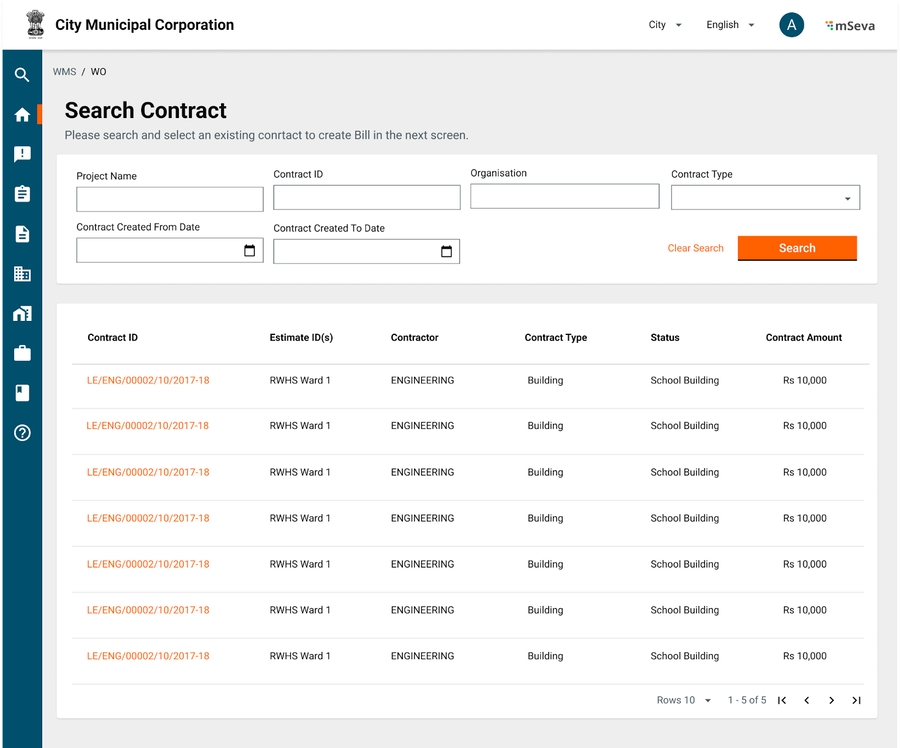

Search Contracts to Create Bills

Users click on create Bill in the billing management inbox and search for existing contracts to create Bills

Search parameters to create Bills

Contract Name

Contract ID

Organization

Contract Type

Contract Created from Date

Contract Created to Date

Search results in the table to show

Contract ID

Estimate ID(s)

Contractor

Contract Type

Status

Contract Amount

Billed Amount

Actions

Validations

Show only contracts whose project closure is not done

Show contracts for which billed amount is equal to contract amount. But do not give option to create a new bill in Actions

Create a New Bill in actions will only be present for contracts whose bill amount is less than contract amount.

Clicking on Contract ID in first tab should show contact view screen exactly as it would open from contracts flow on home screen.

Primary CTA here will be same as what Actions menu shows on the previous screen.

Create Bill (If Billed Amount < Contract Amount)

None (Billed Amount = Contract Amount but project not closed)

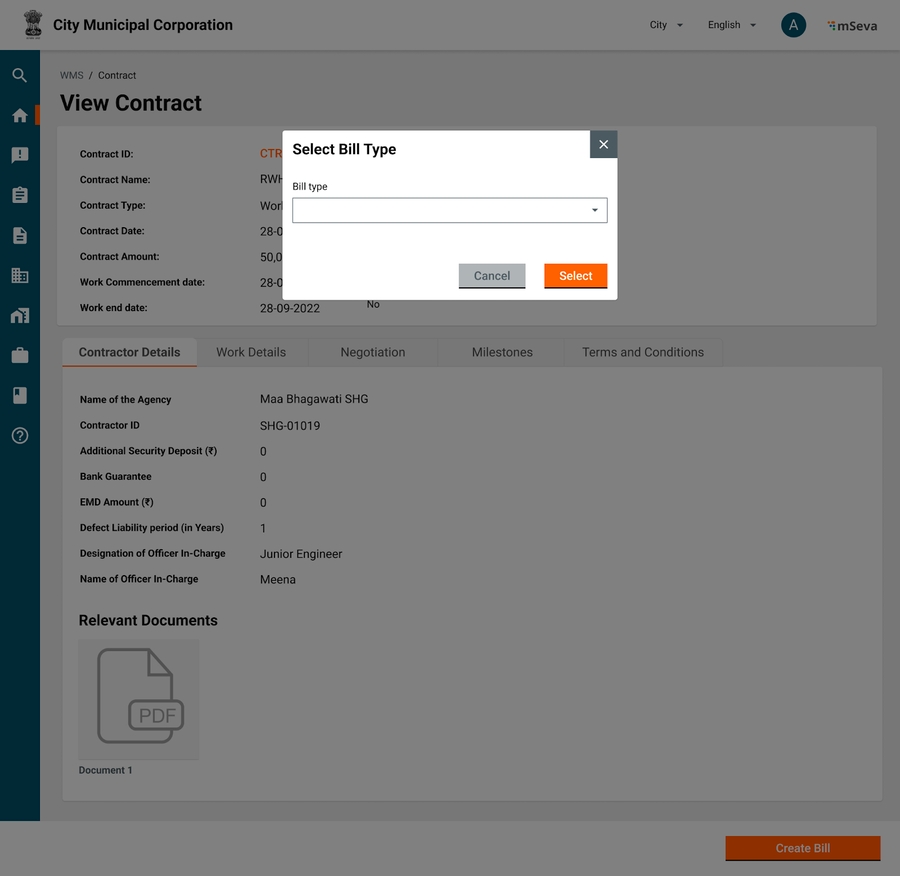

Choosing Bill Type

Clicking on create bill should ask the user to select a particular bill type, next screen will be displayed accordingly.

Expenditure service may have many bill types like Salary/Pension Bill, Contractor Bill, Wage Bill, Vendor Bill, Supervision Bill, Advance Bill etc

Works Product will only show

Advance Bill

Contractor Bill

Vendor Bill

In specific implementations such as Mukta, this can extend to

Contractor Bill

Vendor Bill

Wage Bill

Supervision Bill

Validations

Mapping of Contract Type to Bill Type

WO.Work_Items

Contractor Bill

WO.Labour_and_Material

Vendor Bill

Wage Bill

Supervision Bill

PO

Vendor Bill

Mixed (ex. Mukta// Custom implementation)

Wage Bill (But has validations of contractor Bill)

Vendor Bill (But choose to pay to contractor or vendor depending on internal validations)

Supervision Bill

To create any type of bill under a contract, current billed amount shouldn’t have crossed the contract amount.

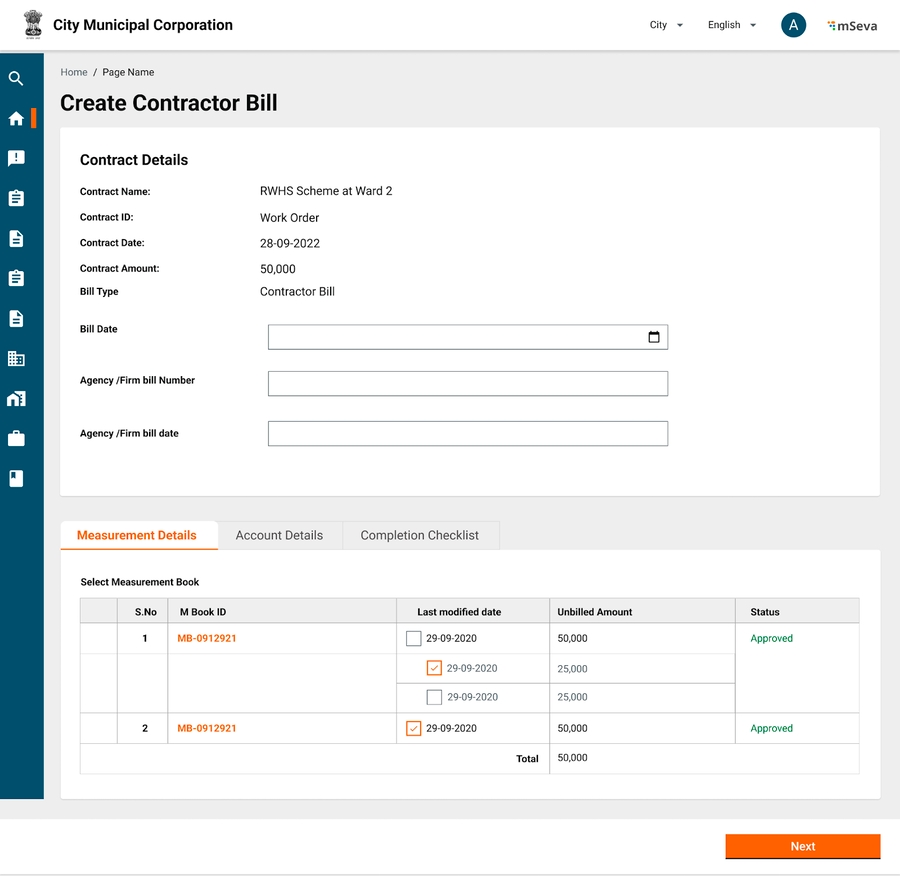

Contractor Bill

Header details will capture

Bill Date - Default to todays, but allow to change to previous date

Agency/ Firm Bill Number

Agency/Firm Bill Date - Date on which the agency has generated bill in their system. This should be before Bill Date

Contractor Bill is completely based on measurement book

If a contract is formed by combining multiple estimates it will have 1 Mbook for each estimate.

All the readings from multiple Mbooks under this contract, that are recorded and approved, but not yet paid will show in measurement details

User can select upto what date of the mbook reading payments can be made.

It is not mandatory to pay for entire approved readings.

Upon selection of days of readings, final calculation of gross amount payables is calculated and displayed.

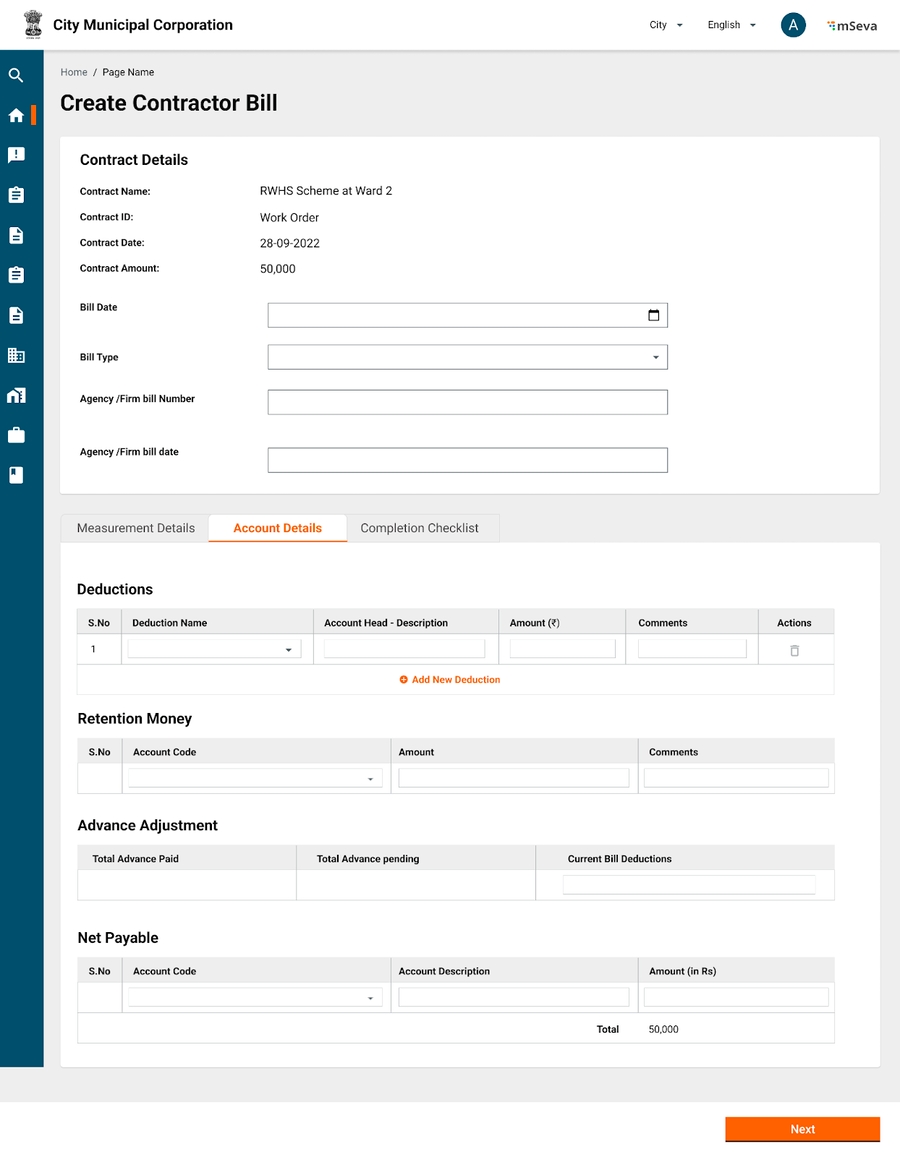

In the second Tab, account details to be selected

Deductions

Deductions will be predefined master

Selecting Deduction Name in searchable dropdown will autopopulate Account head description and Amount

Amount is either percentage of Bill or Lumpsum

User can add comments

Deductions cannot be more than gross bill amount.

