An illustrative guide to using the finance module

The Finance User Manual is a standardized document available on the DIGIT platform to help the municipal employees operate the Financial Module System (FMS).

Financial Module (FM) User Manual is for users who are responsible for processing financial and accounting transactions within Municipal Corporations, Municipalities and ULBs. This user manual guides users on how to use the FMS to account for various financial transactions and generate Demand notes, Receipts, Bills and process Payments. The document also helps users in the creation of masters like adding detailed charts of account, bank branch and account etc.

This document acts as an easy reference for the ULB employees using the Finance module. The user manual presents an overview of the Finance functions and gives step-by-step instructions for completing a variety of tasks.

Post General Ledger

Process bills, payments, and generate receipts

Configure and map bank accounts with defined services

Configure and maintain collection remittance details

Upload Budgets, Budgetary Controls, Budget Enforcement & Budget Re-appropriations

Asset Categorizations, Depreciation, Capitalization & Improvement, Revaluation, sale and disposal

Contra Entry, Bank-reconciliation, Deduction Management & period End Activities

Deduction Management - process statutory and non-statutory deductions and their remittances.

Refer to the table below to understand the different user roles and the scope of action linked to each role. The applicable user roles and action items can vary from one State to another. DIGIT customizes the workflows to suit the requirements defined at the State level.

Bill Creator

Expense bill

Contractor bill

Supplier bill

Voucher from bill

View bill registers

Bank to bank transfers

Bill creators are responsible for creating and adding bills and recording transaction details

Bill Approver

Approve bills

Search vouchers

Approve bills and transactions

Voucher Creator

Create journal vouchers

Create vouchers from bills

Search vouchers

View bill registers

Create and add journal vouchers

Voucher Approver

Approve vouchers

Approve vouchers

Payment Creator

Bill payment

Direct bank payments

RTGS assignments

Cheque assignment

Surrender/reassign cheque

Surrender RTGS

Deductions payments

Deductions cheque assignment

Deductions RTGS assignment

Search/view vouchers

Create and record bill, cheque, or RTGS payment transaction details

Payment Approver

Approve vouchers

Approve payment vouchers

Finance Admin

Create budgets

Create budget definition

Budget addition appropriation

Upload budget

Approve uploaded budget

Search budget

Period end activities

Create and approve budgetary statements; manage period end activities

Financial Report View

All finance reports

Generate finance reports

Collection Remitter

Cash/Cheque remittance

Reconcile bank statements

Reconcile bank statements, prepare cash and cheque remittance statements

Collection Receipt Creator

Create miscellaneous receipts

Search receipts

Generate opening balance report

Create miscellaneous transaction receipts and generate reports

Super Admin

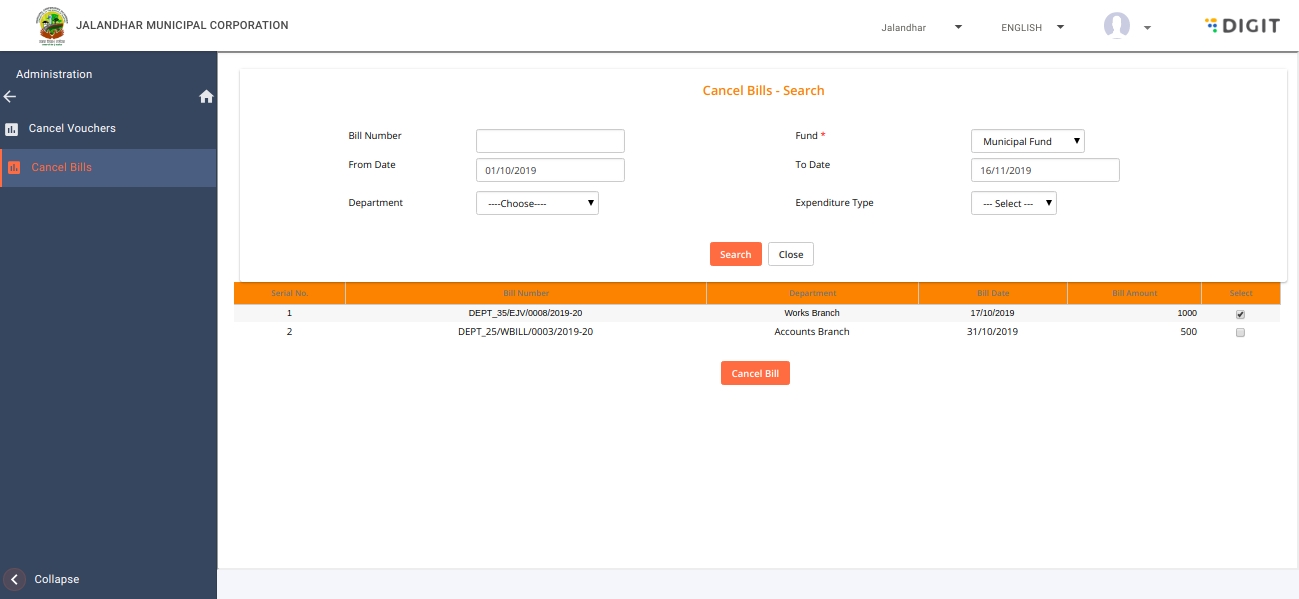

Cancel bill

Cancel voucher

Setting up masters

Configure finance master data lists, cancel bills and vouchers

This section guides you through the details of using the Finance module for each role. Click on the relevant role below to learn more about how to use the module.

This section illustrates the steps for different employee user roles at the ULB level

The bill creator can create and approve all kinds of expense bills and record transactions in the system. Finance transactions can either involve Bills Accounting or recording Contra Entries. Bills include expense bills, contractor bills, and supplier bills. Contra entries include recording bank to bank transfer details.

The system facilitates a defined set of account heads to be used in the debit side and credit side for bills. This enables users to create bills even without knowing the account codes required for the debit and credit side.

Once the user selects the bill type and subledger details, the system provides an option to select the template. However, the subledger type is not mandatory. But, if there is a value updated in the template the information will be populated. It is not mandatory for a user to select a template. Users can do the data entry as well.

To create expense bills

Click on the Finance menu option in the sidebar or the Finance card available on the dashboard.

Navigate to Transactions > Bills Accounting > Expense Bill.

Fill in all the mandatory details in the Expense Bill screen. Please note fields marked with ‘*’ signs are mandatory fields. The Bill Date reflects the current date by default. Click on the field to change the date if required.

Select the relevant Fund, Department, Scheme, and Sub Scheme details. Enter the first 3 letters of the applicable Function Name and select from the available options.

Enter any Narration as required. Enter the Party Bill Number and the Party Bill Date. Select the applicable Bill Subtype. Enter the relevant SubLedger Details. Select the applicable SubLedger Type and enter the payee details.

Select the appropriate Account Code Template. The list of templates is available based on the selected Bill Subtype and SubLedger Type. If the subledger type is not selected then only templates for non-subledger types will be listed.

The Debit, Credit, and Net Payable, GLcode details are auto-populated from the selected template.

Verify the Account Codes populated on both the Debit and the Credit side. Click on the + sign to add new rows to enter additional Debit or Credit details. Enter the Account Code and the Debit or Credit Amount for the listed entry.

Click on the bin icon to delete any existing detail. Enter the applicable Debit or Credit Amount.

Check the entry details available in the Account Details and SubLedger Details panels. Click on the bin icon to delete any entry.

Click on the Browse button to select supporting files. Click on the Add File button to add more files. To forward the bill for approval fill in the Approver Department, Approver Designation, and Approver details. Enter any pertinent information in the Comments section for the approver.

Click on the Forward button to forward the bill to the Bill Approver. Else, click on Create and Approve to approve the bill. There is no need to fill in the Approval Details if the bill is spot-verified.

The Contractor Bill option is used to raise all bills against a work order by the contractor. Once the contractor is selected, all the work orders assigned to this contractor is listed. The contractor bill is based on the listed work order.

To create contractor bill

Click on the Finance menu option in the sidebar or the Finance card available on the dashboard.

Navigate to Transactions > Bills Accounting > Contractor Bill.

Fill in all the mandatory details in the Contractor Bill screen. Please note fields marked with ‘*’ signs are mandatory fields. The Bill Date reflects the current date by default. Click on the field to change the date if required.

Select the Contractor and the applicable Work Order. The system will display all work orders for the selected contractor. Based on the Work order selected, Fund, Department, scheme and sub scheme details are automatically populated. All debit and credit account heads are taken into appropriate sections and the net pay account code is populated based on system configuration.