Retention Money

Retention money is the amount retained within the source as part of every bill.

Retention money account heads will be defined in master.

Amount should be entered from UI

Retention money cannot be more than current bill amount - deductions

Advance Adjustment

Total Advance Paid - Sum of all the advances paid to this contractor under this contract.

Total Advance pending - Advance given - Advance Paid

Current Bill Deductions - Deductions that will be written off against balance amount.

Current Bill deductions cannot be more than gross Bill Amount - Deductions - Retention money

Net Payables

Net payables is the account code from which payment has to be made.

If we are capturing this at time of project creation, make this a default view only screen.

Otherwise, if user is entering it first time while bill creation, make this an inputtable field from UI with selectable dropdowns.

Bill will have the following statuses

Created

Checked

Approved

Rejected

Re-submitted

Cancelled

Completion Checklist

Only for final bills

Along with bill certain checklist and attachments need to be added to it can trigger project closure.

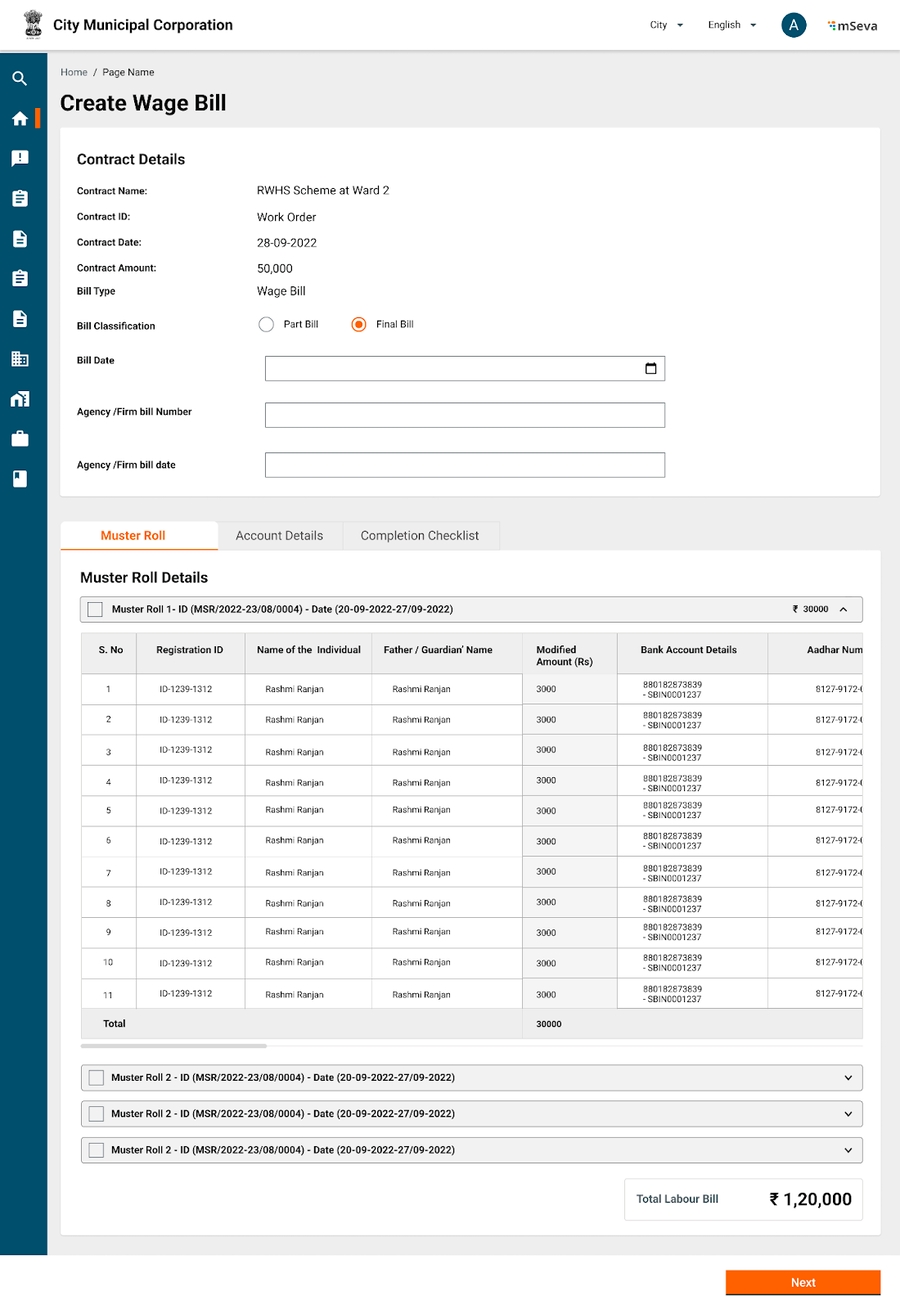

Wage Bill

Header information is same for all types of Bills

Unlike a contractor Bill, Wage bill is verified against Muster rolls.

All Muster rolls that are created and approved under that contract are shown here for user to select which muster rolls can become part of this bill.

User can do multi select and final amount is shown as gross amount of the bill

Deductions on each beneficiary

Similar to Contractor Deductions, each individual also can attract deductions.

User can choose to add deductions by each individual by clicking on edit icon.

A popup shows asking for deduction details.

User can also select to apply same deduction calculationf for all wage seekers from all musters that are selected.

Gross amount is calculated accordingly

Hence deductions in Account details(next tab) is view only field, a sum of all deductions by each deduction head.

Similar columns should be present for Retention money and Advance Adjustment where details against each individual will be captured in a popup and choosent to be applied to all individuals if needed.

Hence, retention money and advance adjustment are also view only fields in next screen.

Functionality of net payables is same as contractor bill.

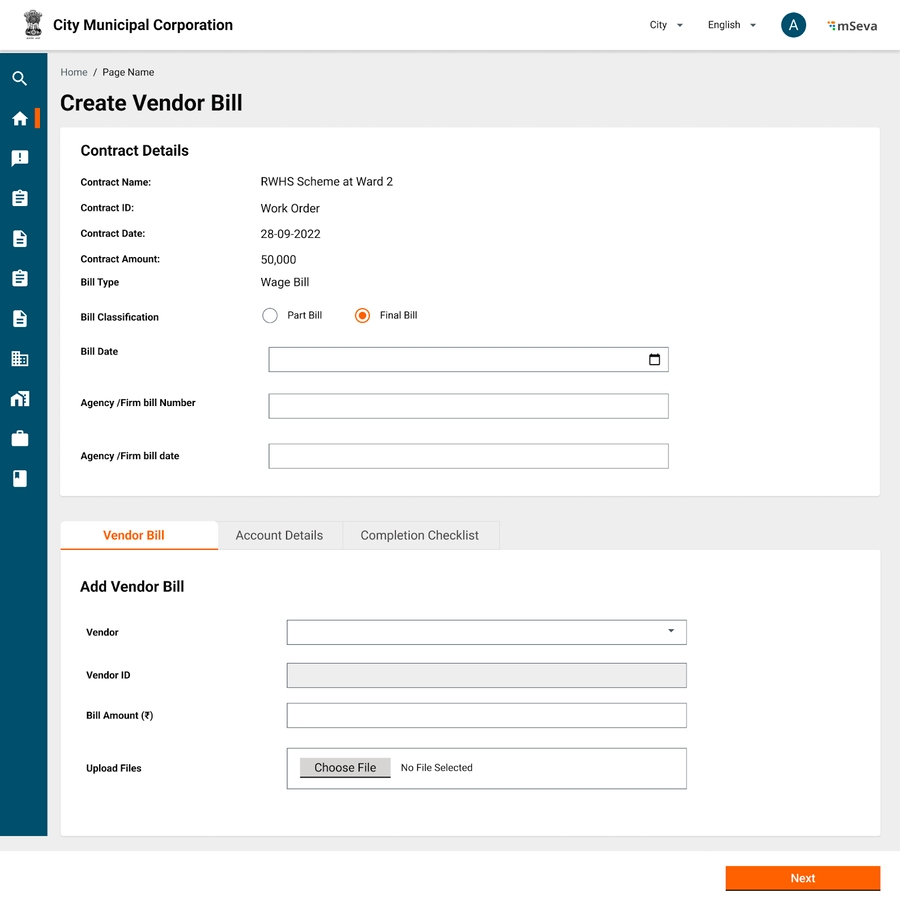

Vendor Bill

A vendor bill should be verified against Purchase order that is given to the supplier.

A purchase order can contain n*m (line items *quantity) and each invoice can be a subset of these items only.

Since in V1, we do not have complete Purchase Order detailed out.

A vendor bill is simply an invoice submitted from the vendor for payments.

It will have

Vendor ID (Ideally comes from contract details if it is PO. Incase of Mixed, or Material and Labour contract this should be captured from UI at the time of Bill creation)

Bill Amount

File Attachment

Deductions, Retention Money, Advance Adjustment and net payables are same as contractor Bill

Advance Bill

Advance Bill is just an amount that is given to the vendor/contractor/individual to commence the work.

Advance bill can be given at any time of the contract.

Advance bill will not have to be verified against any other document

Advance amount should be

< contract value - Billed Amount - Advance Adjustment

There should be provision to adjust Advance Amount in each bill

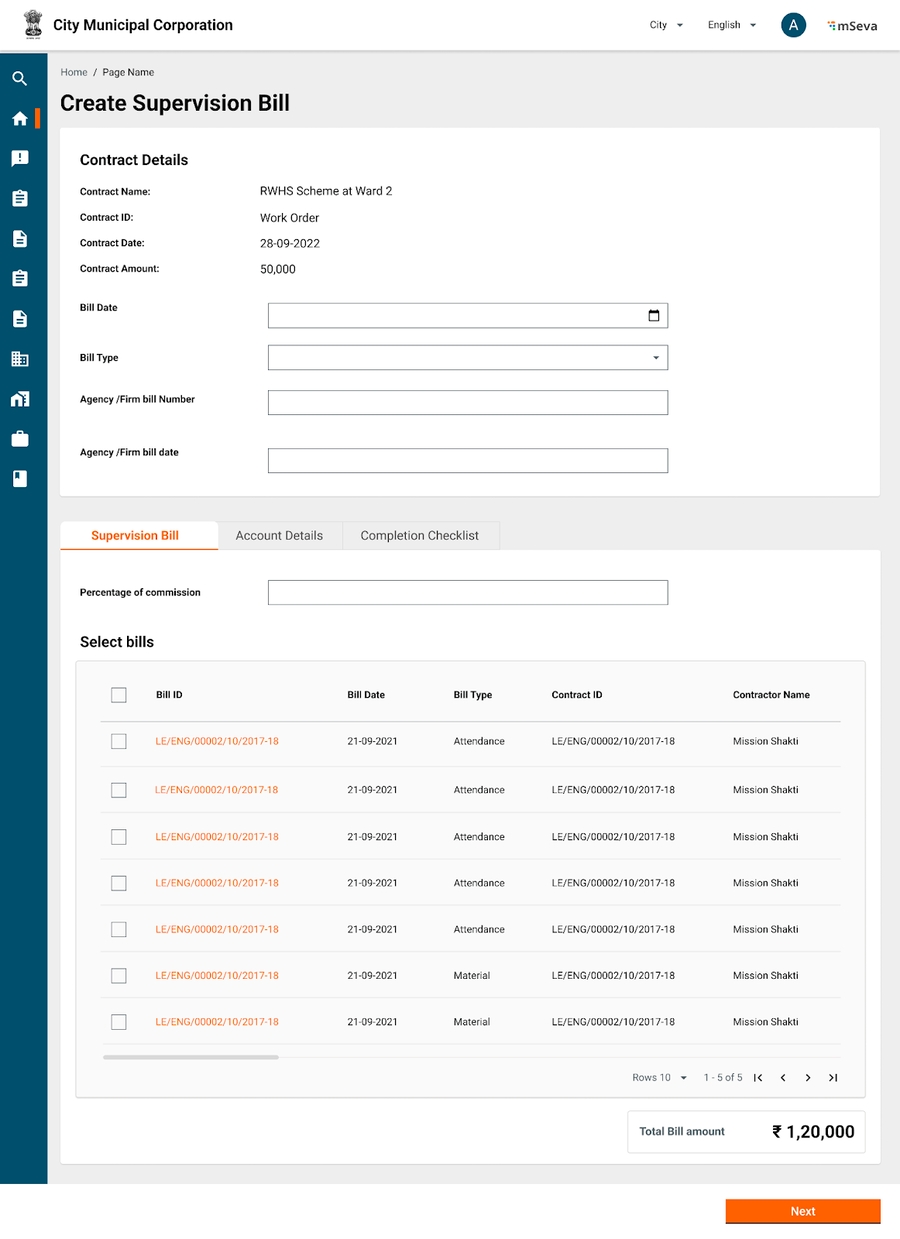

Supervision Bill

A supervision bill is a special type of bill that will be processed as percentage on top of existing bills.

User can select bills under that contract and select percentage to be given as commission. This will be created as new bill in the system

Deductions, Retention money, Advance adjustment and net payables act same as contractor bill.

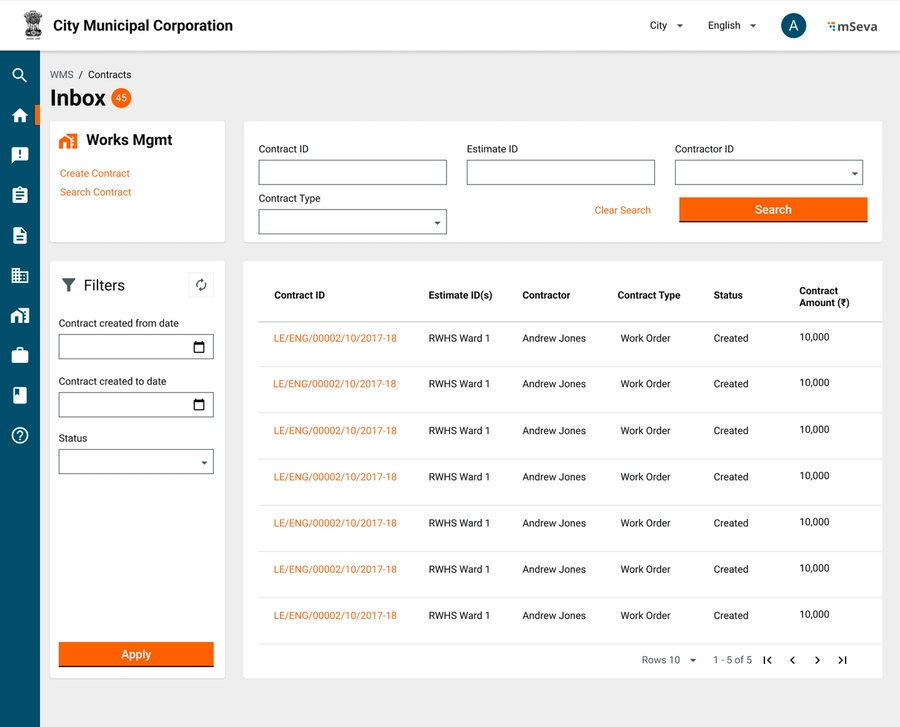

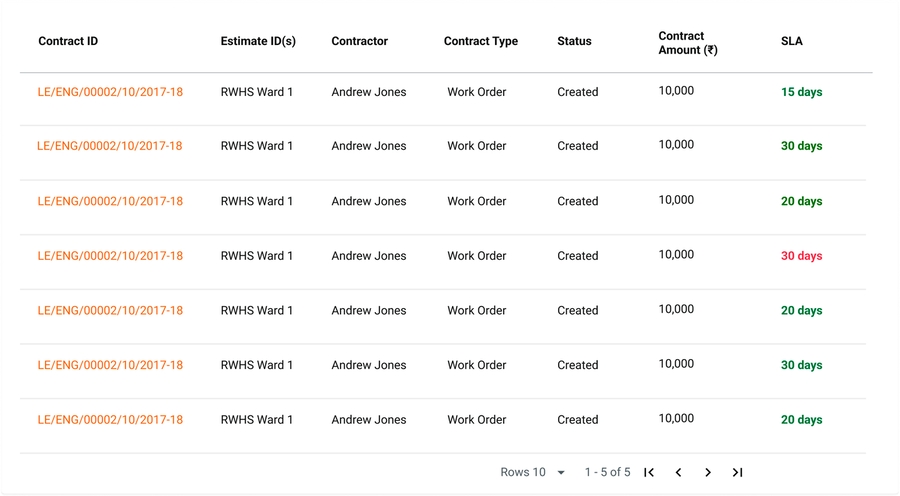

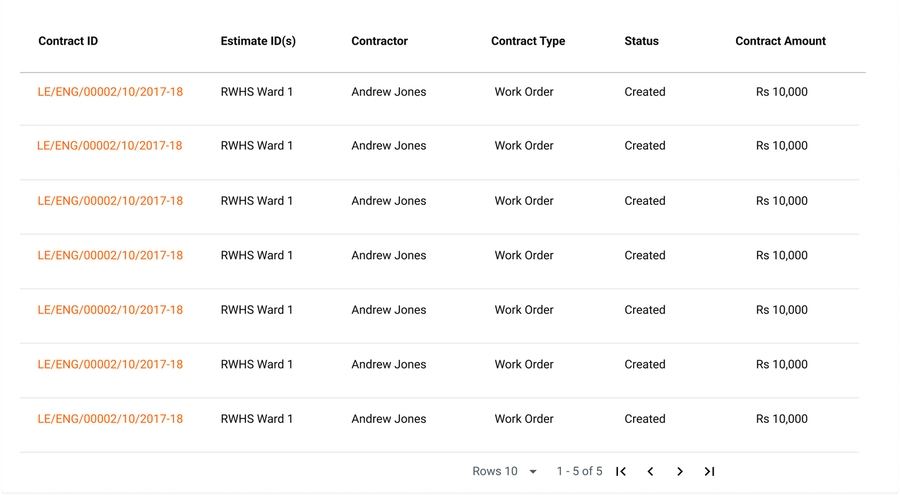

Contract Inbox

Clicking on the Contracts link on the home screen navigates users to a default contract inbox screen.

Default inbox items will be empty for a contract creator.

Users can filter and search using the following options

Contract ID

Estimate ID - Show a list of all contracts by each row when a particular estimate falls in all those contracts.

Contractor ID

Contract Type

Contract Created from date

Contract Created To date

Status

Columns in the Table

Contract ID

Estimate ID(s) - If a contract is formed with multiple estimates show an array of estimates.

Contractor

Contract Type

Status

Contract Amount

SLA

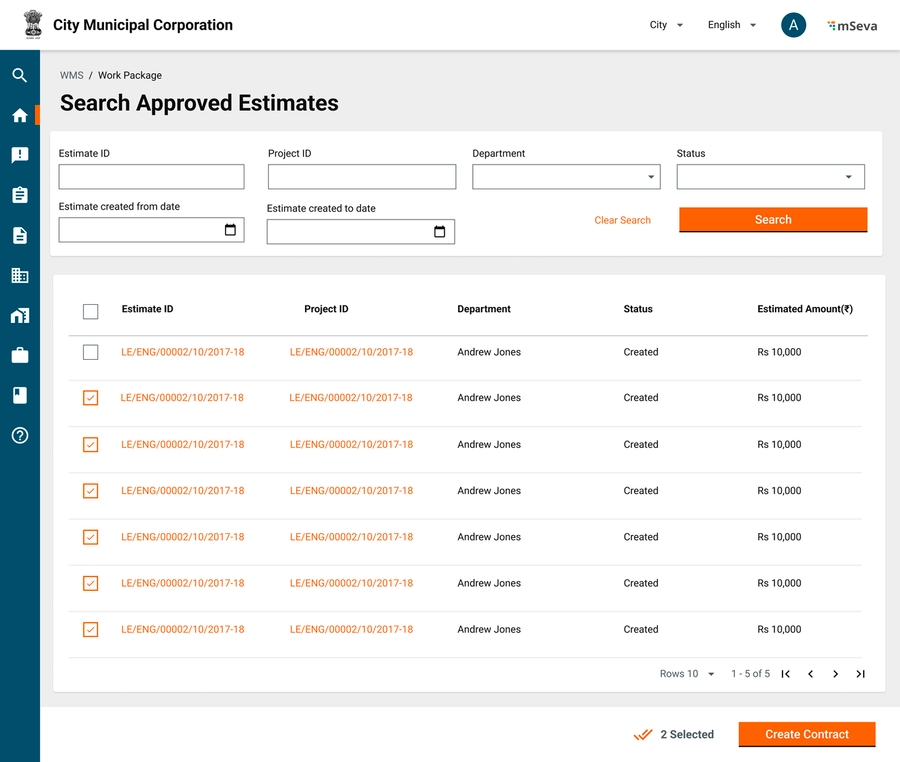

Search Estimates to Create Contract

Click on Create Contract in the contract inbox to search for approved Estimates.

Users can multi-select approved estimates to create contracts.

Search parameters

Estimate ID

Project ID

Department

Status

Estimate created from date

Estimate Created to Date

Table Columns

Estimate ID

Project ID

Department

Status (of the estimate)

Estimated Amount

Select the estimates using checkboxes - a counter shows at bottom of the page.

it should be allowed to search/re-search using the filters while the selection is frozen.

Refreshing the page might lose the selections from UI.

Clicking on create contract will add selected estimates to the respective contract UI to be further actionable(on the next page)