Enter the Party Bill Number, Party Bill Date, and the Party Bill Amount. Select the Bill Type.

Select the relevant Account Code Template. The list of templates is available based on the selected Bill Subtype and SubLedger Type. If the subledger type is not selected then only templates for non-subledger types will be listed.

The Debit, Credit, and Net Payable, GLcode details are auto-populated from the selected template.

Verify the Account Codes populated on both the Debit and the Credit side. Click on the + sign to add new rows to enter additional Debit or Credit details.

Enter the Account Code and the Debit or Credit Amount for the listed entry. Click on the bin icon to delete any existing detail. Enter the applicable Debit or Credit Amount.

Check the entry details available in the Account Details and SubLedger Details panels. Click on the bin icon to delete any entry.

Click on the Browse button to select supporting files. Click on the Add File button to add more files. To forward the bill for approval fill in the Approver Department, Approver Designation, and Approver details. Enter any pertinent information in the Comments section for the approver.

Click on the Forward button to forward the bill to the Bill Approver. Else, click on Create and Approve to approve the bill. There is no need to fill in the Approval Details if the bill is spot-verified.

Supplier Bills refer to all bills that are raised against a purchase order by the supplier.

To create supplier bill

Click on the Finance menu option in the sidebar or the Finance card available on the dashboard.

Navigate to Transactions > Bills Accounting > Supplier Bill.

Fill in all the mandatory details in the Supplier Bill screen. Please note fields marked with ‘*’ signs are mandatory fields.

The Bill Date reflects the current date by default. Click on the field to change the date if required.

Select the Supplier and the applicable Purchase Order. The system will display all purchase orders for the selected supplier. Based on the Purchase Order selected, Fund, Department, Scheme and Sub Scheme details are automatically populated.

All debit and credit account heads are taken into appropriate sections and the net pay account code is populated based on system configuration.

Enter the Party Bill Number, Party Bill Date, and the Party Bill Amount. Select the Bill Type. Select the relevant Account Code Template. The list of templates is available based on the selected Bill Subtype and SubLedger Type. If the subledger type is not selected then only templates for non-subledger types will be listed.

The Debit, Credit, and Net Payable, GLcode details are auto-populated from the selected template.

Verify the Account Codes populated on both the Debit and the Credit side. Click on the + sign to add new rows to enter additional Debit or Credit details. Enter the Account Code and the Debit or Credit Amount for the listed entry. Click on the bin icon to delete any existing detail. Enter the applicable Debit or Credit Amount.

Check the entry details available in the Account Details and SubLedger Details panels. Click on the bin icon to delete any entry.

Click on the Browse button to select supporting files. Click on the Add File button to add more files. To forward the bill for approval fill in the Approver Department, Approver Designation, and Approver details. Enter any pertinent information in the Comments section for the approver.

Click on the Forward button to forward the bill to the Bill Approver. Else, click on Create and Approve to approve the bill. There is no need to fill in the Approval Details if the bill is spot-verified.

Use the Finance module to create vouchers from bills in a few clicks.

To create a voucher from bills

Navigate to Finance > Transactions > Bills Accounting > Voucher from Bill option in the sidebar. Select Bill Type. Select Department. Or, enter the From Date and To Date range to fetch bills raised during the specified period. Else, enter the Bill Number to fetch any specific bill.

Click on the Search button to view the bills matching the specified criteria. Click on the Reset button to renew the search with different parameters. Click on the Close button to go back to the home page.

The list of bills matching the specified parameters is visible on the screen. Click on the Bill Number link to create a voucher. Enter any additional information in the Comments box.

Enter the Approver Department and Approver Designation details to forward the voucher for approval. Select the Approver. Enter any Approver Remarks.

Click on the Forward button to forward the voucher. Click on the Create and Approve button to directly approve and generate the voucher.

Once the bills are created, approved and a voucher is generated, the bills are ready for payment.

To view bill registers

The View Bill Register option enables users to fetch consolidated views of bills.

Navigate to Finance > Transactions > Bills Accounting > View Bill Registers option in the sidebar. ****Select Expenditure Type. Enter the Bill Date From and Bill Date To details to specify the period. Select the applicable Fund. Make sure to fill in the mandatory fields.

Select the Department. Enter Bill Number. Click on the Search button to fetch the bill generated.

Click on the Close button to navigate back to the home page.

Click on the Bill Number hyperlink to view the listed bill details.

To create entries for the bank to bank transfers -

Bill Creators can create entries for the bank to bank transfers.

Navigate to Finance > Transactions > Contra Entries > Bank to Bank Transfer option in the sidebar. Select the applicable Fund. Based on the Fund selected, the bank account details get populated.

Select the relevant Scheme, Sub-Scheme, Department, and Function details. Select the Bank and enter Account No. from where the transfer will take place. The Balance field displays the existing account balance. Enter the relevant Fund, Department, Bank, and Account No. details to which the amount will be transferred.

Select the applicable Mode of Transaction. Enter the transaction Reference Number and Reference Date. Enter the Transfer Amount. Select a relevant Source Inter Fund Code and Destination Inter Fund Code if the selected bank account belongs to different funds.

Key in any additional details in the Narration field. Click on the Save option to create the transaction voucher. In this case, the voucher(s) will be created in approved status.

The Bill Approver user role is responsible for approving the bills or vouchers created by the bill creator.

To approve bills

Click on the Finance card on the dashboard. The system displays the list of bills pending approval.

Click on the refresh icon (highlighted in yellow in the screenshot) to view the Task Processing History for the listed bill.

Click on the specific bill to approve. Review the bill details. Enter any additional information in the Comments section.

Click on the Approve button to approve the bill.

Click on the Reject button to reject the bill. Enter the proper reason for rejecting the bill in the Comments section. Once a bill is approved, it will appear in the Vouchers from the bill section in the menu tree.

Bill approvers can search for vouchers, view and print payment receipts and vouchers.

To search for vouchers

Navigate to Finance > Transactions > View Voucher menu option in the sidebar. ****Enter the Voucher Number directly to search for specific vouchers.

Else, select the applicable Voucher Type and Voucher Name to filter your search. Enter the period in Voucher Date From and Voucher Date To field. Select the applicable Fund and Department. Click on the Search button to view the search results.

Click on the Voucher Number hyperlink to open and view the voucher details.

Click on the Print button to print the voucher. Click on the Source button on the voucher to view the payment source details.

Voucher creator user roles are responsible for creating journal vouchers and view voucher details.

To create a journal voucher

Click on the Finance option in the sidebar and then click on Transactions. ****Click on the Journal Voucher option.

The Voucher Date field by default takes in the current date. Change the date if required. Select the applicable Voucher Sub-Type. Enter the Party Name, Party Bill Number, Party Bill Date, Bill Number, Bill Date.

Select the relevant Fund, Department, Scheme, Sub-Scheme, Fund Source, and Function. Enter the Narration for the voucher.

Enter the Account Code and Debit or Credit Amount accordingly. Enter the Account Code, Type, Name, and Amount details to create the Sub-ledger. Select the relevant Approver Department, Approver Designation, and Approver from the list. Enter appropriate Approver Remarks. Click on the Forward button to forward the voucher for approval.

Click on the Approve button to approve the voucher directly.

To create vouchers from bills

Navigate to Finance > Transactions > Bills Accounting > Voucher from Bill menu option in the sidebar. Select the relevant Bill Type and Department to find the specific bill.

Enter the From Date and To Date details to define the period to which the bill belongs. The system will fetch all bills for the specified time period. Alternatively, enter the Bill Number to fetch the bill directly.

Click on the Search button to view the search list. Click on the relevant Bill Number to open the bill. The bill details are auto-populated into the voucher.

Enter the Voucher Date. Review the voucher and enter any Comments for further processing. Enter the Account Code, Type, Name, and the Amount details to create the Sub-ledger.

Select the relevant Approver Department, Approver Designation, and Approver from the list. Enter appropriate Approver Remarks. Click on the Forward button to forward the voucher for approval.

Click on the Approve button to approve the voucher directly.

To search for vouchers

Navigate to Finance > Transactions > View Voucher option in the sidebar. Enter the Voucher Number directly to fetch the required voucher.

In case you do not remember the voucher number, select the applicable Voucher Type and Voucher Name. Enter the Voucher Date From and Voucher Date To details. Select the applicable Fund and Department to specify the search parameters.