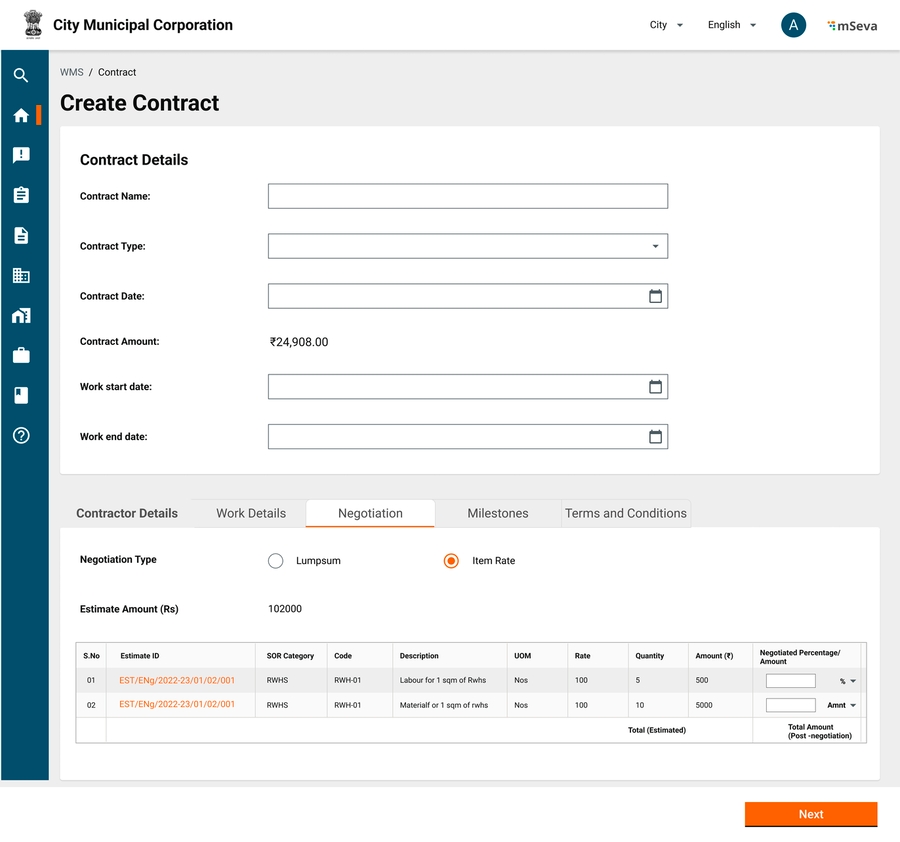

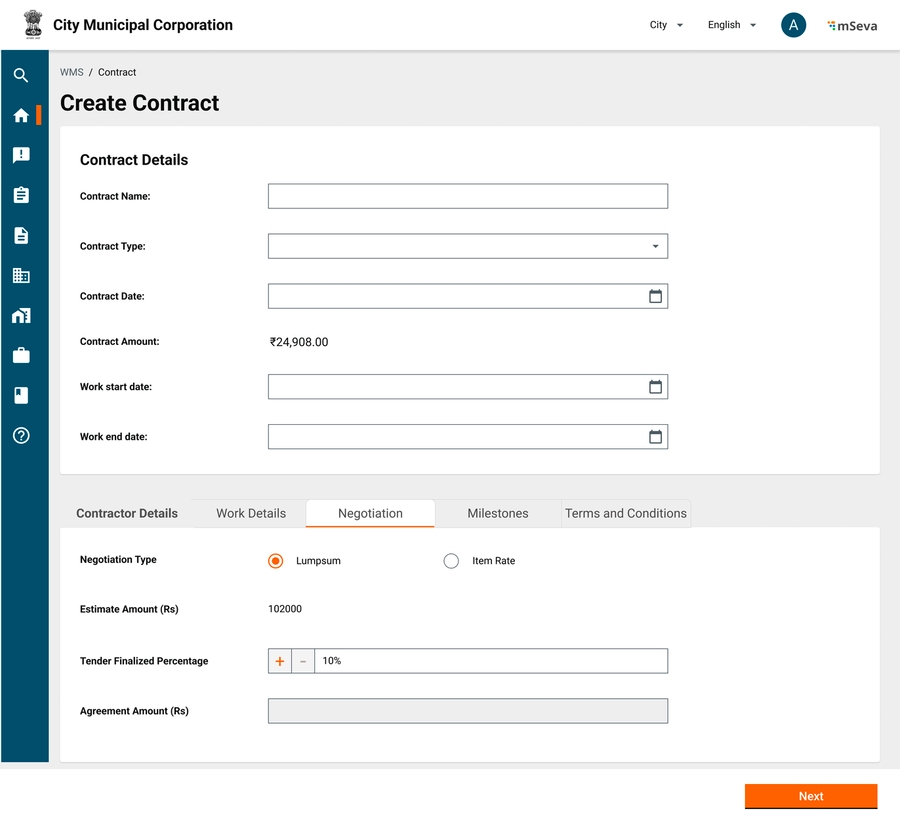

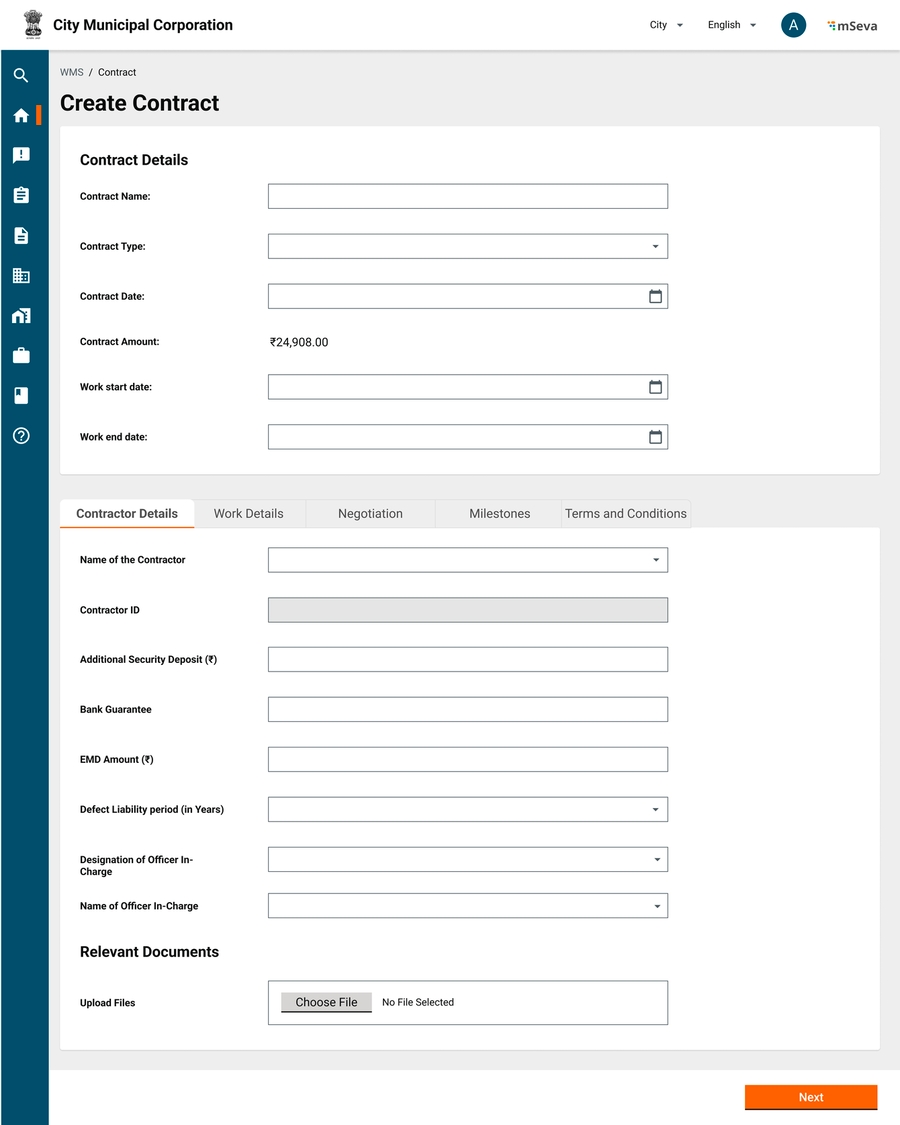

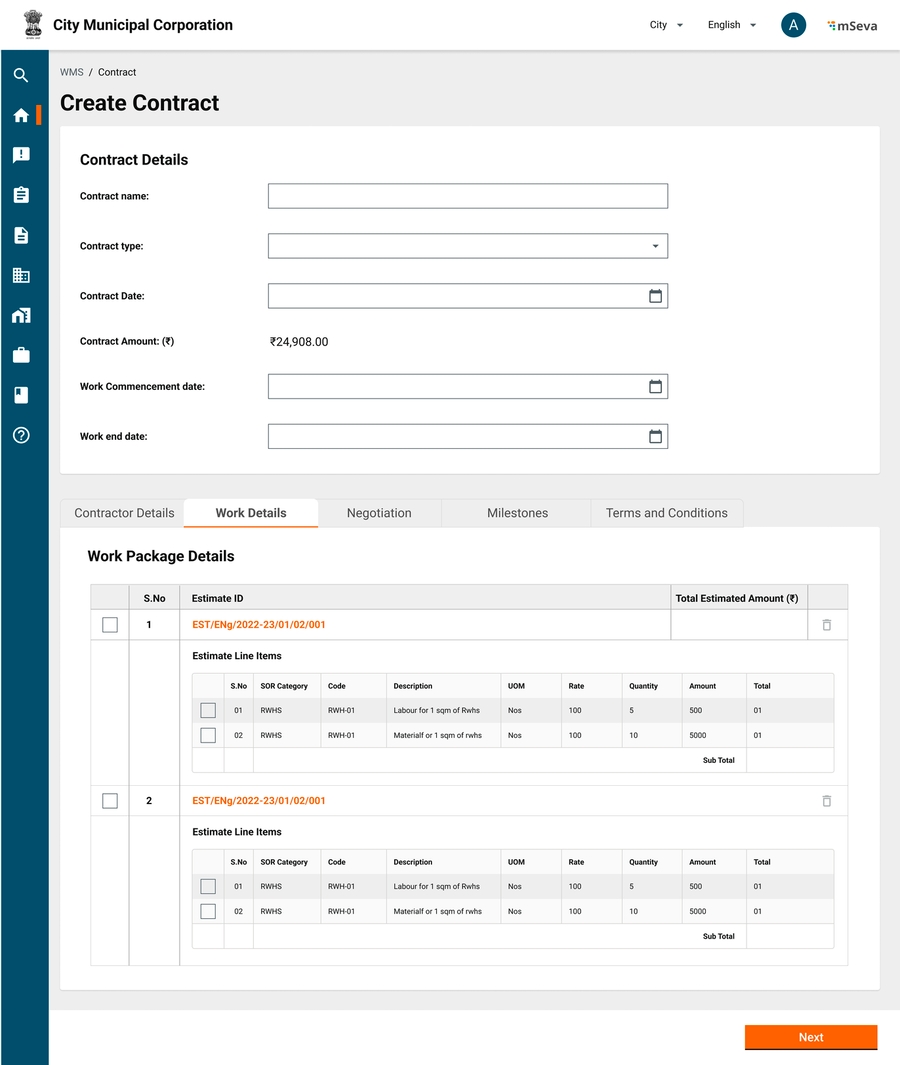

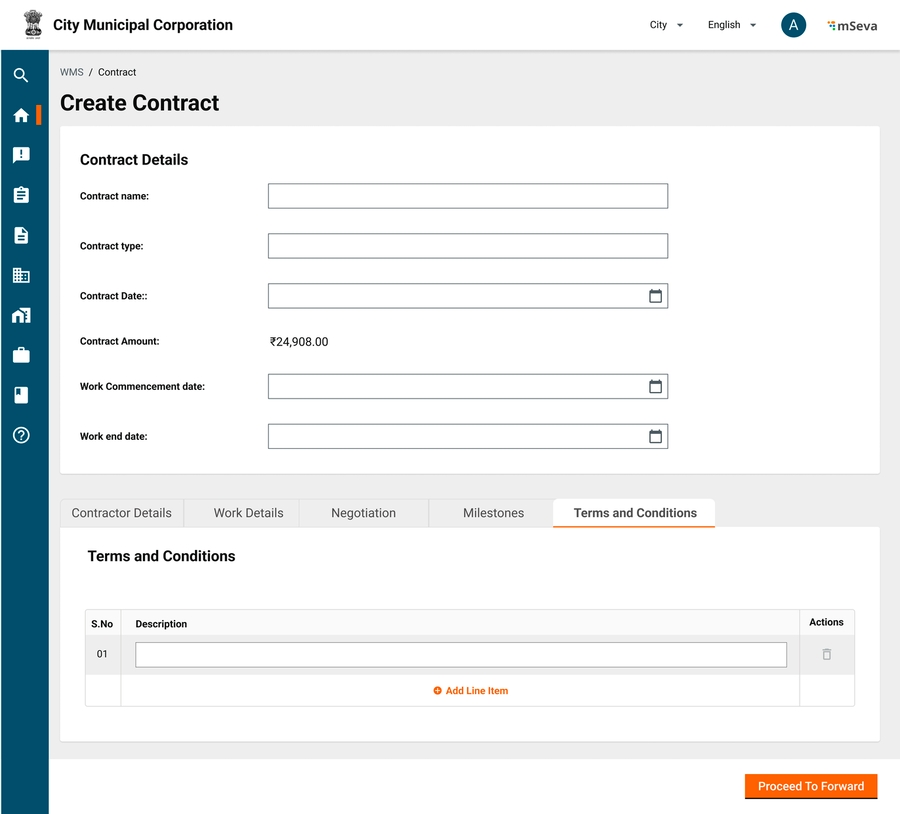

Create Contract - Header & Contractor Details

Contract creation UI displays the headers and multiple tabs.

Attribute details are added separately in the story

Contract Amount is a display-only field.

Value dynamically changes based on selections in the work details and the negotiation tab

Initially, the contract amount is the sum of selected estimates

But, if in the work details, certain line items are removed from the estimates, then only the remaining amount needs to be displayed in the Contract Amount

In the negotiation tab, only line items that are fixed from the work details tab are shown. These will have negotiated percentage/amount values for each line item.

Only the finalised sum of negotiated values is to be shown as the Contract Amount

Contractor ID is a display-only field. It is shown on searching and selecting a contractor from the contractor select drop-down.

Work Details

The Work Details section shows the list of estimates and estimates for the line items from the selection made before coming to the contract screen.

Estimate line items that are already selected and part of other created contracts should show up as non-selectable line items in this table UI.

Users can select line items from different estimates and the final amount of selected line items will show up in the Contract Amount under header details

Clicking on next will take the user to the Negotiation tab.

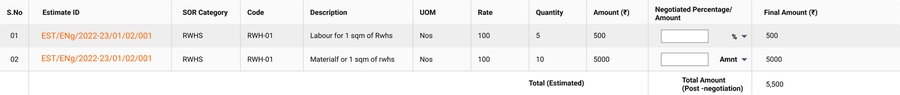

Negotiation Details

Negotiation is of two types

Percentage-tender (Lumpsum)

Item rate negotiation

In Lumpsum, the entire contract is negotiated by a certain amount/percentage.

On the UI, we will capture by percentage and calculate the final amount of the contract.

The same will be displayed on Contract Amount in the Header details

For the Item rate negotiation type, line items selected in the Work Details tab only will be shown in a table.

This table will have a column for the users to input either amount or percentage of the line item that is negotiated.

Finalised amount, the sum of all negotiated values is the contract amount.

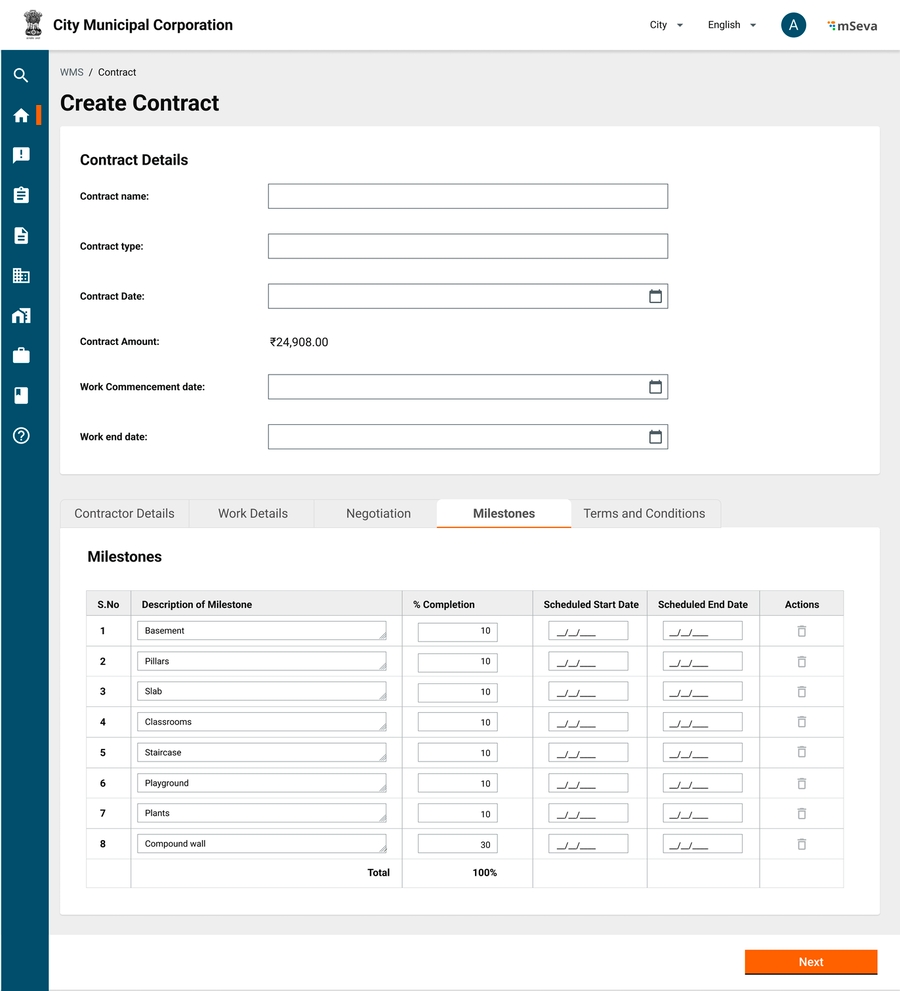

Milestones Creation

Milestones are tagged to a certain percentage of completion of the project.