Click on the Search button to view the search results. Click on the Voucher Number hyperlink to view the voucher.

To view bill registers

Navigate to Finance > Transactions > Bill Accounting > View Bill Registers option in the sidebar. Select the relevant Expenditure Type.

Enter Bill Number. Enter the Bill Date From and Bill Date To details to fetch bills for the specified period. Select the applicable Fund and Department. Click on the Search button to fetch the list of bills matching the specified search parameters.

Click on the Bill Number hyperlink to open and view the bill details**.**

The voucher approver user role is responsible for approving vouchers.

To approve vouchers

Navigate to Finance > Transactions > View Voucher option in the sidebar. ****Enter the Voucher Number to fetch a voucher directly. Select the Voucher Type and Voucher Name.

Enter Voucher Date From and Voucher Date To details to fetch vouchers for the specified period. Select applicable Fund and Department details to filter the view of vouchers. Click on the Search button to view search results.

Click on the relevant Voucher Number to open the voucher. Click on the Approve button to approve the voucher or the Reject button to reject the voucher. Provide the reason for rejection in the Comments section.

The payment creator user role is responsible for inputting and recording payments and deductions details into the system. The payment creator can initiate bill payments, direct bank payments, RTGS payments, issue cheques, or create deductions entries.

To pay bills

Navigate to Finance > Transactions > Payments > Bill Payment option in the sidebar.

Enter the applicable search parameters to find the bill for making payment. Use any of the following parameters to search for the bills - Bill Number, Bill Date From, Bill Date To, Expenditure Type, Fund (mandatory), Fund Source, Scheme, Sub-Scheme, Department or Function.

Click on the Search button to view the list of bills. Click on the Contractor Bill, Supplier Bill, or Expense Bill tab to view the list of bills in listed categories.

Click on the Bill Voucher Number hyperlink to view the bill details. Select the Mode of Payment as either Cheque, Consolidated Cheque, or RTGS. Check the Select box available in the first box to select a specific bill for payment.

Click on the Generate Payment button to make the bill payment.

Enter the Payment Details as per the selected mode of payment. Enter Approver Details - Approver Department, Approver Designation, Approver, and Approver Remarks to forward the bill for payment approval. Click on the Forward button to pass the bill for approval.

Else, click on the Create and Approve button to process the payment.

The bill is processed for payment.

To make a direct bank payment

Navigate to Finance > Transactions > Payments > Direct Bank Payment option in the sidebar. Select the applicable Fund, Scheme, Sub Scheme, Fund Source, Department and Function detail.

Select the relevant Bank and Account Number for bank payment. Enter the payment Amount. Select the relevant Mode of Payment option. Enter the Paid To, the Document Number and the Document Date details.

Enter any Narration as required for the transaction. Select the relevant Function, Account Code, Account Head, Debit and Credit Amount details. Click on the Add button to input additional account details. Click on the Delete button to remove any entry.

Enter the relevant Sub Ledger details - Account Code, Type, Code, Name and Amount. Click on the Add button to input additional sub ledger details. Click on the Delete button to remove any entry.

Enter Approver Details - Approver Department, Approver Designation, Approver, and Approver Remarks to forward the bill for payment approval. Click on the Forward button to pass the bill for approval.

Else, click on the Create and Approve button to process the payment.

Bills can be assigned for RTGS payment.

To assign bills for RTGS payment

Navigate to Finance > Transactions > Payments > RTGS Assignment menu option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to search for vouchers assigned for RTGS payment. Or, you can directly enter the Payment Voucher No. to fetch the voucher details. Alternatively, select applicable Bill Type, Fund, Department, Payee Bank-Branch, Payee Bank Account.

Click on the Search button to view vouchers based on given parameters. Select the relevant Payment Voucher from the list. Enter RTGS Date and then click on Assign RTGS Number.

The system displays a success message. Click on the Generate PDF or Generate xls link to generate RTGS Advice in pdf or excel format.

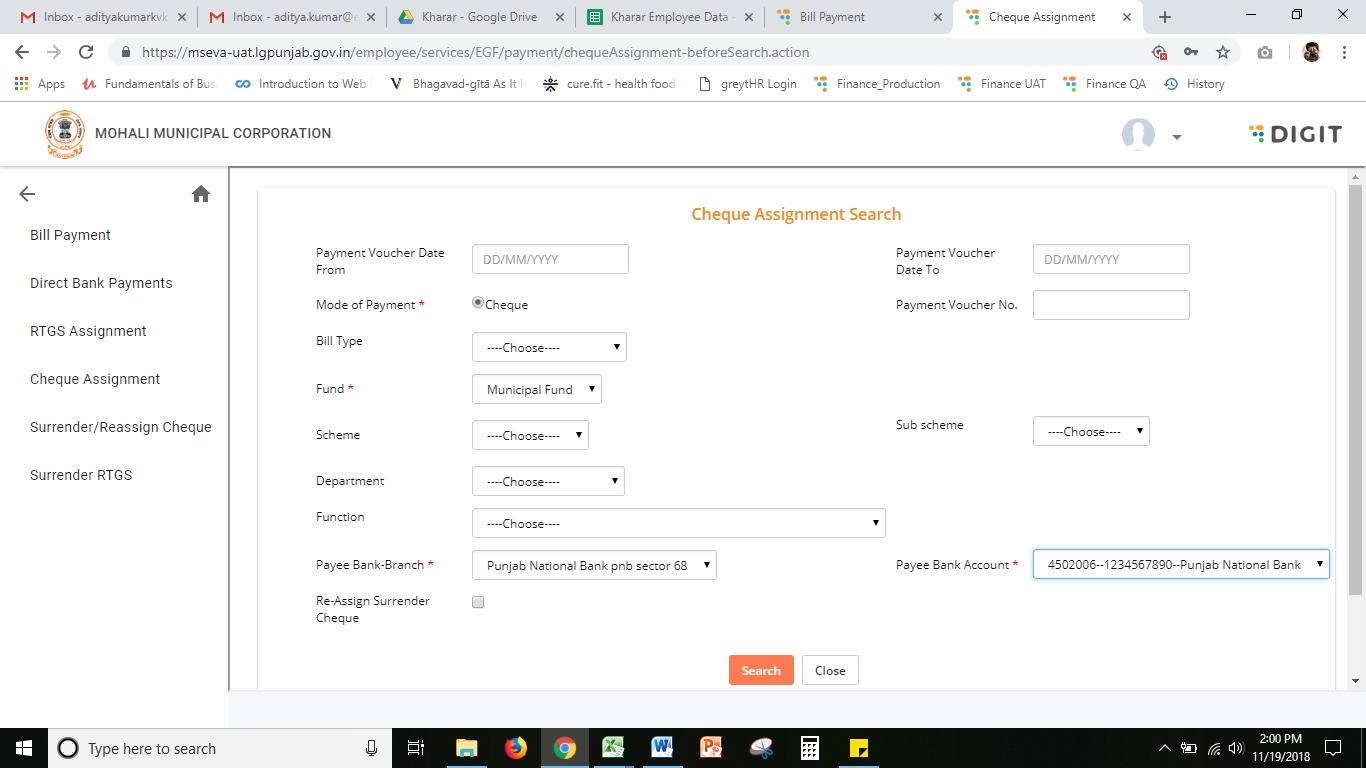

To assign a cheque for the payment

Navigate to Finance > Transactions > Payments > Cheque Assignment menu option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to search for vouchers assigned for cheque payment.

Select the Mode of Payment as either Cheque or Consolidated Cheque. Or, you can directly enter the Payment Voucher No. to fetch the voucher details. Alternatively, select applicable Bill Type, Fund, Department, Scheme, Sub Scheme, Fund Source, Function, Payee Bank-Branch, Payee Bank Account.

Check the option Re-assign Surrender Cheque if applicable. Click on the Search button to view vouchers based on given parameters.

Select the voucher for which cheques need to be assigned. Enter in the Cheque Number. The cheque number should be as per the cheque Masters. Select the applicable Cheque Issued Department and then click on Assign Cheque.

The cheque is assigned for payment and the system displays a success message.

Once a cheque is assigned to payment, there is an option to surrender the cheque and then reassign the payment with a new cheque.

To surrender and reassign a cheque

Navigate to Finance > Transactions > Payments > Surrender/Reassign Cheque menu option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to search for vouchers where cheques need surrendering or reassigning. Or, you can directly enter the Payment Voucher No. or Cheque Number to fetch the voucher details.