There will be milestone templates(v2) based on project type and subtype. Users will only have to fill in start and end dates then.

A contract can have any number of milestones.

The sum of % completion of all these milestones however should add up to 100%

Terms and Conditions

Terms and conditions are an array of upto 100 strings in V1.

Users can click on Contract ID in their inboxes to come to view the contract screen.

The View Contract attributes is the same as Create Contract attributes from a UI perspective. All the fields are standard view-only components.

The View Contract screen will additionally have the Contract ID displayed in the header details

Depending on the user and path selected View Contract will have the call to action options.

For users in the workflow

Approve

Reject

For final users

Approve

Reject

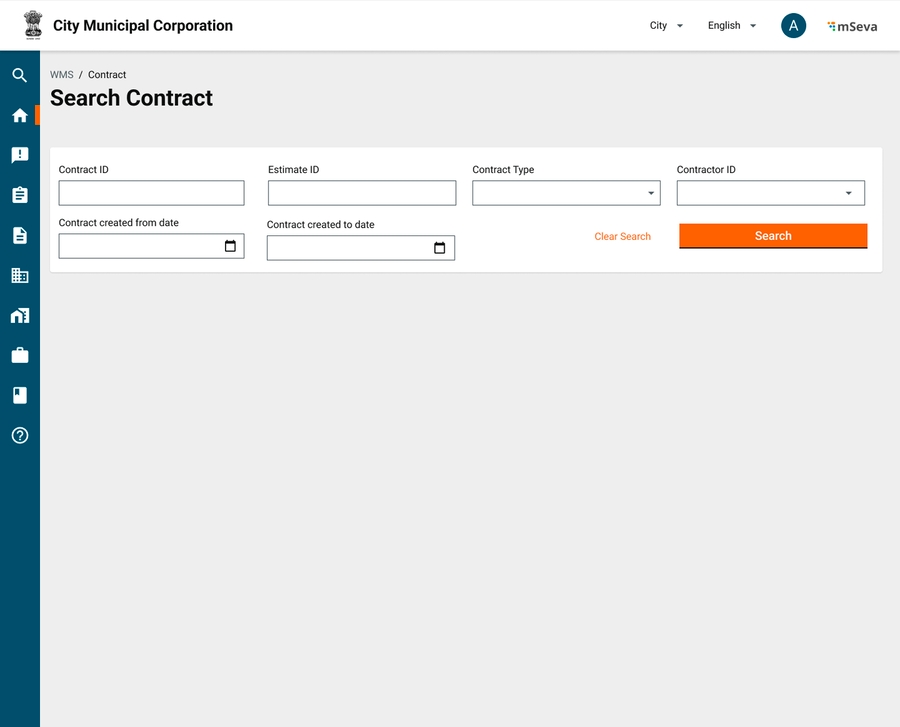

Search Contract

Search contract flow helps in searching any contract in the system (Currently in progress or old contracts or rejected contracts)

Users have the option on the contract Inbox to search for contracts. Clicking on that link will get users to the contract search page

Default is an empty page with a set of search options

Contract ID

Estimate ID - Searching for project ID should list all contracts that are part of that project

Contract Type

Contractor ID

Contract Created from Date

Contract Created to Date

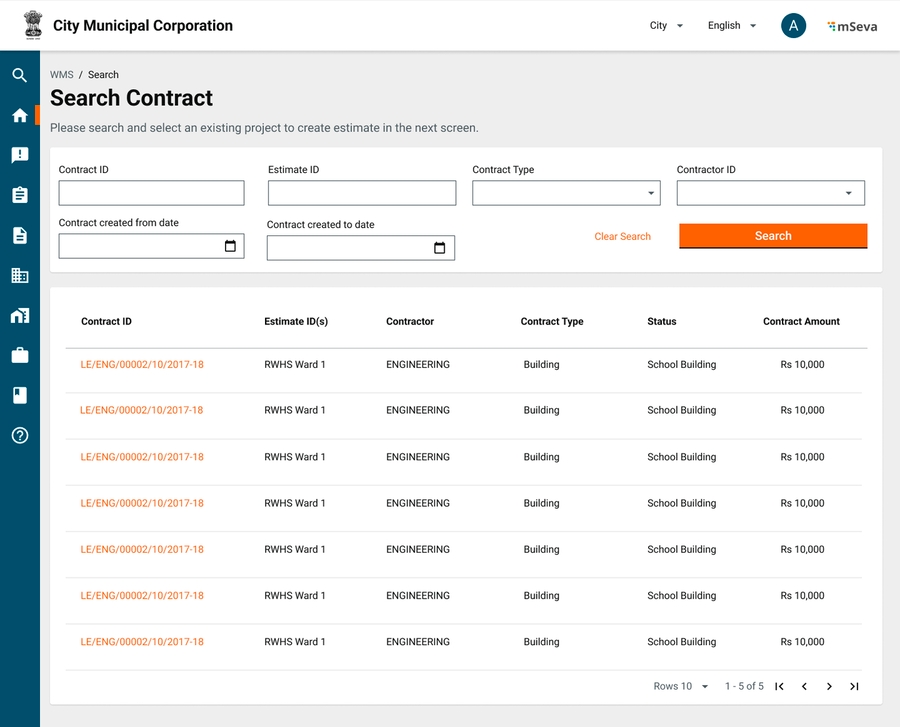

Contract search results table -

Contract ID

Estimate ID

Contractor

Contract Type

Status

Contract Amount

Clicking on any Contract ID will take the user to the View Contract screen

Modify Contract

Before the contract is finally approved, all fields should be editable. System-generated Contract ID is non-editable.

By the time contract becomes editable, some of the estimates/estimate line items could possibly be added to other contracts.

The system should ensure the same line items are not part of 2 different created contracts

Base Contracts once issued and accepted cannot be modified

Revised Contracts (v2)

Estimates go through revision and also need a revised contract to be issued

A revised contract can be a change in line items (scope) or a change in the amount

Estimates are created for each project/sub-project entity.

Need and Background

An estimate is prepared for each Works project to get technically sanctioned and proceed with tendering/contract.

Estimates are created for each project/sub-project entity.

There are multiple estimate types for each project prepared with different levels of abstraction (refer to the table below).

Proposal

A single line item has the overall project cost against the project title. This requires in-principal Admin sanction. Once approved detailed estimate for the same is created.

Detailed

A detailed estimate contains engineering drawings done on AutoCAD & other drawing tools. Modern tools also abstract out many measurements and materials from drawings created by these tools.

Abstract

An abstract estimate is prepared using standard SOR & Non-SOR Items defined by PWD (mostly ULBs customise SOR and have their own copies). SOR items are created internally using item rates.

Revised

When a project's finances are increasing then to what is initially estimated, revision estimates are created and approved. revision estimates may or may not have the same SORs as initial estimates. Revised estimate line items added to initial line items will give overall project cost.

Deviation

A deviation statement is a type of estimation when the scope of the project changes but the project cost is meant to remain the same. The deviation statement and revised estimate are the same as far as the estimation process is concerned. The approving authority changes only.

Spill Over

For a multi-year project, an estimate is financially broken down into pieces and budget allocation is done for each year instead of allocating the entire budget in the first year.

After creating the project (and getting it approved if it is in the workflow) the Junior Engineer estimates it.

The following details are required to create an estimate -

Line items from SOR

Non-SOR line items

Overheads

There are 3 ways how estimates can be added.

Manually adding from the SOR master list

Using estimate template

Copying the format of existing similar projects and changing the values

To select line items for SOR, select the SOR category, search for the SOR line item by SOR code or SOR description and select the SOR.

To the SOR line item, add the quantity required for the project.

SOR standard amount multiplied by this quantity gives the line item-wise cost.

Measurements are captured at the SOR line item level directly by the specified UOM or length, breadth, height, and quantity are captured and stored in an empty measurement book. The measurement book recordings can be used later.

Multiplication of will give the required quantity of the line item for the estimate.

A non-SOR line item will not be defined in MDMS and hence will not be searchable using the SOR category or Code.

Rate, Quantity and Description have to be entered manually.

Just like SOR, capture details.

All SOR and Non-SOR items in the way captured in the estimates will be created as empty records in the Measurement Book to capture readings later.

Overheads are predefined masters.

The project cost becomes the cost of SOR and non-SOR items plus overheads.

Overheads are either added on top of SOR and Non-SoR separately or can be derived from SOR Sub Line items.

Overhead amounts will not be going to the contractor but will be going to specific heads defined in the Master for respective overheads. (GST 12% to GST department, Cess 1% to labour dept etc). This means Contracts will selectively capture only a few overheads for contractors.

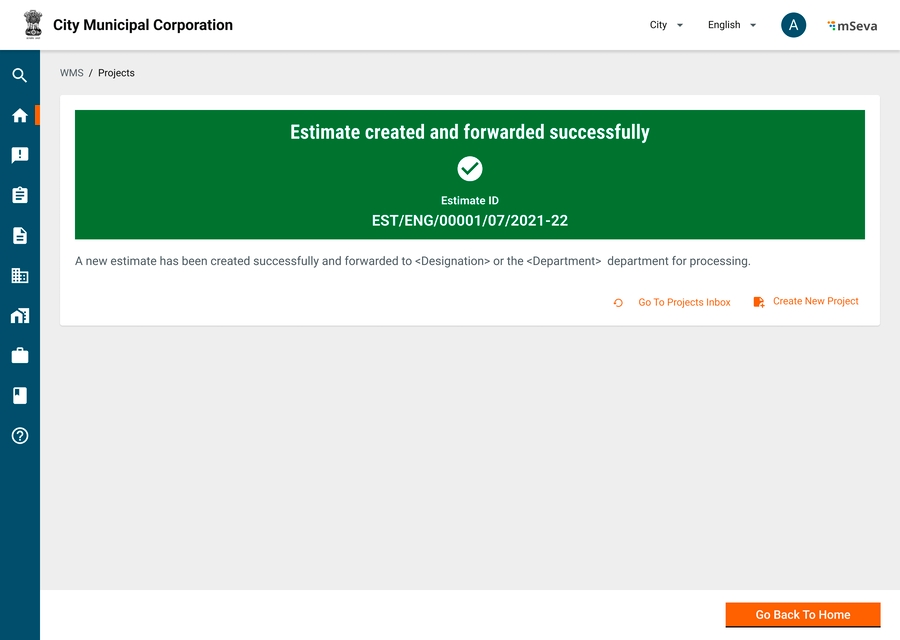

Each estimate will have a unique ID that is generated

ID: EST/<ULB/Department Code>/<Year>/<month>/<Date>/<running sequence number>

Status of an estimate

Created

In progress

Approved

Rejected

Cancelled

SOR is a line item that represents the rate for a single unit of work. SOR is defined by the Central PWD or state PWD and is revised based on the market needs from time to time. In general, there are about 3000+ SOR line items

Each executing authority ULB/Department may modify the rates of these SORs by applying lead charges.

Lead Masters will vary for each project as the project site will be different for each.

For simplicity, SORs are usually kept constant under a ULB.

Each SOR Item may have multiple variants with slight changes in description and amounts.

Example: The estimate of tiling for the ground floor and the estimate of tiling for the first floor will change by 15 Rs to capture the carriage charges. These should be captured with .serial_number. (Parent.Child)

SOR Category ID

Drop down

Y

Options will be the list of Category Code from the SOR category type master

The combination of category Code and Item code is unique

Item ID

Alphanumeric

Y

System generated

Item Description

Y

Item description of the selected Item

Unit of Measurement

Y

Options will be the list from Unit of measurement master

[Array] for specific date ranges

Item Rate

Numeric

Y

Multiple entries can be specified for each Item, but there cannot be an overlap in the rates for a range of dates

Item rate Applicable From

Date

Y

To be entered in the format dd/mm/yyyy

Item rate Applicable To

Date

N

To be entered in the format dd/mm/yyyy

Analysis of Rates

Each line item of a SOR master/SOR variant will further be divided into sub-line items that come from a set of category Masters like Labour Master, Material Master, Royalty Master, Carriage Master etc.

A group of sub-line items together will form an estimate line item.

Each sub-line item will have Item detail 1, item detail 2, quantity, UOM, rate, and estimated amount.