Select the applicable Bank, Bank Account, and Department. Click on the Search button to view vouchers based on given parameters.

Select the record for which the cheque has to be surrendered. State the reason for surrender.

Click on the Surrender button.

In case the payment for which cheque is surrendered has to be assigned with a new cheque, give the new Cheque Number and Cheque Date.

Click on Surrender & Reassign button.

The new cheque is now assigned to the payment and the old cheque is marked as surrendered.

Once a RTGS is assigned to payment, there is an option to surrender the same.

To surrender and reassign a cheque

Navigate to Finance > Transactions > Payments > Surrender RTGS menu option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to search for vouchers where RTGS need surrendering. Or, you can directly enter the Payment Voucher No. or RTGS Ref Number to fetch the voucher details.

Select the applicable Bank, Bank Account, and Department.

Select the RTGS record that needs to be surrendered along with the reason. Click on the Surrender button.

The system displays an acknowledgement page on success.

To process deductions payment

Navigate to Finance > Transactions > Deductions > Deduction Payment option in the sidebar.

Select the applicable Recovery Code.

Enter the period in the From Date and To Date fields. Select applicable Fund, Fund Source, Scheme, Sub Scheme, Department, and Function details to get the bills from which there are deductions for the selected recovery code. Select the bills that are to be remitted and then click on Generate Payment.

Input the payment-related information. You can modify the amount to remit in the Remittance Details section.

Click on Create and Approve if no verification and approval is needed, else select the approver details and click on Forward.

Any deduction payments that are sent for verification and approval will be listed in the Inbox of the verifier/approver, similar to that of bills. On clicking this record the approver can either reject or approve the payment.

To process deductions cheque assignment

Navigate to Finance > Transactions > Deductions > Deduction Payment option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to fetch vouchers for the listed period. Enter Payment Voucher No. Select the applicable Recovery Code.

Select applicable Fund, Fund Source, Department, and Function details to get the bills from which there are deductions for the selected recovery code. Select the applicable Payee Bank-Branch and Payee Bank Account details.

Check the Re-assign Surrender Cheque option if applicable.

Click on Search to list the payment vouchers for assigning cheques. Select the payments for which cheques need to be assigned. Input the cheque details and click on Assign Cheque.

The system displays an acknowledgement page with a link to download the Bank Advice.

When deductions payments are done using RTGS mode, this option is used to assign the RTGS number for the payment made.

To assign RTGS for deductions payment

Navigate to Finance > Transactions > Deductions > Deduction RTGS Assignment option in the sidebar. Enter the Payment Voucher Date From and Payment Voucher Date To details to fetch vouchers for the listed period. Enter Payment Voucher No.

Select applicable Bill Type, Fund, and Department details to get the bills from which there is deductions payment. Select the applicable Payee Bank-Branch, Payee Bank Account, Drawing Officer, and Remittance COA details. Remittance COA is applicable for all RTGS assignments involving service tax departments.

Click on the Search button to fetch the list of vouchers. Select the voucher for which RTGS needs to be done. Enter the RTGS details. Click on Assign RTGS.

The system displays an acknowledgement page with a link to download the Bank Advice.

To search for vouchers

Navigate to Finance > Transactions > View Voucher menu option in the sidebar. Enter the Voucher Number directly to search for specific vouchers.

Else, select the applicable Voucher Type and Voucher Name to filter your search. Enter the period in Voucher Date From and Voucher Date To field. Select the applicable Fund and Department.

Click on the Search button to view the search results. Click on the Voucher Number hyperlink to open and view the voucher details.

Click on the Print button to print the voucher. Click on the Source button on the voucher to view the payment source details.

To approve vouchers

Navigate to Finance > Transactions > View Voucher option in the sidebar.

Enter the Voucher Number to fetch a voucher directly. Select the Voucher Type and Voucher Name.

Enter Voucher Date From and Voucher Date To details to fetch vouchers for the specified period. Select applicable Fund and Department details to filter the view of vouchers. Click on the Search button to view search results.

Click on the relevant Voucher Number to open the voucher. Click on the Approve button to approve the voucher or the Reject button to reject the voucher. Provide the reason for rejection in the Comments section.

This is a summary report of how much amount is pending for reconciliation for the selected bank account.

To generate reconciliation summary report

Navigate to Finance > Transactions > Bank Reconciliation > Reconciliation Summary Report option in the sidebar. Select the applicable Bank, Branch, Bank Account, and Bank Statement Balance details.

Enter the relevant Bank Statement Date. Click on the View Summary button.

To generate Income Expenditure Statement

Navigate to Finance > Reports > Financial Statements > Income Expenditure Statement option in the sidebar.

Select the relevant Period, Year, Rupees format, Department, Fund and Function details. Select As On Date detail to generate the statement till a specified date.

Click on the Submit button to view the statement.

Click on the Schedule Number hyperlink to open the individual schedule report. Click on the Amount to drill down to the ledger report for the selected account code. Click on View All Minor Schedules button to see the schedule report at minor code level.

Click on the View All Schedules button to see the schedule report. Click on the Amount to get the further details of the transaction.

To generate the Balance Sheet

Navigate to Finance > Reports > Financial Statement > Balance Sheet option in the sidebar. Select the relevant Period, Year, Rupees format, Department, Fund and Function details.

Select As On Date detail to generate the statement till a specified date. Click on the Submit button to view the statement.

Click on the Schedule Number hyperlink to open the individual schedule report. Click on the Amount to drill down to the ledger report for the selected account code.

Click on View All Minor Schedules button to see the schedule report at minor code level.

Click on the View All Schedules button to see the schedule report.

Click on the Amount to get the further details of the transaction.

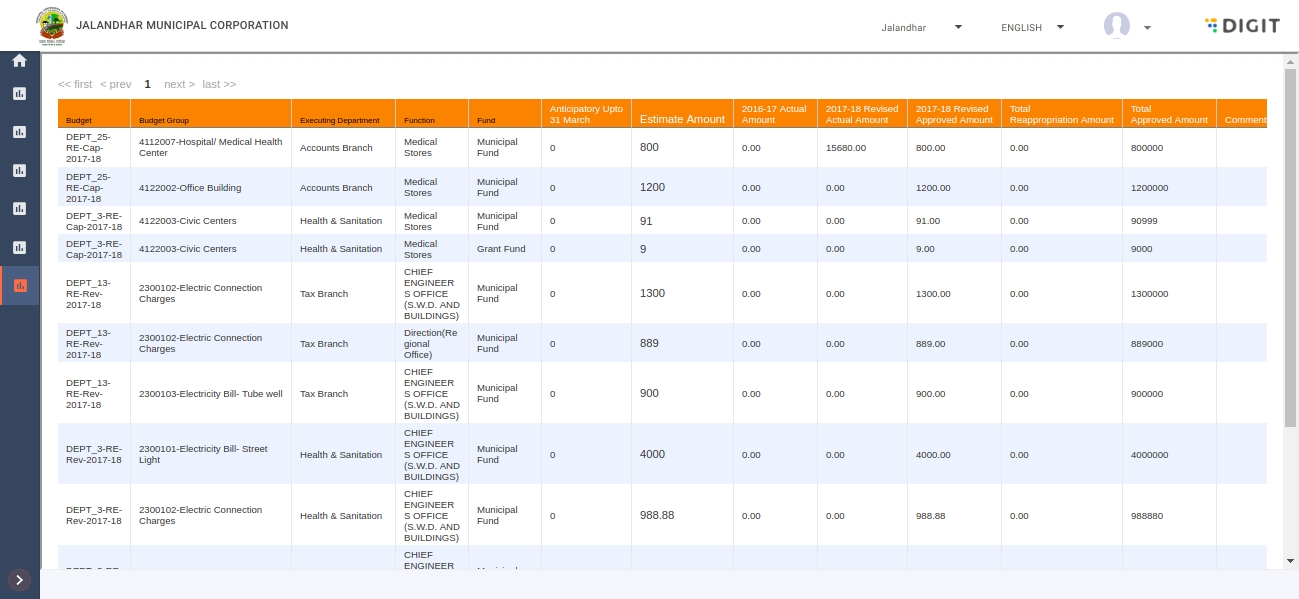

To generate the budget information department wise

Navigate to Finance > Reports > Budget Reports > Departmentwise Budget menu option in the sidebar. Select the applicable Financial Year, Department, and Type.

Click on the Search button to get the report.

Click on the Save as PDF or Save as Excel option to download the reports in PDF or Excel format.