The sum of all sub-line items will become the total of the SOR line item

Item detail 1 will capture whether it is material/labour/carriage/overhead/royalty etc

Item detail 2 will capture the exact details of the item from the respective item master. rates need to be auto-populated.

With this when extracted, we should be able to produce labour analysis, material analysis and other standard reports, coming from the estimates.

ID

NA

Na

System generated ID

Department

Dropdown

Y

Labour rates may vary by each department

Material Category

Dropdown

Y

brick and tile, stone and road, metal and iron etc

Description of Material

Alphanumeric

Y

Second Class Table Moulded Chamber Burnt Bricks 9" x 41 /2" x 3"

Quantity

Numeric

Y

Quantity for which base rate is defined. Default to 1

Unit

Dropdown

Y

Number, Tons..etc

[Array] for specific date ranges

Item Rate

Numeric

Y

Multiple entries can be specified for each Item, but there cannot be an overlap in the rates for a range of dates

Item rate Applicable From

Date

Y

To be entered in the format dd/mm/yyyy

Item rate Applicable To

Date

N

To be entered in the format dd/mm/yyyy

Note: There are roughly about 200 materials, some of whose rates change quarterly.

ID

NA

Na

System generated ID

Department

Dropdown

Y

Labour rates may vary by each department

Skill Category

Dropdown

Y

Highly Skilled, Semi Skilled Unskilled etc

Description of Labour

Alphanumeric

Y

Technical Assistant, Stone Polisher, Smith etc

Quantity

Numeric

Y

Quantity for which base rate is defined. Default to 1

Unit

Dropdown

Y

Day/Week/Month

[Array] for specific date ranges

Rate

Numeric

Y

Rate of Labour for specified (Quantity' units)

From Date

Date

Y

Date from which these rates are applicable

To Date

Date

Y

Date to which these rates are applicable

There are about 80 types of labour.

The Lead Master will have the carriage and royalty details of each item that goes into the individual SOR items.

ID

NA

NA

System Generated

Item ID

Dropdown

Item for which Lead SOR is present

Item Name

Autofill/Dropdown

Y

Item for which Lead SOR is present

Name of Quarry

Dropdown

N

For Materials. Doesnt appy for labour

Unit

Dropdown

Y

Unit of Measurement

Lead (Km.)

Numeric

N

Distance from quarry

Basic Cost

Autofill

Y

Basic cost pulled from material rate master or labour rate master

Conveyance Cost

Numeric

N

Royalty

Numeric

N

Royalty on applicable material, abstracted, will go into specific head defined during estimation

Total

Calculation

Y

Total new cost of line item

When a lead master is set on a particular material in a particular ULB, all SOR line items that contain this item will take the amount from the lead master and not from the basic rate master

CPWD does not define non-SOR items and based on project requirements will get added to the estimate.

They will have the same attributes as the SOR item but not a defined SOR ID or SOR category.

Example - Purchasing fancy benches & themed dustbins at the Park. The rate, in this case, is fixed by JE upon discussion with potential vendors.

Overheads can be of two types.

In-Line Overheads - Defined within the SOR line items

Estimate Level Overheads -

These are defined on top of estimates. Each overhead is defined within a time range with either a percentage or lump sum value of the estimated cost.

We should be able to abstract out similar overheads from multiple SOR line items and groups to form a single overall overhead for the estimate.

ID

NA

NA

ID generated for each overhead type

Name

Alphanumeric

Y

Name of the overhead

Ex. Labour Cess, GST, Royalty etc

Description

Alphanumeric

N

Description

Account head

Dropdown

Y

Account head to which overheads should be credited

[Array] for specific date ranges

From Date

Date

Y

Date from which these rates are applicable

To Date

Date

Y

Percentage/ Lumpsum

Numeric

Y

Percentage or Lumpsum amount of estimate including value

Revised Estimates

Estimate revision can happen before the final bill is submitted and the project is closed. For a revised estimate, the user can come onto the existing estimate and click actions → Revise estimate. This goes for a similar approval cycle as the main estimate.

For a revised estimate -

New line items can be added.

Existing line items can be removed

Quantities in existing estimates can be modified.

A contract created from this estimate needs to be revised and sent to the contractor for approval.

Measurement books accordingly will be changed as per the new estimate.

If some part of the estimate is already measured and the bill has been created/approved, a revised estimate for that line item cannot go under that approved bill quantity for that line item.

A schedule category is a grouping of SORs for easy identification and filtering. There are a total of about 3000 SOR items divided into 15-20 SOR groups

Examples - Earthwork, masonry, brickwork, painting, etc

Category Code

Alphanumeric

Y

Unique Code Assigned to the Schedule Category

Category Name

Alphanumeric

Y

Name Assigned to the Schedule Category

Templates are created for specific types and sub-types of work so they can be reused for future use.

Templates are groupings of SOR items that combine to complete similar kinds of work.

On the UI, the Estimates inbox will have an Estimate Template section and users can see a list of templates, create a new template from there, or modify the existing template.

Example - Template to build 100 mt of 20 ft road, Template to build 8*10 sq ft standard room.

Template Code

Alphanumeric

Y

Define the template code

Name

Alphanumeric

Y

Name for template

Description

Alphanumeric

Y

Description of the template

Status

Dropdown

Y

Status of the template

Active

Inactive

Work Type

Dropdown

Y

Select the Type of work. All the work types defined in the system should be shown

Work Sub Type

Dropdown

Y

Select the Sub type of work. All the work sub types defined in the system should be shown here

[Array] for each line item

Schedule Category

Dropdown

Y

Options are the list of SOR categories from the SOR category master.

SOR

Alphanumeric

Y

Enter the template code and search for it

Non_SOR Code

Alphanumeric

N

Non_SOR Description

Alphanumeric

N

Non_SOR UOM

Dropdown

N

lenght--KM; Area--SQM

Non_SOR Unit Rate

Numeric

N

Overheads

Contains the overhead charges applicable on an estimate.

SOR

- Sample data for SOR

Contains a comprehensive list of items and rates defined by the department. To be used in preparation of an estimate.

SOR Rates

- Sample data for Rates

Contains a comprehensive list of items and rates defined by the department. To be used in preparation of an estimate.

Category

Contains the category of all items. - SOR - NON-SOR - OVERHEAD

UOM

Contains the unit of measurement for all categories.

Create Estimate

Estimate Successfully Created

Estimates Inbox

Inbox Table

SOR Data entry screen

A user should be able to -

Create an estimate using templates

Add SOR items from the SOR Master

Change values as required for current work

Add/auto-populate overheads

Able to generate material analysis and labour analysis

Download PDFs of labour analysis, material analysis, and overall estimate

This section gives information related to Organisation Services. An organisation can be any contractor/vendor/business unit that works with the government and helps in citizen service delivery.

A contractor/vendor is someone who does projects with the government. Every Project, after estimation approval and tendering, will have to be assigned to a contractor/vendor for it to be executed.

Works contractors bid for or are assigned works' contracts depending on the mode of entrustment for specific projects

Process of registering a contractor.

A contractor will apply for registration with any of the government departments. The contractor will be assigned a class and ID upon registration. A contractor will be issued projects that will fall into that class.

A contractor can have multiple staff that manage contractor organisation with permissions

List of things done by contractors for a project -

(Offline) Bid for contracts

(Offline)Negotiate contracts

(Offline)Accept Letter of Intent

(Offline) Issue Letter of Acceptance

(System) Accept/Reject Contract

(System) Track Work Measurements

(System) Track Attendance Measurements

(System) Create Running/Final Bills

(System) Download and upload relevant documents

Each contractor organisation is given a contractor class/grade depending on the screening/validation process.

Following are the fields required to grade contractors. This constitutes the MDMS data.

Grade

Alphanumeric

Y

Unique field

Description

Alphanumeric

Y

Description of the grade

Minimum Amount

Numeric

Y

Minimum value of work that can be assigned to the contractor of the grade

Maximum Amount

Numeric

Y

Maximum value of work that can be assigned to the contractor of the grade

A contractor organisation has a class associated with at least one department; type and subtype based on what the organisation supplies to the government, staff details to know who is managing the organisation and financial details to make payments.

Organisation Details

Vendor ID

NA

NA

System Generated unique code assigned to the contractor

Format: VO-<FY>-<6 digit running sequence number> - VO-2022-23-000001

Organisation Name

Alphanumeric

Y

Name of the Organisation

Organisation ID

Alphanumeric

N

Offline reference of Organisation ID given by govt

Formation Date

Date

N

Date of Formation of Organisation

Contractor Class

Drop down

N

Options will be list of contractor grades from the contractor grades master

Organisation Type

Multi Select Dropdown

Y

Contracts should be awarded to organisations who are of certain type. A Contractor registered as Vendor(material suppier) can only be awarded material contract

Ex - Contractor, Materials Supplier, Mixed

Organisation Sub Type

Multi Select Dropdown

N

Subset of type of organisation

Ex - Vendor - Sand, cement, concrete, paint etc Contractor - NA Mixed - NA

Status

Drop down

Y

Options will be the list of Contractor status maintained by the ULB

Active

Inactive

Black listed

Debarred

Registered by department

Drop down

N

Options will be list of the departments of the ULB defined in the department master

Public Works Department, Water Department, Education Department

Registered date

Date

N

Date of registration with the department

Valid From Date

Date

N

The date from which the specified status is applicable to the contractor

Valid To Date

Date

N

The date until which the specified status is applicable to the contractor

Documents

Attachment

N

Upto 3 files max of 2 MB each

Location Details

Address

Alphanumeric

N

Contractor address using boundary hierarchy - Locality, Ward, ULB, District etc

Billing Address

Alphanumeric

N

Contractor address using boundary hierarchy - Locality, Ward, ULB, District etc

Contact Details

Owner Name

Alphanumeric

Y

Name of the owner

Owner Mobile number

Numeric

Y

Mobile Number of the owner

Owner e-mail address

Alphanumeric with special chars

N

Email of the owner

Contact person Name

Alphanumeric

Y

Name of the contact person

Contact person mobile number

Numeric

Y

Mobile Number of the contact person

Contact person email address

Alphanumeric with special chars

N

Email of the contact person

Total Members

Numeric

N

Number of members in the organisation

Financial Details

Account Name

Alphabet

Y

Name of the Bank Account

Account Type

Drop down

N

Savings, Current, Loan, Credit

Account Number

Alphanumeric

Y

Account number of the contractor against which payments will be made

Transfer Code

Drop down

Y

MDMS Data for selection of type of unique transfer code per bank account

Ex. IFSC Code

Bank Name

Drop down

N

Options will be a list of banks specified in the banks master. Used to select the bank where contractor’s account is maintained for direct bank payment

Bank Branch

Drop down

N

Tax Identifiers

Table Select Dropdown

N

Table with multiple identifier types List

GSTIN

PAN

TIN

User to enter identfier values for each identifier type

[Array] Staff Details

Staff ID

NA

NA

System generated ID of the staff that is prepopulated because of search by phone number

Staff Name

Name of staff

Staff Role

Dropdown

Y

Role Assigned to StaffAdmin - Role that allows all actions within the organisation including adding new members to organisationManager - Role allows only functional activities like accepting contracts, creating bills etc

Staff Designation

Dropdown

N

Designaton of the staff

Owner, President, Secretary, member etc

Employement start date

Date

N

Start date of the employement

Employement end date

Date

N

End date of the employement

Employment status

Dropdown

Y

Active, Inactive status of the employee

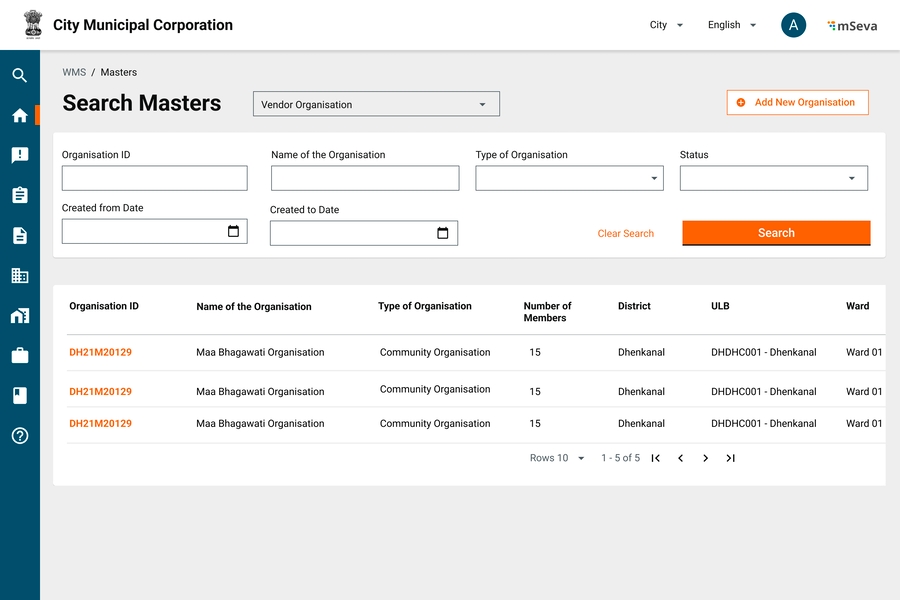

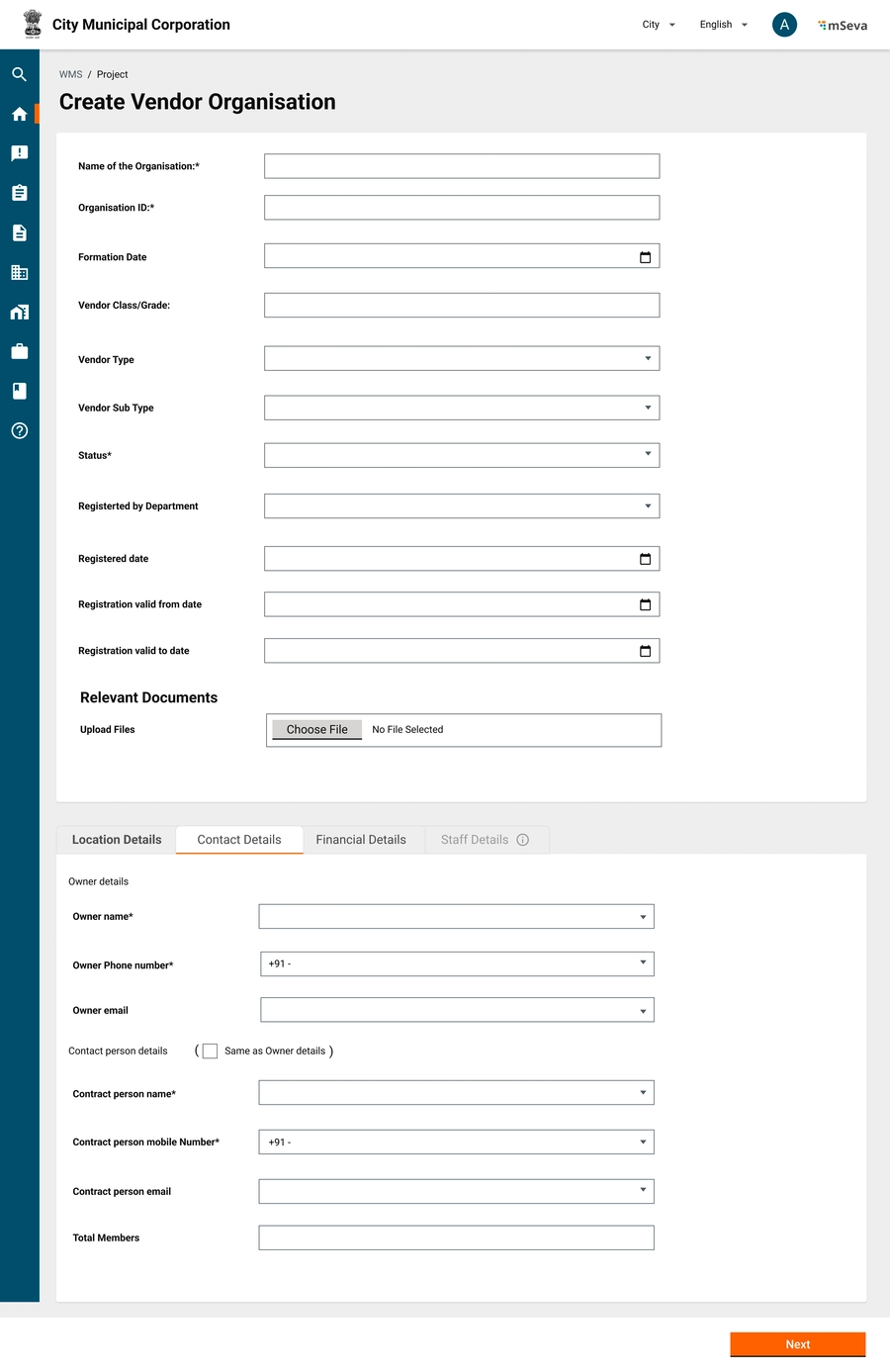

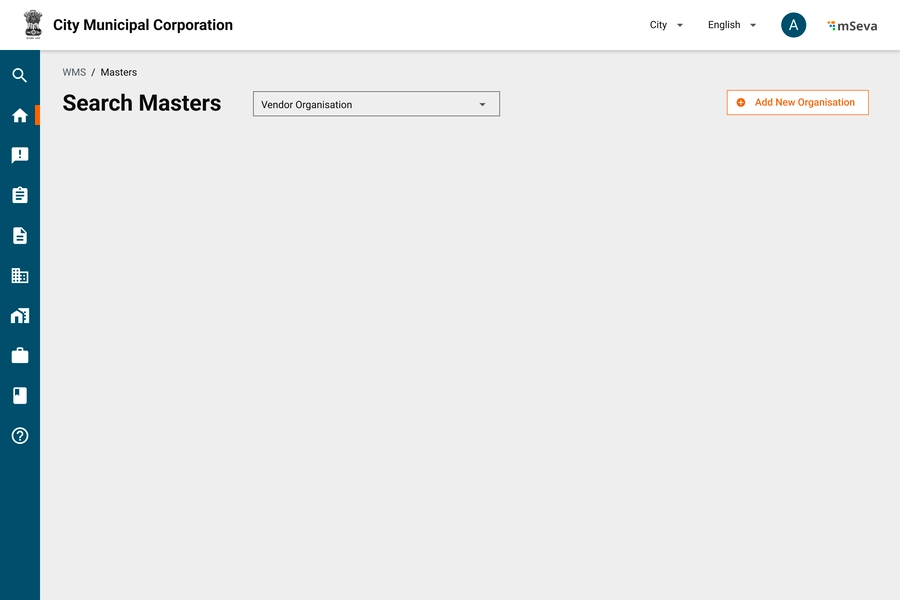

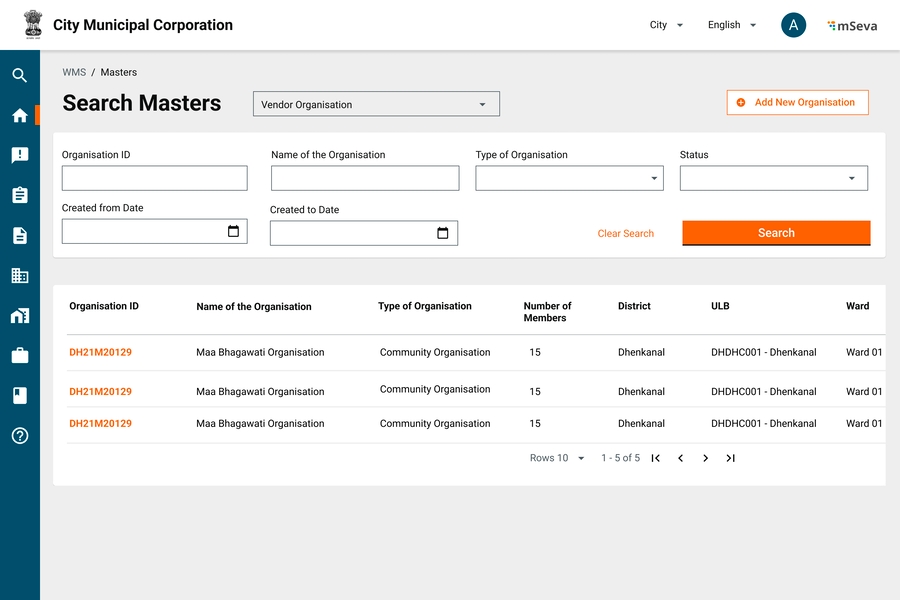

Users with permission to Create Master records have to click on Masters on the home page to navigate to the Masters landing page.

On this page, the user has to select Vendor Organisation in the drop-down (one of the few registries that are available to edit/add from UI) and click on Search.

Users are shown records of existing vendors and the option to add new Vendor Organisation.

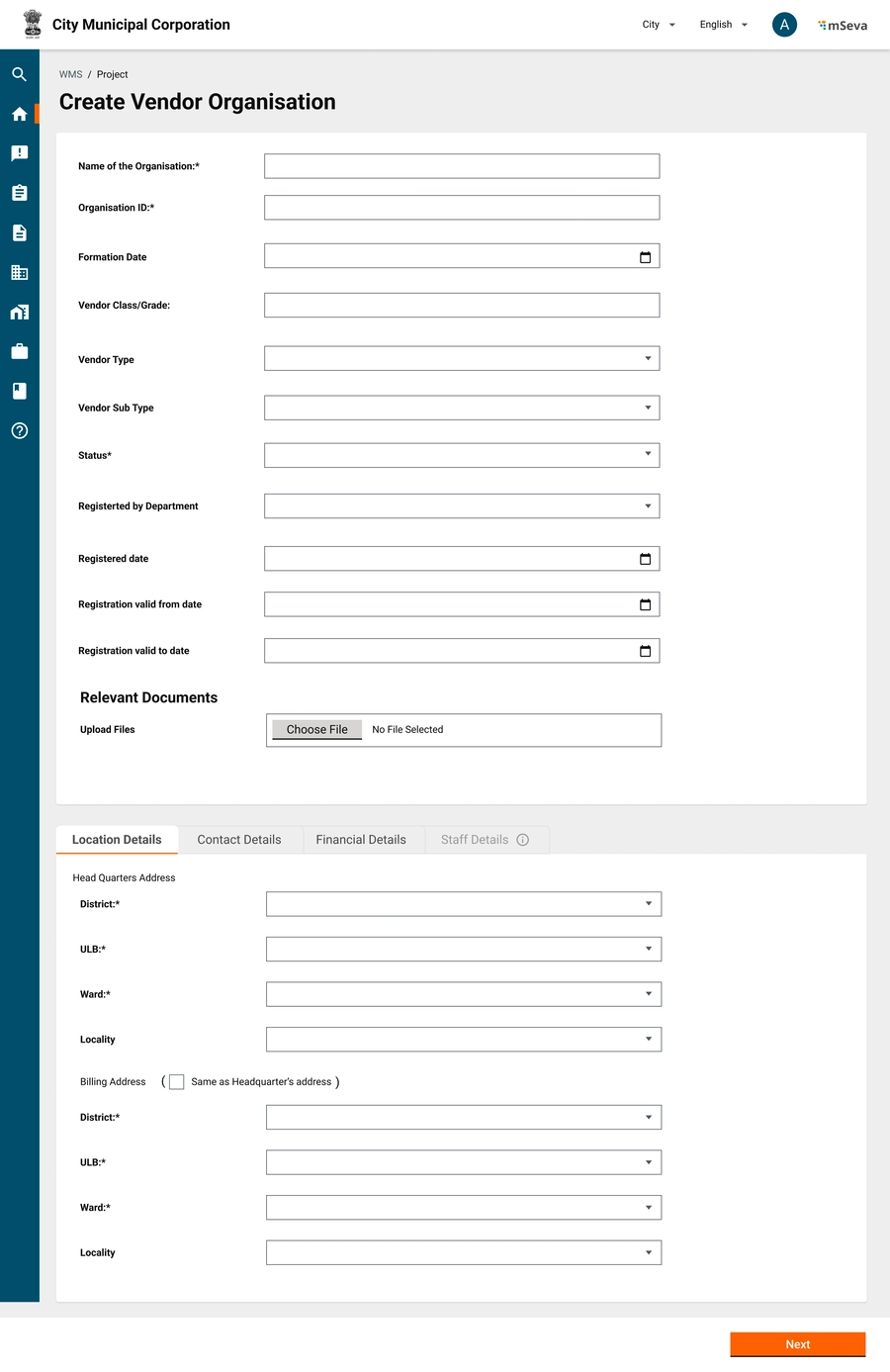

Clicking on Add New Organisation redirects users to Create New Organisation page.

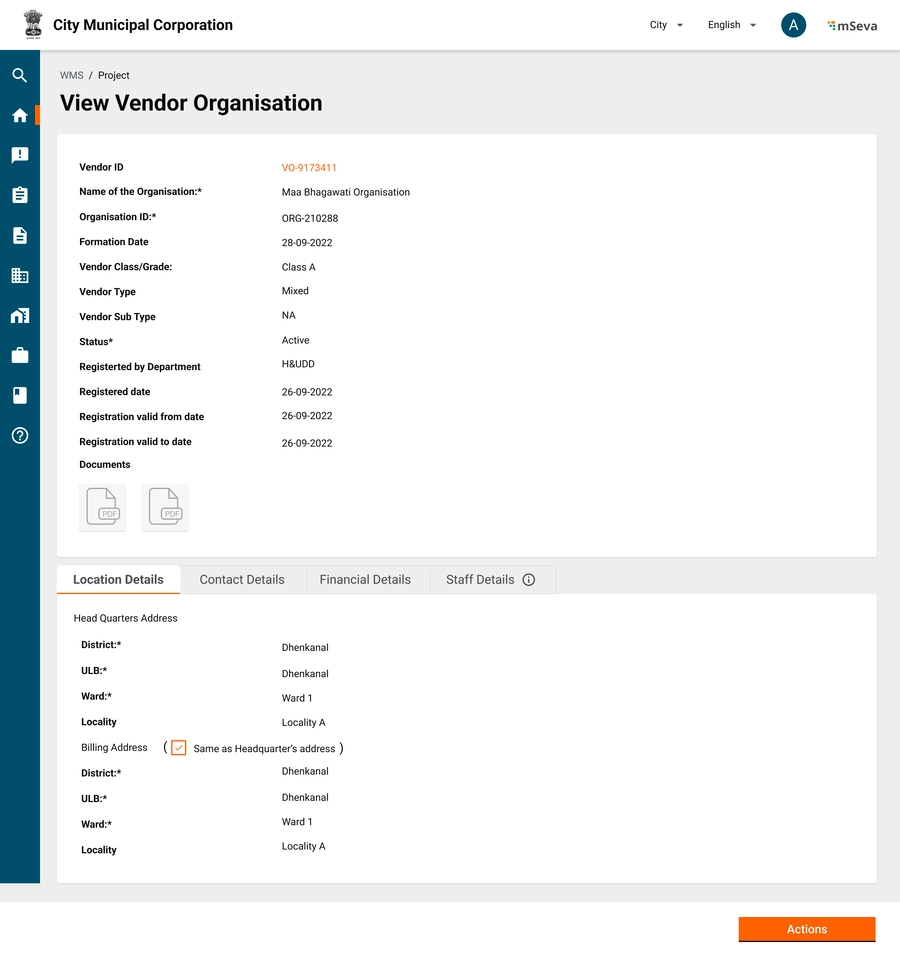

Create Organisation page has 4 Tabs along with header details.