To generate budget information function wise

Navigate to Finance > Reports > Budget Reports > Departmentwise Budget menu option in the sidebar.

Select the applicable Financial Year, Department, Type and Function. Click on the Search button to get the report.

Click on the Print button to print the report. Click on the Save as PDF or Save as Excel option to download the reports in PDF or Excel format.

To fetch the budget utilization details for any specific budget item

Navigate to Finance > Reports > Budget Reports > Budget Watch Register menu option in the sidebar.

Select the applicable Fund, Department, Function, Type, Budget Head, and As On Date details. Click on the Search button to get the report. Click on the Print button to print the report. Click on the Save as PDF or Save as Excel option to download the reports in PDF or Excel format.

The Budget Variance report provides the comparison on what was planned in the budget and how it is being utilized.

To generate the budget variance report

Navigate to Finance > Reports > Budget Reports > Budget Variance Report menu option in the sidebar. Select the applicable Department, Function, Fund, Account Type, Budget Head, and As On Date details.

Click on the Search button to get the report.

Click on the Print button to print the report. Click on the Save as PDF or Save as Excel option to download the reports in PDF or Excel format.

The budget upload report provides information that is uploaded in the system using the upload facility and is currently not approved.

To generate the budget upload report

Navigate to Finance > Reports > Budget Reports > Budget Upload Report menu option in the sidebar.

Select the applicable Budget, Reference Budget, Fund, Department, and Function details. Click on the Search button to get the report.

Click on the Print button to print the report. Click on the Save as PDF or Save as Excel option to download the reports in PDF or Excel format.

To generate the general ledger report

Navigate to Finance > Reports > Accounting Records > General Ledger Report option in the sidebar.

Enter the applicable Account Code, Fund, Department, Starting Date, Ending Date, and Function details.

Click on the Search button to view the report. These reports can be downloaded in PDF as well as in Excel format. Also drilldown is available from the Voucher Number field.

To generate the Trial Balance

Navigate to Finance > Reports > Accounting Records > Trial Balance option in the sidebar.

Select the relevant Report Type. Select the period using the From Date and To Date fields. Select the applicable Fund, Department, Function, Functionary, and Field details.

Click on View HTML button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Bank Book report

Navigate to Finance > Reports > Accounting Records > Bank Book option in the sidebar.

Select the relevant Fund, Department, Function, Bank Name, Account Number, Start Date and End Date details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Subledger Schedule report

Navigate to Finance > Reports > Accounting Records > Sub Ledger Schedule Report option in the sidebar.

Enter the relevant Account Code, Fund, Starting Date , End Date, Sub Ledger Type, and Department details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

Click on the Name field to see the transactions made by any particular entity.

To generate the Subledger Report

Navigate to Finance > Reports > Accounting Records > Sub Ledger Report option in the sidebar.

Enter the relevant Account Code, Fund, Starting Date , End Date, Sub Ledger Type, Entity Details and Department details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

Click on the Voucher Number field to see the details of the voucher.

To generate the Day book report

Navigate to Finance > Reports > Accounting Records > Day Book Report option in the sidebar. Enter the relevant Start Date , End Date, and Fund details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Journal book report

Navigate to Finance > Reports > Accounting Records > Day Book Report option in the sidebar.

Enter the relevant Starting Date , End Date, Fund, Voucher Name, Function and Department details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Opening Balance report

Navigate to Finance > Reports > Accounting Records > Opening Balance Report option in the sidebar.

Enter the relevant Financial Year, Fund, and Department details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Complete Bill Register Report

Navigate to Finance > Reports > MIS Reports > Complete Bill Register Report option in the sidebar.

Enter the relevant Fund, Department, From Date, To Date, Expenditure Type, Bill Type, Voucher Number, and Bill Number details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate the Bank Advice for RTGS

Navigate to Finance > Reports > MIS Reports > Bank Advice Report for RTGS option in the sidebar.

Enter the relevant Bank Name, Bank Branch, Account Number, and RTGS Number details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate RTGS Register Report

Navigate to Finance > Reports > MIS Reports > RTGS Register Report option in the sidebar.

Enter the relevant Fund, Department, RTGS Assigned From Date, RTGS Assigned To Date, Bank, Bank Branch, Account Number, and RTGS Number details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate Voucher Status Report

Navigate to Finance > Reports > MIS Reports > Voucher Status Report option in the sidebar.

Enter the relevant Fund, Department, Voucher Type, Voucher Name, From Date, To Date, and Status details. Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

To generate Cheque Issue Register

Navigate to Finance > Reports > MIS Reports > Cheque Issue Register option in the sidebar. Enter the relevant Fund, Department, Voucher Type, Voucher Name, From Date, To Date, and Status details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

Click on the Multiple link in the Bank Payment Voucher & Date columns to see the vouchers associated.

Click on View Voucher to see the details of the selected voucher.

To generate the report on the surrendered cheques

Navigate to Finance > Reports > MIS Reports > Surrendered Cheque option in the sidebar. Enter any or a combination of the listed parameters - Fund, Bank Branch, Bank Account, Reason for Surrender, From Date and To Date details. The report view will be filtered based on the selected parameters. The fields marked in red star are mandatory.

Click on the Search button to generate the report. Once the Report is generated, the user can see all the relevant information why the cheque is surrendered and the voucher attached to the cheque and so on.

Click on the PDF or Excel button to download the report in pdf or excel format. Click the Print button to print the report. Users can drill down from the Voucher Number to see more details about the voucher that is associated with the surrendered cheque.

Note: Users have a feature to click on the search tab on the right top and easily navigate to the desired cheque.

To generate the Remittance Pending Report

Navigate to Finance > Reports > Deduction Reports > Remittance Pending option in the sidebar.

Enter the relevant Fund, Department, Voucher Type, Voucher Name, From Date, To Date, and Status details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

Deductions Summary

To generate Deduction Summary

Navigate to Finance > Reports > Deduction Reports > Deduction Summary option in the sidebar. Enter the relevant Recovery Code, Fund, From Date, As On Date, Department, and Party Name details.

Click on the Search button to generate the report. These reports can be downloaded in PDF as well as Excel format.

The cash and cheque remittance feature is used to remit the amount into the bank account after the collection is made through the Revenu/Collection - Misc Receipt.

The cash remittance feature is used to remit the amount into the bank account after the collection is processed through Misc Receipt.

To do the cash remittance

Navigate to Finance > Revenue/Collections > Cash Remittance option in the sidebar.

Select the Bank account number and Financial Year from the drop down. The cash remittance search can be either done by selecting the Financial year or by the Date Range as well. Once the search parameter is selected the list of total cash collected which need to be remitted is displayed on the screen

Now the user can select a particular amount which needs to be remitted or select multiple amounts which need to be remitted into the bank account. Once the user selects the amount which needs to be remitted a pop message appears for the confirmation of receipt remittance.

Once the user clicks on the ok the cash remittance will be processed and the receipt number will be generated.

Users can also print the bank challan as well.

To do the cheque remittance

Navigate to Finance > Revenue/Collections > Cheque Remittance option in the sidebar.

Select the Bank account number and Financial Year from the drop down. The cash remittance search can be either done by selecting the Financial year or by the Date Range as well. Once the search parameter is selected the list of total cheque collected which need to be remitted is displayed on the screen

Now the user can select a particular amount which needs to be remitted or select multiple amounts which need to be remitted into the bank account. Once the user selects the amount which needs to be remitted a pop message appears for the confirmation of receipt remittance.

Once the user clicks on the ok the cheque remittance will be processed and the receipt number will be generated.

Users can also print the bank challan as well.

The Bank Reconciliation feature is used to reconcile the books of accounts with the bank statement report received from a bank. There are multiple options available under the bank reconciliations module.

This feature is used to manually reconcile all the instruments that are currently not reconciled.

To reconcile with bank manually

Navigate to Finance > Transactions > Bank Reconciliation > Reconcile With Bank Manual option in the sidebar. Select the relevant Bank, Bank Account, Branch, Reconciliation Date and the Bank Statement From and To Date for which the reconciliation needs to be done. Refer to the bank statement provided by the bank to input bank statement dates.

Click on the Search option to list all the instruments that are not reconciled.

Click on the Show Pendings button to view unreconciled totals for each instrument.

Provide the Reconciliation Date and click on the Reconcile button.

At this point the bank statements and instruments are marked as Reconciled.

This feature provides the facility to capture the entries that are missing in the books of the organization when compared with the Bank statement received from Bank.

To capture bank statement entries not in bank book

Navigate to Finance > Transactions > Bank Reconciliation > Bank Statement Entries - Not in Bank Book option in the sidebar. Select the applicable Fund, Scheme, Sub Scheme, Department, Function, Bank, Bank Branch, and Account Number details. Input the mandatory details (fields marked in red star).

Click on the Search button to fetch entries based on the selected parameters. Select Type as Receipts or Payments for the listed entries. Input the Account Code details and check the Create Voucher option.

Click on the Save button.

System will make a voucher for the corresponding entry. If the Create Voucher option is not selected, a voucher will not be created, but an entry is made in the organization’s book which is reflected in the Reconciliation Summary Report.

This is a summary report of how much amount is pending for reconciliation for the selected bank account.

To generate reconciliation summary report

Navigate to Finance > Transactions > Bank Reconciliation > Reconciliation Summary Report option in the sidebar. Select the applicable Bank, Branch, Bank Account, and Bank Statement Balance details.

Enter the relevant Bank Statement Date. Click on the View Summary button.

This feature provides the facility to process the reconciliation books of accounts with the Bank statement automatically by filling in the excel template with all the relevant information and uploading into the system.

To auto reconcile uploaded bank statements

Navigate to Finance > Transactions > Bank Reconciliation > Auto Reconcile Uploaded Statement option in the sidebar. Click on the Download Template link in blue.

Once the template is downloaded the user can go through on how to update the template using the information available in the Details tab. Users must have the bank statement ready. Update the relevant information into the excel by converting the bank statement into excel format.

Select the Bank, Branch, and the Bank Account details.

Click on the Choose File button to select the updated bank statement file. Click on the Upload button to upload the bank statement.

If the data provided in the file are as per the standard the records get uploaded which can be used for further processing. If there are mistakes in the data, the same will be notified in the acknowledgement page.

This feature provides the facility to process the bank statement uploaded in the auto-reconcile statement upload screen. The system reconciles the bank statements.

To reconcile uploaded statements

Navigate to Finance > Transactions > Bank Reconciliation > Reconcile Uploaded Statement option in the sidebar.

Select the applicable Bank, Bank Account, Branch, Reconciliation Date, Bank Statement From Date and Bank Statement To Date to process reconciliation. Click on the Process button to trigger the auto reconciliation. System will pick all the files associated with the bank account selected and try to reconcile the instruments mentioned in the files. All instruments that system can match properly will be marked as reconciled and the remaining will come as failed.

Click on Generate Report to see the details of entries that are not reconciled.

Failed transactions need to be assessed why the reconciliation was not processed and to amend the transaction accordingly and process again or to do manual reconciliation.

This option is used to see all the files that are uploaded for reconciliation along with its processing status.

To view uploaded bank statements

Navigate to Finance > Transactions > Bank Reconciliation > View Bank Statement Uploaded option in the sidebar. Select applicable Bank, Bank Branch, and Account Number.

Select the relevant AsOnDate to specify the date till which you want to view the bank statement upload details. Click on the Search button to view the list of uploaded files.

Click on the file name link to directly open the file or download and save the file into the system.

Open the file to view the details of all the transactions which were updated in the excel template and uploaded into the system. The status of individual transactions indicates whether it was uploaded successfully or was there any error in the transaction.

With the status of individual transactions updated in the file, users can take necessary action if there are any errors in updating the information in the excel file. User can amend the error transaction and re-upload the file into the system for auto reconciliation.

To view vouchers

Navigate to Finance > Transactions > View Voucher option in the sidebar. Enter the required filters to narrow down the search for specific vouchers. Enter the Voucher Number directly to fetch a specific voucher.

Select the applicable Voucher Type, Voucher Name, Voucher Date From, Voucher Date To, Fund, and Department details to fetch vouchers matching the given criteria.

Click on the Voucher Number link to view the details. A pop-up window opens with the basic details of the selected voucher. Click on the Source link in blue to open the source of the voucher.

Click on the Print button to print the voucher.

To generate the Opening Balance report

Navigate to Finance > Reports > Accounting Records > Opening Balance Report option in the sidebar.

Select the applicable Financial Year, Fund and Department details. Click on the Search button to generate the report.

The report is generated. Click on the relevant Export Option to download the report in PDF or Excel format.

This section illustrates the steps for configuring the masters data for finance module

The Finance Admin is responsible for maintaining budget details, processing financial period-end activities, and configuring budget control parameters.

Budget group is defined either at a single chart of account level or at a minor code level or for a range of chart of account codes.

To create budget group

Navigate to the Finance > Budgeting > Budget Group > Create Budget Group option in the sidebar. Enter a Name for the Budget Group.

Select the applicable Account Type and Budgeting Type. Select the relevant Major Code. Alternatively, select the appropriate Detailed Min Code and the Detailed Max Code.

Enter a brief Description for the budget. Check the Budget Group Active option to mark this budget group active. Click on the Create button. The budget group is created.

To view budget group details

Navigate to the Finance > Budgeting > Budget Group > View Budget Group option in the sidebar. Enter the Name of the Budget Group in the Search panel.

Click on the Search button. Click on the Budget Group name to view the group details.

Click on the Print button to print the details. Click on the PDF or Excel button to generate a pdf or excel statement for the listed budget group.

To modify budget group details

Navigate to the Finance > Budgeting > Budget Group > Modify Budget Group option in the sidebar. Enter the Name of the Budget Group in the Search panel.

Click on the Search button.

Click on the Budget Group name to view and modify the group details. Make the necessary changes to the budget group. Click on the Update button to update the details.

Click on the Print button to print the details. Click on the PDF or Excel button to generate a pdf or excel statement for the listed budget group.

Budget is defined as a tree structure which starts at department level and then adds up to the consolidated one. This master is used for defining each of the budget nodes.

To create budget definition

Navigate to Finance > Budgeting > Budget Definition > Create Budget Definition option in the sidebar. Enter a Name for the listed budget.

Check the applicable box for Budget Estimate or Revised Estimate. Select the applicable Financial Year. Select the relevant Parent.

Add a suitable Description for the budget definition. Check the boxes to indicate if the listed budget definition is Active Budget and Primary Budget. Select the relevant Reference Budget from the list of available budgets.

Click on the Create button to create the budget definition.

To view budget definition

Navigate to Finance > Budgeting > Budget Definition > View Budget Definition option in the sidebar.

Select the applicable Financial Year. Select Budget Estimate or Revised Estimate to filter the search for budget definition.

Click on the Search button. Select the relevant Budget Definition from the filtered list of budget definition.

Click on the Print button to print the details. Click on the PDF or Excel button to generate a pdf or excel statement for the listed budget group.

To modify the budget definition

Navigate to Finance > Budgeting > Budget Definition > Modify Budget Definition option in the sidebar. Select the applicable Financial Year.

Select Budget Estimate or Revised Estimate to filter the search for budget definition. Click on the Search button.

Click on the Budget Group name to view and modify the group details. Make the necessary changes to the budget group. Click on the Update button to update the details.

Click on the Print button to print the details. Click on the PDF or Excel button to generate a pdf or excel statement for the listed budget group.

This feature allows users to update budgets that are already approved. The system allows increasing or decreasing the budget amount for any item. It also has the provision to budget for new items which were not part of the original budget.

To make budget addition appropriation

Navigate to Finance > Budgeting > Budget Addition Appropriation option in the sidebar. Click on the Add/Release menu option.

Select the applicable Financial Year. Select either Budget Estimate or Revised Estimate. Select the relevant Executive Department. Set these parameters to filter the budget combination for which amount needs to be appropriated.

Select the Date. Enter any Comments for the budget appropriation. Click on the Get Actuals button to fetch specific budget details. The system will auto-populate the already expended amount along with the budgeted amount.

Select the applicable Budget Group, Function, and Fund details. Enter the additional amounts for specific budget items.

Click on the Add button to insert additional budget line items. Click on the Delete button to delete budget line items. Click on the Save button to save the details.

The budget details and appropriations are reflected accordingly.

This feature is to upload the budget data in an excel file prepared offline.

To upload budget

Navigate to Finance > Budgeting > Upload Budget menu option in the sidebar. Click on the Download Template option to download the template.

Fill in the budget data as per the instructions given in the excel sheet and save the file. Click on the Choose File button to browse and select the saved budget file. The system allows you to upload .xls file formats only. The system will throw an error message in case there are any issues in the data format. Otherwise, the budget data will be loaded in the system in pre-approved status.