Attributes and explanations for each are mentioned in the attribute table above.

Vendor ID is the unique ID generated by the system with a specific format.

Organisation ID is the ID given to each vendor during offline registration.

The system checks the organisation ID to ensure that no existing record is present and avoid de-duplicating. This check can be performed by clicking on the Next button on the first screen.

Location Details have HQ address and Billing Address.

The selection of location details in the hierarchy limits the results to that selected boundary in the next hierarchy.

The check box copies the details of the HQ address to the Billing address and makes the fields non-editable.

The staff details tab is not accessible until the vendor organisation is created. The Show Info icon alongside staff states “Organisation needs to be created to add staff and staff details”

Contact Details have owner info and contact person info.

Name and Phone number of both are made mandatory.

System should check if user with this phone number is present already in user registry and if not create a new user.

Designation for Owner is auto-assigned in the staff details as the owner

The role of the owner defaults to admin and manager.

The designation and role of the contact person are kept open.

The checkbox shows the default details of the contact person same as the details of the owner and creates a single user.

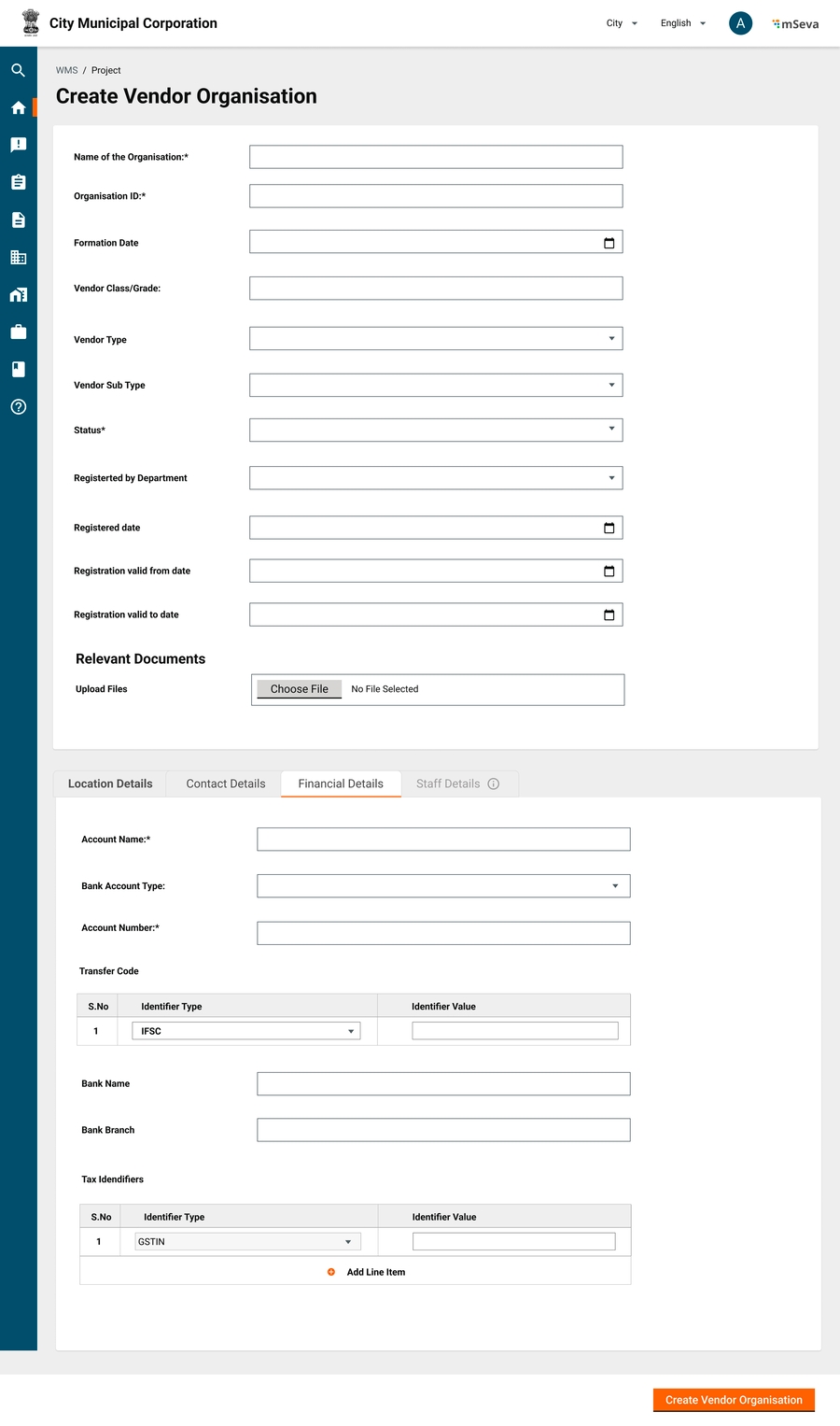

Financial details of the organisation captures bank account details where payments are to be made.

Transfer code has single identifier type per bank account. List will have only IFSC code for now. User has to input IFSC code against it.

Tax identifiers are array of attributes which are financial/accounting related objects of the vendor like PAN, GSTIN, TIN etc. This list will be defined in MDMS and user can select/add any number of identifiers that are listed in the master.

As per Indian context, default the first row to GSTIN and allow user to add from second row.

Any identifier that is mandatory can be shown already with a row instead of user adding that row.

After adding financial details, user can create a vendor organisation by clicking on create vendor organisation

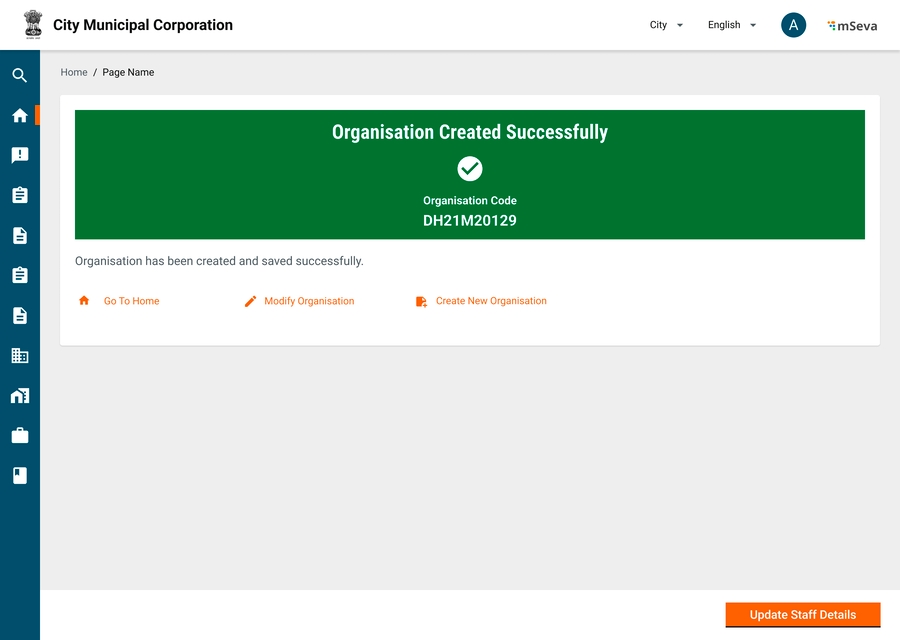

Vendor organisation is created successfully and ID is displayed.

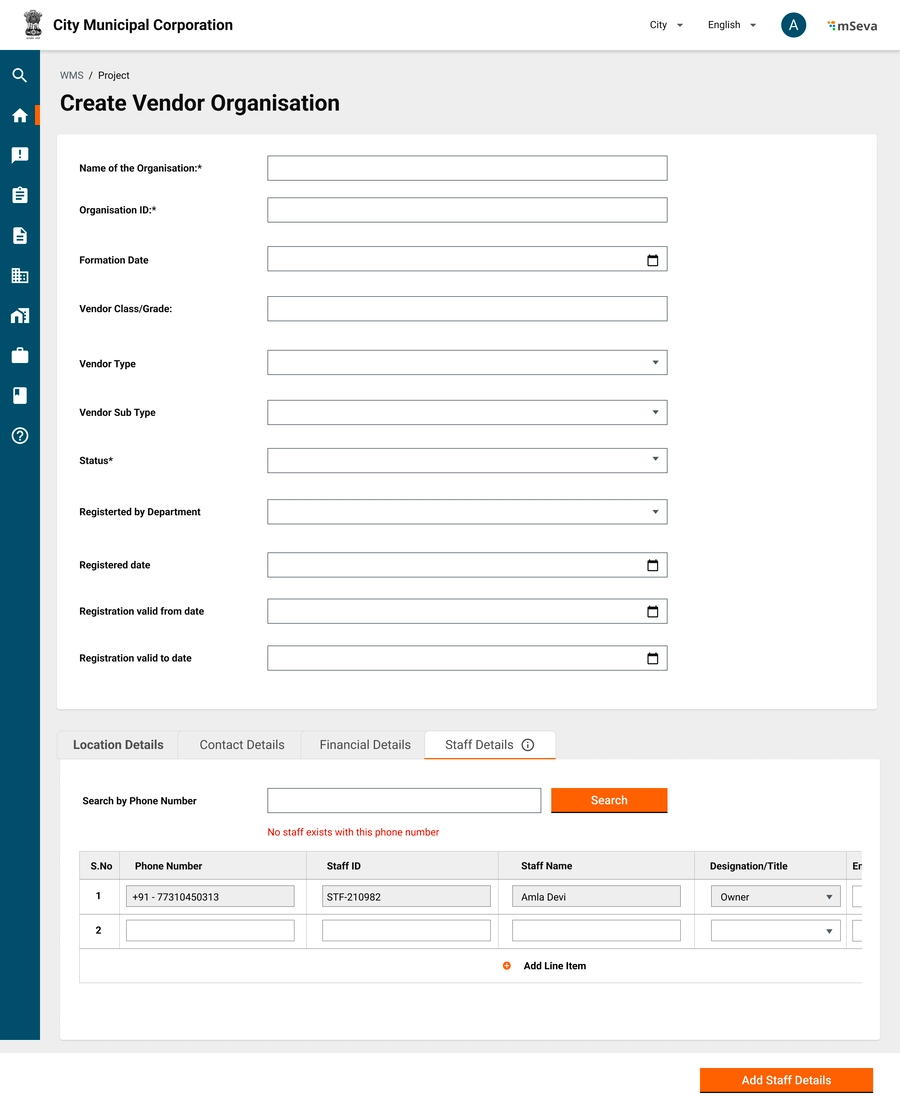

The user is prompted to add staff to the created vendor organisation.

By default the first/first two rows are auto-filled with the owner and contact person details inputted while creating the organisation.

Users can add the remaining attributes of these two users like employment start and end dates.

To add new/other users - Search by Phone number to see if the user already exists in the user registry

If a user exists -

The default phone number will be displayed on the new row along with the name. Allow the user to add other details like designation, start and end dates, and status.

Staff ID is not editable and is auto-generated once the Add Staff Details button is clicked.

If the user does not exist -

Display a message stating that “No staff exists with this phone number”

Capture phone numbers on UI using auto-fill. Allow the user to enter all other details including name designation, start and end dates and employment status.

Both these flows will ensure duplicate staff entries are not created in the user registry.

Once the Staff Details are added, a success message is displayed stating that the staff has been added successfully to that organisation.

Clicking on Masters on the home page redirects users to an empty screen where he/she will have to select the master/registry they want to create/view.

Selecting that registry from the dropdown displays the relevant records with pagination on the first screen.

Users can click on any data record to view that record or click on add new organisation that appears on selecting that master.

Filters for the master

Organisation ID

Name of the Organisation

Type of the organisation

Status

Create between start and end dates

Using this filters user should be able to shortlist/pinpoint to that organisation.

Show default no results found illustration screen along with text “No results found” when filter returns empty.

View Vendor screen has the same details as Create Vendors with 1 additional attribute which is the Vendor ID