Click on the Upload Budget button to upload the budget. System displays an acknowledgement page with a message. There are two options - Download Input file, Download output file. Click on these options to download the files.

All budget data that are loaded using the Upload Budget option can be approved using the Approve Uploaded Budget option. Once the budget is approved it will be considered for budgetary controls.

To approve uploaded budget

Navigate to Finance > Budgeting > Approve Uploaded Budget menu option in the sidebar. Select the Budget Definition for which the budget data is to be approved. Select the relevant Reference Budget information linked to the selected budget. Click on the Approve button to approve the budget.

This option enables users to search the entire budget data aggregated at the budget definition level for a particular financial year.

To search for budget

Navigate to Finance > Budgeting > Search Budget menu option in the sidebar. Select the relevant Financial Year, Budget, Executing Department, Fund, and Function details.

Click on the Search button to fetch budgets based on the selected parameters.

Click on the Name field to open the details of that particular budget.

All major activities that are done as part of year or period-end processing are covered here.

Close Period

To search for closed periods

Navigate to Finance > Period End Activities > Close Period. Select the applicable Financial Year from the drop-down and then click on the Search button.

The system will display the existing closed period for the selected financial year.

Add Close Period

To add close periods

Click on the Add Close Period button available in the top right corner. This will open a pop-up window.

Enter the applicable Financial Year, From Month and Till Month to specify the period you want to close. Select the Close Type as either SoftClose or HardClose.

Enter any Remarks relevant to the closure. Click on the Submit button to close the selected period. Once you close the period the system will stop accepting any type of transaction for the selected accounting period.

Note: There are two types under Close Type with the option of Soft Close and Hard Close. When the user selects Soft Close it can be reopened in the future if required, on the other hand if Hard Close is selected the financial period cannot be reopened in the future.

Reopen Closed Period

To reopen a closed period

Navigate to Finance > Period End Activities > Reopen Closed Period option in the sidebar. Select the Financial Year from the drop-down and then click on the Search button.

Select the desired period from the search result. This will open a popup window.

Enter the Starting Date and the Ending Date to specify the period for which you are reopening. Click on Reopen. The system will show the reopen period message.

The system reopens the accounting period and starts accepting transactions for the selected accounting period.

Click on the Receipt Number link to view the receipt details. The report displays the total Cheque and Cash collected on any individual day.

The report will be generated and the same can be downloaded in PDF and Excel format.

Click on the Receipt Date to see the individual transaction level of the collection received. Users can also drill down the information based on the individual user collection wise.

Enter the From Date and To Date details to specify the period for which you want to generate the report.

Select any or a combination of the listed parameters - Service, Payment Mode, and User ID to filter the report view.

Click on the Search button to generate the report.

Navigate to Finance > Revenue/Collection > Reports > Remittance Pending Report option in the sidebar.

The Remittance pending report provides the information on Cheque/DD and cash collection which has not been remitted into the bank.

The report is generated and the same can be downloaded in PDF and Excel format.

Pending Remittance Collection Report

Navigate to Finance > Revenue Collection > Reports > Remittance Collection Reports option in the sidebar.

Enter the Account Number, Financial Year, Fund, Payment Type, Service, From Date and To Date details. Add all or any combination of these parameters to filter the report view. Parameters marked with a red star are mandatory.

Click on the Search button. This will give you information related to the remittance done via Cheque or Cash depending on the selected Payment Type.

To generate remittance collection report

Remittance collection report provides the information on both the cheque and cash remitted into the bank after the collection is made.

Remittance collection Reports

Note: Users have a feature to click on the search tab on the right top and easily navigate to the desired cheque details.

Click on the Receipt Number to view individual receipt details.

Click on the PDF or Excel button to download the report in pdf or excel format.

Click on the Search button to run the report.

Select the Cheque Dishonored From Date and Cheque Dishonored To Date details to specify the period for which the report needs to be generated.

Add advanced filters like Bank & Account Number, Service, Payment Mode, and Cheque Number to refine the report view for specific cheque details.

Navigate to Finance > Reports > MIS Reports > Dishonoured Cheque Report option in the sidebar.

To generate cheque dishonoring report

All the cheques which are dishonoured will be shown in this report with all the relevant information.

Dishonoured Cheque Report

Verify the Original Entry and Reversal Entry details populated in the screen.

Click on the Process button to Dishonour the Cheque/DD.

Select the Cheque/DD dishonour reason from the list of Dishonour Reason.

Enter additional comments in the Remarks field to provide more information on the reason for Cheque/DD Dishonour.

Click on the Transaction details to process with the Dishonouring of the Cheque/DD.

Transaction Date would be the date on which the instrument is dishonoured in the bank. (date would be defaulted to today’s date - user can change the date if required).

Enter the Cheque/DD Number.

Enter the applicable Cheque/DD Date.

Click on the Search option to list the transaction details of the Cheque/DD remitted into the Bank.

Cheque Dishonouring

This feature is used for the purpose of dishonouring a cheque/DD. All the payments collected through cheque/DD (in case it gets dishonoured), users shall be able to use this screen to pass an entry for dishonour of cheque/DD.

To dishonour cheque

Navigate to Finance > Revenue/Collections > Dishonour Cheque menu option in the sidebar.

Select the instrument type cheque/DD in the Instrument Mode field.

A Success message will appear and the opening balance is updated.

If the selected Account Code is a control code system mandates subledger type and master data for the entity chosen to be provided.

In case there is an opening balance already captured for the selected year and other parameters, this amount will be populated by the system on selection of account code (subledger information in case of control code). This amount can be changed by the users.

Click on the Create button.

Click on the Proceed button to fetch the listed account head details.

Enter Account Codes and amount in the debit and credit column accordingly. Value has to be there on either the credit or debit side.

Navigate to Finance > Period End Activities > Opening Balance Entry menu option in the sidebar.

Select the relevant Financial Year, Department, Fund, Function, asset or liability Type, Major Head and Minor Head details.

To make an opening balance entry in the system

Opening Balance Entry

The system checks if this year is eligible to be closed and if so a success message is shown. Otherwise, the system throws an error message.

Select the relevant Financial Year from the dropdown list.

Click on the Search button to fetch the details.

Check the Close Financial Year option in the checkbox and click on the Submit button.

Navigate to Finance > Period End Activities > Close Financial Year menu option in the sidebar.

To close a financial year

Close Financial Year

Select the Financial Year from which the closing balance needs to be transferred.

Click on the Transfer button.

Navigate to Finance > Period End Activities > Transfer Closing Balance option in the sidebar.

To transfer closing balance

Transfer Closing Balance

Click on the row for which details of the master are to be modified. System will open a pop-up window with all information.

Make changes to the data in this new window and then click on the Update button. At this point the changes will be made to the financial year data.

Navigate to Finance > Period End Activities > Financial Year > Edit Financial Year menu option in the sidebar.

Select the applicable Financial Year from the drop-down list available.

Click on the Search button to view the search result.

To edit a financial year master in the system

Navigate to Finance > Period End Activities > Financial Year > View Financial Year menu option in the sidebar.

Select the applicable Financial Year from the drop-down list available.

Click on the Search button to view the search result.

Edit Financial Year

To view a financial year master in the system

View Financial Year

A new financial year is created in the system.

Navigate to Finance > Period End Activities > Financial Year > Create Financial Year menu option in the sidebar.

Enter the date range for the year and the list of fiscal periods that needs to come as part of this financial year.

Click on the Create button.

To create a new financial year

Create Financial Year

The Financial Year period end activity allows users to define the financial year and fiscal period in the system.

Financial Year

Navigate to Finance > Masters > Purchase Order > Modify Purchase Order menu option in the sidebar.

Click on the Search button to fetch details.

Click on the relevant purchase order to view details.

Make changes to the data in this screen and then click on the Update button. At the point the record will be updated with the new values.

To modify purchase order

This option is to modify any purchase order present in the system.

Navigate to Finance > Masters > Purchase Order > View Purchase Order menu option in the sidebar.

Click on the Search button to fetch details.

Click on the relevant purchase order to view details.

Modify Purchase Order

To view purchase orders

This option is for viewing all the purchase orders in the system.

Navigate to Finance > Masters > Purchase Order > Create Purchase Order menu option in the sidebar.

Check Active (Y/N) option to indicate if the purchase order is active.

Click on the Create button to add the new record to masters.

View Purchase Order

To create a new purchase order

Navigate to Finance > Masters > Work Order > View Work Order menu option in the sidebar.

Click on the Search button to fetch details.

Click on the relevant work order to view and modify details.

Make changes to the data in this screen and then click on the Update button. At the point the record will be updated with the new values.

Purchase Order

Create Purchase Order

To modify work order

This option is to modify any work order present in the system.

Navigate to Finance > Masters > Work Order > View Work Order menu option in the sidebar.

Click on the Search button to fetch details.

Click on the relevant work order to view details.

Modify Work Order

To view work orders

This option is for viewing all the work orders in the system

Navigate to Finance > Masters > Work Order > Create Work Order menu option in the sidebar.

Enter the Order No., Order Date, Order Name, Description, Contractor Name, Contractor Code, Total/Order Value, Advance Payable, Fund, Department, Scheme, Sub Scheme, Sanction No., and Sanction Date details.

Click on the Create button to add the new record to masters.

View Work Order

To create a new work order

Click on the Search button to find the relevant master record.

Click on the desired master record to view and modify details.

Make required changes in the data and then click on the Update button.

Work Order

Create Work Order

Navigate to Finance > Masters > Subledger Configuration > Modify Subledger Master menu option in the sidebar.

Enter Account Detail Type, Name, and Code to search for the relevant subledger master.

To modify subledger master

This option is to modify any information for an already defined subledger master in the system.

Navigate to Finance > Masters > Subledger Configuration > View Subledger Master menu option in the sidebar.

Click on the Search button to find the relevant master record.

Click on the desired master record to view details.

Modify Subledger Master

To view subledger master

This option is for viewing the entire subledger master for a specific subledger category in the system.

Navigate to Finance > Masters > Subledger Configuration > Create Subledger Master menu option in the sidebar.

Select Account Detailed Type.

Check the Active option to activate the listed subledger master.

Click on the Create button to add the master entry.

View Subledger Master

To create subledger master

This option is for defining a new subledger master for the subledger category defined in the system.

Enter subledger Name and Description to find specific subledger record.

Click on the Search button.

Click on the listed subledger to view and modify details.

Make required changes in the data and then click on the Update button. Now the data will be updated with the changes proposed.

Create Subledger Master

Navigate to Finance > Masters > Subledger Configuration > Modify Subledger Category menu option in the sidebar.

To modify subledger category

This option is to modify any information for an already defined subledger category in the system.

Enter subledger Name and Description to find specific subledger record.

Click on the Search button.

Click on the listed subledger to view details.

Modify Subledger category

Navigate to Finance > Masters > Subledger Configuration > View Subledger Category menu option in the sidebar.

To view subledger category

This option is for viewing the entire subledger category in the system.

Enter Account Entity Name and Description.

Check the Active option to activate the subledger head.

Click on the Create button to add the entity.

View subledger category

This option is for defining a new subledger category in the system.

Create Subledger Category

This option is to define the various accounting entities in the system. Also master data for each of these accounting entities can be defined here.

Subledger Configuration

The function record is updated with new values.

Or, check the Active option to view all active functions.

Or, select the applicable Parent Type to view all functions linked to the selected parent type.

Click on the Search button to fetch the list of functions.

Click on the relevant function to view and modify function details.

Click on the Update button to save the changes.

Navigate to Finance > Masters > Function > Modify Function menu option in the sidebar.

Enter the Function Name or Code to search for the relevant function.

To modify function details

This option is to modify any information for an already defined function in the system.

Enter the Function Name or Code to search for the relevant function.

Or, check the Active option to view all active functions.

Or, select the applicable Parent Type to view all functions linked to the selected parent type.

Click on the Search button to fetch the list of functions.

Click on the relevant function to view function details.

Modify Function

To view function details

This option is for viewing all the functions defined in the system.

Enter the Function Name, Code, and Level details.

Select the applicable Parent Type.

Check the Active and Isnotleaf options if applicable. Isnotleaf option indicates that the listed function is not a child entity.

Click on the Create button to add the function to the masters list.

View Function

Navigate to Finance > Masters > Function > Create Function menu option in the sidebar.

To add function master details

This option is for defining a new function master in the system.

Create Function

All the functions will be defined using the Function master.

Function

At this point the master record gets updated with the new set of information.

Navigate to Finance > Masters > Deduction > Modify Deduction menu option in the sidebar.

Click on the Search button to view the deduction details.

Click on the relevant deduction to view and modify the details.

Click on the Update button to save the changes.

To modify deduction details

This option is to modify any information for an already defined recovery code in the system.

Navigate to Finance > Masters > Deduction > View Deduction menu option in the sidebar.

Click on the Search button to view the deduction details.

Click on the relevant deduction to view the details.

Modify Deduction

To view deduction details

This option is to view all the recovery code in the system.

View Deduction

At this point a new master record is created in the system.

Select the relevant option for Applied To from the drop down list. The listed deduction will be applied to the selected head.

Select the relevant Account Code to link it to the listed deduction.

Check the Bank Loan and Active options if the deduction is linked to the bank account and to mark the deduction head as active.

Enter the applicable details for Remitted To, IFSC Code, Account Number, and Description.

Click on the Create button to create the deduction head.

Navigate to Finance > Masters > Deduction > Create Deduction menu option in the sidebar.

Enter the applicable Deduction Name and Deduction Code.

To create new deductions

This option is for defining a new recovery code in the system.

Create Deduction

All the recovery heads will be defined using the deduction master.

Click on the Update button to save the changes.

Deductions

Click on the relevant supplier to view and modify details.

Enter the supplier Name and Code.

Click on the Search button.

Navigate to Finance > Masters > Supplier > Modify Supplier menu option in the sidebar.

To modify suppliers

Modify Suppliers

Select the listed Supplier to view supplier details.

Click on the Search button.

Navigate to Finance > Masters > Supplier > View Supplier menu option in the sidebar.

Enter the supplier Name and Code.

To view suppliers

View Suppliers

The supplier is added to the system.

Select and enter the applicable Bank, IFSC Code, Bank Account Number, and Registration No.

Select and enter the applicable Status of the supplier, PAN No., EPF No., and ESI No. details.

Click on the Create button to add the supplier to the master data.

Navigate to Finance > Masters > Supplier > Create Supplier menu option in the sidebar.

Enter Supplier Code, Name, Correspondence Address, Permanent Address, Contact Person, Email, Narration, Mobile Number, GST/TIN No., and GST Registered State/UT.

To add suppliers

After making changes, click on the Update button. This will save the changes in the Contractor masters screen.

Supplier

Create Supplier

Select the relevant contractor to view and modify details.

Enter any or a combination of search parameters to find the relevant contractor. The parameters include the contractor Name or Code.

Click on the Search button to find the contractor.

Navigate to Finance > Masters > Contractor > Modify Contractor menu option in the sidebar.

To modify contractor details

Modify Contractor

Select the relevant contractor to view details.

Click on the Search button to find the contractor.

Navigate to Finance > Masters > Contractor > View Contractor menu option in the sidebar.

Enter any or a combination of search parameters to find the relevant contractor. The parameters include the contractor Name or Code.

To view contractor details

View Contractor

The contractor is added to the system.

Select and enter the applicable Bank, IFSC Code, Bank Account Number, and Registration No.

Select and enter the applicable Status of the contractor, PAN No., EPF No., and ESI No. details.

Click on the Create button to add the contractor to the master data.

Navigate to Finance > Masters > Contractor > Create Contractor menu option in the sidebar.

Enter Contractor Code, Name, Correspondence Address, Permanent Address, Contact Person, Email, Narration, Mobile Number, GST/TIN No., and GST Registered State/UT.

To add to Contractor masters data

Contractor

Create Contractor

After making changes, click on the Update button. This will save the changes in the Fund masters screen.

Click on the Search button to find the fund details.

Click on the relevant fund to view and modify the fund details.

Navigate to Finance > Masters > Funds > Modify Funds menu option in the sidebar.

Enter any or a combination of search parameters to find the relevant fund. The parameters include the fund Name, Code, Parent Fund, and Active funds. Check the Active option to list all active funds.

To modify fund details

Modify Fund

Click on the relevant fund to view the fund details.

Click on the Search button to find the fund details.

Navigate to Finance > Masters > Funds > View Funds menu option in the sidebar.

Enter any or a combination of search parameters to find the relevant fund. The parameters include the fund Name, Code, Parent Fund, and Active funds. Check the Active option to list all active funds.

To view fund details

View Funds

The Fund is created.

Select the relevant Parent Fund.